Recovery Act Third Quarterly Report - Supplement

THE ECONOMIC IMPACT OF THE AMERICAN RECOVERY AND REINVESTMENT ACT OF 2009

SUPPLEMENT TO THE THIRD QUARTERLY REPORT

THE ARRA AND THE CLEAN ENERGY TRANSFORMATION

A central piece of the American Recovery and Reinvestment Act of 2009 (ARRA) is more than $90 billion in government investment and tax incentives to lay the foundation for the clean energy economy of the future. As discussed in CEA’s Second Quarterly Report on the impact of the ARRA, this investment will help create a new generation of jobs, reduce dependence on oil, enhance national security, and improve the environment.1 Ultimately, the investments could help transform the United States into a global clean energy leader.

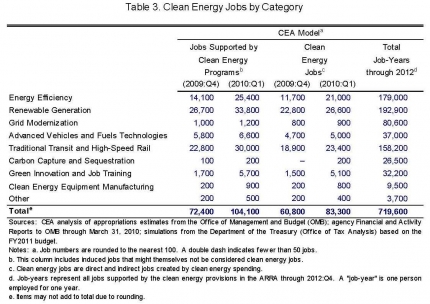

The ARRA clean energy investments are also providing crucial stimulus to the economy. Through programs such as enhanced tax credits for homeowners who make energy-efficient improvements, funding for research into new clean energy technologies, or grants to qualifying businesses, these investments are generating economic activity and creating new employment opportunities. This supplement to the CEA’s Third Quarterly Report updates our estimates of the effect of the ARRA’s clean energy provisions on economic recovery through the first quarter of 2010. We find that the Recovery Act directly created more than 80,000 clean energy jobs in the first quarter of 2010, and that the clean energy investments supported an additional 20,000 jobs throughout the economy.

CEA’s Second Quarterly Report described our classification of 56 projects and activities in the ARRA related to the clean energy transformation. This list includes 45 spending provisions with a total appropriation of $60.7 billion and another 11 tax incentives that will cost $29.5 billion through fiscal year 2019, according to the Office of Tax Analysis, for a total investment of over $90 billion.2 In some cases, a relatively small amount of Federal investment leverages a larger amount of non-Federal support; we count toward the appropriation only the expected subsidy cost of the Federal investment.3

Figure 1 illustrates the distribution of this $90 billion investment across eight categories of clean energy projects, along with a ninth “other” category containing programs that do not fit in elsewhere. The types of programs included in the eight categories are described in Box 1.4 The largest investments are in renewable energy generation, energy efficiency (for example, weatherproofing), and transit (including high-speed rail).

Because most of the clean energy investments occur through grants and contracts that require that proposals be reviewed before funds are expended, not all of the money appropriated for these investments could be spent quickly. Thus, as with the ARRA more generally, only a portion of the appropriation has been spent to date.

Box 1: Clean Energy Investments under the Recovery Act

The Recovery Act pursued a multifaceted approach to clean energy. Undertaking a broad range of investments in energy efficiency, clean energy, and new technologies will allow us to make the transformation to a clean energy economy smoothly and effectively. The ARRA investments in the clean energy transformation fall into eight categories:

1. Energy Efficiency. The ARRA is promoting energy efficiency through investments that reduce energy consumption in many sectors of the economy. For instance, the Act appropriates $5 billion to the Weatherization Assistance Program to pay up to $6,500 per dwelling unit for energy efficiency retrofits in low-income homes. The ARRA appropriates another $3.2 billion to the Energy Efficiency and Conservation Block Grant program.

2. Renewable Generation. The ARRA is making investments in renewable generation that are leading to the installation of wind turbines, solar panels, and other renewable energy sources. For example, the ARRA adds $4 billion to the Department of Energy’s (DOE) Loan Guarantee Program for a variety of projects, including renewable energy and advanced biofuel. Additionally, the ARRA extends an existing 2 cents per kilowatt-hour (in 2008 dollars) production tax credit for wind, geothermal, and hydroelectric generation and a 1 cent per kilowatt-hour production tax credit for biomass and landfill gas.

3. Grid Modernization. As the United States transitions to greater use of intermittent renewable energy sources such as wind and solar, the Act is helping to finance the construction of new transmission lines that can support electricity generated by renewable energy. The ARRA provides about $10.5 billion to support projects that will modernize the electric grid, enhance the efficiency of the U.S. energy infrastructure, and ensure reliable electricity delivery, largely through smart grid projects and interconnection transmission planning. The ARRA also increases the borrowing authority of the Bonneville and Western Area Power Administrations (two of the four regional power marketing agencies in DOE) by $3.25 billion each, providing financing for further investments in transmission.

4. Advanced Vehicles and Fuels Technologies. The ARRA is funding research on and deployment of the next generation of automobile batteries, advanced biofuels, plug-in hybrids, and all-electric vehicles, as well as the necessary support infrastructure. For instance, the President announced in March 2009 that $2.4 billion in grants from the ARRA would be made available to U.S. firms to support domestic manufacturing of advanced batteries and other components needed for electric vehicles and plug-in hybrids. In addition, the ARRA funds a tax credit for plug-in electric vehicles of up to $7,500 per vehicle when they become available on the U.S. market.

5. Traditional Transit and High-Speed Rail. The Recovery Act is providing grants that will lead to upgrades in the reliability and service of public transit and conventional intercity railroad systems. The Act provides $8 billion to improve existing or build new high-speed rail in 100 to 600 mile intercity corridors. In addition, it has made $1.3 billion available to support Amtrak, the national railroad passenger corporation. The ARRA also provides about $7 billion in grants to support a wide variety of capital spending for public transit.

6. Carbon Capture and Sequestration. One strategy for limiting greenhouse gas emissions is to prevent the carbon released by fossil fuel combustion from entering the atmosphere. The ARRA provides $3.4 billion to support initiatives that range from characterizing the carbon sequestration potential of geologic formations, to cost-sharing agreements to demonstrate advanced carbon capture and storage technologies for coal.

7. Green Innovation and Job Training. The ARRA is investing in the science and technology needed to provide the foundation for the clean energy economy. A total of $400 million has been allocated to the Advanced Research Projects Agency - Energy (ARPA-E) program, which funds new, creative research ideas aimed at accelerating the pace of innovation in advanced energy technologies. The Recovery Act also includes $500 million for competitive grants to state agencies and non-profits to support programs that train workers for jobs in the energy efficiency and clean energy industries of the future. It includes another $100 million for training and hiring workers in the utility and electrical manufacturing sectors.

8. Clean Energy Equipment Manufacturing. The ARRA is increasing our capacity to manufacture wind turbines, solar panels, electric vehicles, batteries, and other clean energy components domestically. For instance, the ARRA authorizes a 30-percent tax credit for investments in advanced energy manufacturing projects that will provide estimated government funding of over $1.6 billion for renewable energy generation, energy storage, advanced transmission, energy conservation, renewable fuel refining or blending, plug-in vehicles, and carbon capture and storage.

2 Throughout this analysis we classify the Section 1603 program as a tax provision even though it is treated as a Treasury Department outlay in the Financial and Activity Reports to the Office of Management and Budget. The 1603 program provides government payments in lieu of tax credits for certain clean energy investments.

3 We make an exception for borrowing authority granted to the Bonneville and Western Area Power Administrations. Because of the public nature of these agencies, we count the projected drawdown of the borrowing authority as the ARRA appropriation.

4See also Council of Economic Advisers (2010a) for a more detailed discussion of the eight categories.

5The totals shown in columns 2 and 3 differ from those in Council of Economic Advisers (2010a). The difference stems from a revision in the timing of outlays for the 1603 credit over the course of the 2010 fiscal year.

6Outlays represent payments made by the government. Those funds represent spending that has already occurred. Obligations represent funds that have been made available but not necessarily outlayed. In many instances, obligations can generate economic activity because recipients may begin spending as soon as they are certain funds are available.

Expenditures are tracked by Treasury Account Financial Symbol (TAFS). In some cases, clean energy and non-clean energy programs are grouped into the same TAFS and no information is available about the composition of obligations and outlays to date. To estimate clean energy expenditures, we allocate obligations and outlays to date using the clean energy share of the total appropriation for the TAFS. This will overstate clean energy spending to date if non-clean energy projects began faster than clean energy projects and will understate clean energy spending if the clean energy projects began faster. For tax provisions, we include the Office of Tax Analysis’s estimate of the total cost through fiscal year 2019 in column 1, and its estimate of the cost to date in columns 2 through 5.

7The 2009:Q4 totals differ from those shown in Council of Economic Advisers (2010a) for the reason described in footnote 5.

8 This number is obtained by dividing the anticipated spending on clean energy programs through the end of 2012 -- about 75 percent of the total appropriation to these programs -- by $92,136, as discussed in Council of Economic Advisers (2009). This may overstate the near-term job creation potential of these programs, as the clean energy programs in the ARRA have slightly slower spendout than the average ARRA spending program; thus a smaller fraction of these jobs occurs in the next few years than for the Act as a whole. When we take account of the actual and projected spendout rates for the clean energy programs using the model developed in the CEA report, we estimate job creation through 2012 about 8 percent below what is indicated in column 5 of Table 3.

In most cases, projected Federal outlays through the end of 2012 include the bulk of expected expenditures. In a few cases, however, programs are scored as having budgetary impacts spread over many years. For example, the Advanced Energy Manufacturing Tax Credit (also known as “48c,” from the relevant section of the Internal Revenue Code) will reduce Federal revenues for several years after 2012 as companies using the credit apply it against their future tax liabilities. For this credit, only about half of the cost (and half of the estimated jobs impact) will be incurred by the end of 2012. Counting all costs through 2019, our calculation yields over 17,000 job-years, 9,500 of which come from spending through the end of 2012.