Berkshire Hathaway's (BRK.A 0.94%) (BRK.B 0.97%) long-term performance is the envy of Wall Street. Since Warren Buffett took over as chief executive officer in 1965, the former textile manufacturer has grown into a massive conglomerate with ownership or investment in numerous companies. Over those 59-odd years, the stock has returned an average of 19.8% annually. A $100 investment back then would be worth a bit more than $3.23 million today.

Berkshire's historical performance is undeniable. But buying stock is more about future performance than past performance, and the future of Berkshire Hathaway includes some uncertainties regarding its leadership. Investors may feel nervous about the company's future and its ability to maintain its stellar performance.

If you're invested in or plan on investing in Berkshire Hathaway, you might want to consider the following.

Reason to sell Berkshire Hathaway

Warren Buffett and his longtime business partner Charlie Munger built an incredible company at Berkshire Hathaway over several decades and complemented each other exceptionally well. Buffett began his career as a Benjamin Graham value investor, but Munger eventually convinced Buffett to "give up buying fair businesses at wonderful prices" and, instead, focus on buying "wonderful businesses purchased at fair prices."

Charlie Munger passed away last November, roughly one month shy of his 100th birthday. Buffett has alluded to his own mortality (he's 93), telling investors during this year's annual meeting, "I feel fine, but I know a little about actuarial tables."

Image source: The Motley Fool.

It'll be interesting to see if Berkshire can continue firing on all cylinders when Buffett finally passes (or retires). 62-year-old Greg Abel is the designated CEO successor at Berkshire Hathaway. During the company's annual meeting, Buffett told investors that the company's capital-allocation decisions would be left to Abel, currently CEO of Berkshire Hathaway Energy and vice chair of its non-insurance operations.

In addition, Berkshire Hathaway has Todd Combs, 53, and Ted Weschler, 62, as two of its top investing lieutenants. Combs previously operated the hedge fund Castle Point Capital Management. Meanwhile, Weschler famously grew his IRA account from $70,385 to over $264 million over three decades.

While that sounds good, it remains to be seen if these designated Berkshire successors can continue to build on Buffett and Munger's success. If you own the stock and Berkshire's succession plan has you nervous or skeptical, you might want to consider selling.

Reasons to buy or hold Berkshire Hathaway

Berkshire Hathaway is an incredibly resilient business. Buffett and Munger have long invested in companies they understand, focusing on those with strong brands and positive cash flow. The solid return on investment they have received is reflected in the solid stock performance Berkshire has generated on such a consistent basis for decades.

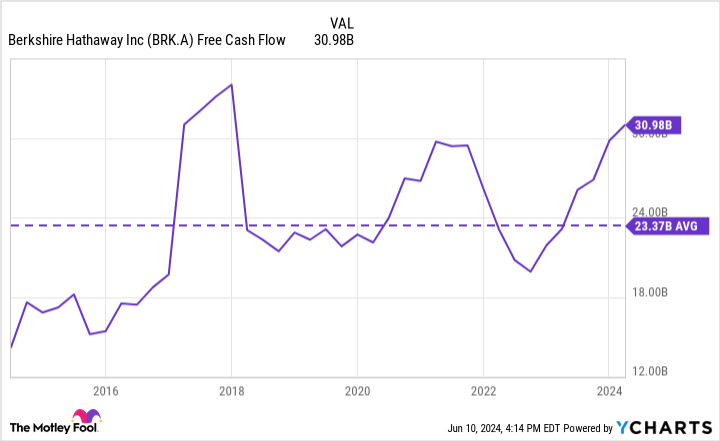

As a holding company, it owns numerous companies across various industries, including insurance, reinsurance, freight transportation, utilities, and energy, to name a few. These companies provide Berkshire Hathaway with exceptional cash flow and are a big reason for its massive cash stockpile. Over the trailing 12 months, Berkshire raked in $31 billion in free cash flow, which represents the cash it generates after outflows for operations and capital equipment.

BRK.A Free Cash Flow data by YCharts.

Berkshire's available cash and short-term investments totaled $189 billion at the end of the first quarter, a record high for the company. With its excess cash, Berkshire can repurchase its shares, add to its pile of U.S. Treasuries, or set aside capital for future investing opportunities. This gives it the flexibility to scoop up good deals on great companies, as it has done during previous market downturns. If it can't find any great deals, it just invests in itself through stock buybacks ($9.2 billion in 2023 alone).

A fork in the road for investors

Berkshire Hathaway is a well-run company that produces stellar free cash flow year after year. Under the leadership of Warren Buffett and his lieutenants, it has grown into an $887 billion company today.

Berkshire will likely change somewhat when its new management team eventually takes over. But owning Berkshire for the long haul has always been an investment in the vision of Buffett, and that isn't likely to change even when he's gone. Hish long-time chosen successors will see to that. If his decisions reflect the same value-driven approach that's guided its investments, Berkshire could continue to thrive for many years to come. That suggests more of the same outsized returns and solid reasons to continue to hold and/or buy the stock.