Release date: October 17, 2018 | Next release date: October 24, 2018

EIA expects U.S. heating oil prices to be higher compared with last winter

The U.S. Energy Information Administration (EIA) expects that average household bills for most major energy sources of home heating will rise this winter. The increased expenditures are largely driven by higher energy prices, although in some regions colder forecasts for winter also drive up some expenditures. According to EIA’s Winter Fuels Outlook and the October update of the Short-Term Energy Outlook (STEO), the average household that uses heating oil is forecast to spend about $269 (20%) more this winter compared with last winter (Figure 1).

The National Oceanic and Atmospheric Administration (NOAA) expects that temperatures for the winter of 2018–19 will be only 1% colder—as measured in heating degree days (HDD)—than last winter on average for most of the country. On a national-average basis, temperatures last winter were generally close to the 10-winter average. HDD are an approximate measure of how cold temperatures are compared with a base temperature—more HDD indicate colder temperatures. However, the forecast varies among U.S. regions, with forecasts ranging from 7% more HDD than last winter in the West region to 3% fewer HDD than last winter in the Midwest region.

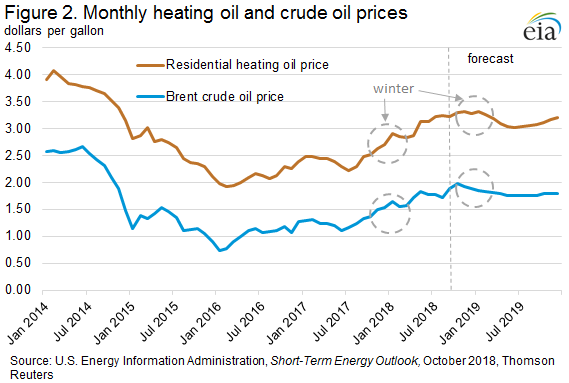

EIA expects heating oil prices to be higher this winter than last winter because of higher crude oil prices and higher distillate fuel margins (the price difference between wholesale distillate fuel and crude oil). EIA forecasts that the Brent crude oil price, which is the most significant crude oil price in determining U.S. petroleum product prices, will average $79/barrel (b) this winter. This price would be $15/b, or 36 cents per gallon (gal), higher than last winter. Higher forecast Brent crude oil prices this winter are the result of gradually tightening global oil balances and concerns about potential supply disruptions in the coming months.

However, crude oil prices are highly uncertain, and any deviation in crude oil prices from forecast levels would cause a similar deviation in retail heating oil prices and consumer expenditures.

The increased cost for households whose primary space heating fuel is heating oil reflects both retail heating oil prices (forecast to be 50 cents/gal, or 18%, higher than last winter) and average consumption (forecasts to be only 1% higher than last winter) (Figure 2). EIA expects winter heating oil expenditures to be the highest in the past four years because of higher fuel prices and the forecast winter temperatures (which are close to the recent 10-year average).

Customers in the U.S. Northeast rely on heating oil more than in any other region. About 21% of households in this region use heating oil for space heating, down from 27% seven years ago. An increasing number of homes in the Northeast have switched to natural gas (55%) and electricity (16%) for space heating. Nationwide, 4% of households use heating oil for space heating.

Northeast U.S. distillate fuel inventories (which include heating oil) totaled 30.7 million barrels on October 5, 2018, 4.6 million barrels (13%) lower than at the same time last year and 7.7 million barrels (20%) lower than the five-year (2013–17) average for that week. Distillate inventories fell to very low levels earlier in 2018 because of continued growth in distillate demand, driven by strong global industrial and economic activity. However, Northeast inventory levels have risen by 11.7 million barrels (62%) since the low for 2018 was reached in early June, in part, because U.S. refineries operated at record or near-record levels for much of the summer.

Although U.S. refinery runs have declined in recent weeks because of typical seasonal maintenance, refineries continue to operate at a high level for this time of year. The high level of refinery runs and an increase in distillate fuel yields have contributed to higher refinery output of distillate fuel and an increase in distillate stocks. Although refining capacity in the Northeast is limited compared with the Midwest and Gulf Coast, the region is part of a large distribution network, making national-level inventories relevant to the overall ability for the Northeast to receive heating fuel. STEO does not forecast at the sub-Petroleum Administration for Defense Districts (PADD) level, but national-level inventories are forecast to remain within the five-year range (Figure 3).

EIA expects strong U.S. refinery runs and distillate margins, each of which encourage refiners to maximize distillate production, to continue through the winter. In STEO, EIA projects U.S. refinery production of distillate fuel to average 5.1 million barrels per day (b/d) during the winter of 2018–19, which would be up from an average of 5.0 million b/d last winter.

However, if temperatures become severely cold, the Northeast typically increases imports of distillate fuel to help meet demand. As a result, prices have the potential to rise higher than forecast levels. Higher prices encourage imports to be shipped to the region. If a cold snap in the U.S. Northeast coincides with a cold snap in Europe, which is the primary source of U.S. imports, additional upward pressure on distillate prices might occur.

Although NOAA’s forecast for this winter indicates temperatures could be close to levels from both last winter and the typical winter from the past 10 years, recent winters provide a reminder that weather can be unpredictable. The winters of 2013–14 and 2014–15 were generally colder than normal, but the winters of 2015–16 and 2016–17 were much warmer than normal. Recognizing this potential variability, the Winter Fuels Outlook includes scenarios where HDD in all regions are 10% higher (colder) or 10% lower (warmer) than forecast.

In the scenario that assumes a 10% colder-than-forecast winter, projected expenditures for heating oil are $458 (33%) higher than during last winter. In this case, EIA forecasts heating oil prices to be 57 cents/gal (21%) higher than last winter and consumption to be 11% higher. In the 10% warmer scenario, EIA forecasts expenditures to be $102 (7%) higher than last winter as a result of heating oil prices that are 45 cents/gal (16%) higher than last winter and consumption that is 8% lower than last winter.

U.S. average regular gasoline price falls, diesel price increases

The U.S. average regular gasoline retail price fell over 2 cents from the previous week to $2.88 per gallon on October 15, 2018, up 39 cents from the same time last year. The Midwest price fell over six cents to $2.76 per gallon, and the Rocky Mountain and East Coast prices each fell nearly two cents to $2.98 per gallon and $2.81 per gallon, respectively. The West Coast price increased nearly two cents to $3.49 per gallon, and the Gulf Coast price increased less than one cent, remaining at $2.63 per gallon.

The U.S. average diesel fuel price increased nearly 1 cent and remained at $3.39 per gallon on October 15, 2018, 61 cents higher than a year ago. The East Coast price rose over two cents to $3.38 per gallon, the West Coast price rose over one cent to $3.88 per gallon, the Rocky Mountain price rose one cent to $3.40 per gallon, and the Gulf Coast price rose less than one cent, remaining at $3.17 per gallon. The Midwest price was unchanged at $3.35 per gallon.

Propane/propylene inventories rise

U.S. propane/propylene stocks increased by 2.0 million barrels last week to 82.3 million barrels as of October 12, 2018, 4.3 million barrels (4.9%) lower than the five-year (2013-2017) average inventory level for this same time of year. Gulf Coast inventories increased by 2.4 million barrels, and Rocky Mountain/West Coast and Midwest inventories each increased by 0.1 million barrels. East Coast inventories decreased by 0.5 million barrels. Propylene non-fuel-use inventories represented 2.9% of total propane/propylene inventories.

Residential heating fuel prices increase

As of October 15, 2018, residential heating oil prices averaged $3.36 per gallon, 1 cent per gallon more than last week and nearly 71 cents per gallon higher than last year’s price at this time. The average wholesale heating oil price for this week is nearly $2.41 per gallon, almost 7 cents per gallon less than last week but nearly 52 cents per gallon higher than a year ago.

Residential propane prices averaged $2.40 per gallon, one cent per gallon more than last week and nearly nine cents per gallon higher than a year ago. Wholesale propane prices averaged nearly $1.01 per gallon, almost one cent per gallon less than last week and nearly three cents per gallon lower than last year’s price.

For questions about This Week in Petroleum, contact the Petroleum Markets Team at 202-586-4522.

Retail prices (dollars per gallon)

| Retail prices | Change from last | ||

|---|---|---|---|

| 10/15/18 | Week | Year | |

| Gasoline | 2.879 | -0.024 | 0.390 |

| Diesel | 3.394 | 0.009 | 0.607 |

| Heating Oil | 3.364 | 0.012 | 0.706 |

| Propane | 2.402 | 0.013 | 0.087 |

Futures prices (dollars per gallon*)

| Futures prices | Change from last | ||

|---|---|---|---|

| 10/12/18 | Week | Year | |

| Crude oil | 71.34 | -3.00 | 19.89 |

| Gasoline | 1.942 | -0.144 | 0.320 |

| Heating oil | 2.321 | -0.071 | 0.524 |

| *Note: Crude oil price in dollars per barrel. | |||

Stocks (million barrels)

| Stocks | Change from last | ||

|---|---|---|---|

| 10/12/18 | Week | Year | |

| Crude oil | 416.4 | 6.5 | -40.0 |

| Gasoline | 234.2 | -2.0 | 11.8 |

| Distillate | 132.6 | -0.8 | -1.8 |

| Propane | 82.298 | 2.037 | 3.461 |