Neighbor News

The Free Market

What drives the free market and when does it fail? The answer might be obvious.

A lot of praise has been heaped upon the magic of the free market. This praise is much deserved as this, "magic," is responsible for most of the economic growth, complex technologies, and comfortable lifestyles we have available to us today.

But what is the source of this magic? What makes the free market so powerful? Are there ever times when the free market doesn't work?

Physics has the answers to all of these questions. The economy is a complex adaptive system that exists in a far-from-equilibrium state. Systems such as these automatically increase their own complexity in response to increases in the energy gradients that support them.

Find out what's happening in Fridleywith free, real-time updates from Patch.

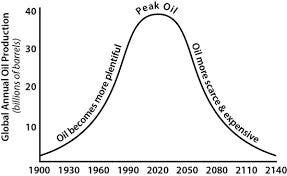

Humans have been increasing the size of the global economy's energy gradient almost every year for 150 years due to ever increasing fossil fuel extraction. Other energy sources have contributed since then but the existence and production of fossil fuels is what makes all the rest of them possible.

Even with strict regulation and far-from-free markets the system will still find ways to add complexity and grow in the presence of a growing energy gradient. Now throw in a bit of freedom and the process accelerates greatly.

Find out what's happening in Fridleywith free, real-time updates from Patch.

So what is the source of the magic? Increasing energy consumption. Simply that.

What makes the free market so powerful? Having free markets allows for ever greater consumption of the energy and resources.

Are there ever times when the free market doesn't work?

This is the most important question we can ask today. The answer is one great big, "Yes!"

Far-from-equilibrium complex adaptive dissipative systems all behave in the exact same way when the size of the energy gradient stops increasing. They stop growing and begin to become less complex.

When energy consumption can no longer go up for whatever reason the free market loses its power to stimulate growth and add complexity. In fact, it is the free market (and its lack of energy) that then becomes responsible for the decreases in complexity and growth and eventually leads to stagflation.

The most recent recession was, at its roots, caused by the plateau of conventional oil production. Unconventional oil production has taken up some of the slack but unless oil prices hit the $150s soon the shale resources in the Bakken and Eagle Ford are already past peak (2015).

If stagflation is the result of stagnant growth in the energy gradient what happens when the size of the gradient actually begins decreasing for whatever reason?

You get economic upheaval similar to what Argentina saw in 1999, what Russia experienced in the 90s and what the US saw in the 30s. Yemen is another horrifying example.

So what does this mean for the free market? Well given that the main energy gradient for the economy cannot continue going up due to resource depletion the power of the global free market has waned and likely won't wax again ever. We're going to see the global economy shrink, begin cracking apart and eventually collapse under its own weight.

It is very possible that the collapse of the global economy will make room for some national and regional economies to thrive. Especially if they pursue an all-of-the-above approach to energy production, hoard the energy instead of exporting it and decrease their own complexity a great deal.

Some of you are already drafting replies in your head about how we have hundreds of years of fossil fuels available to us if only the government would get out of the way. If you believe that then I've got some math to show you.

The US consumes 7,000,000,000 barrels of oil every year. There is an estimated (not reserves, not resources but estimates) 42,000,000,000 barrels of oil that are politically off-limits. Let’s double that in order to strong-man the argument being knocked over.

If we assume that the US economy stays stagnant (consumes a steady amount of energy) how many years will that off-limits oil last? Answer: 12 years.

If the Macondo prospect had given up all of its oil to the US economy (50 million barrels) how long would that oil keep the US running? That much oil can keep the global economy running for about 13 hours.

The average Bakken well produces about 650,000 barrels of oil over its lifetime (much less if it is capped due to non-profitability). If we assume we can magically increase that to 1,000,000 barrels per well, how many wells would have to be drilled per year to support stagnant US consumption?

Feel free to drop the answers in the comments below. :)