CrowdStrike (CRWD 1.46%) stock has now rocketed 140% higher in the last year alone. The leading cloud-based endpoint cybersecurity software provider (protection for laptops, smartphones, and endpoint devices in general for businesses) has gone from strength to strength since its 2019 initial public offering (IPO). But after the update for its fiscal 2025 first quarter (the three months ended in April 2024), which contributed to a more than 560% run as of the five-year anniversary of the IPO, is it too late to buy?

There's no denying growth is slowing -- is that really a problem?

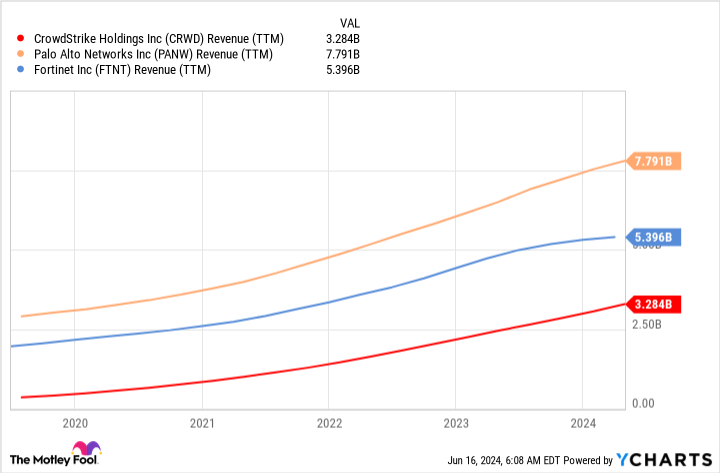

CrowdStrike's annual revenue has quickly surpassed the $3 billion mark, owing to its rapid double-digit growth over the years. As measured by revenue, it's still a distant third place behind older network cybersecurity pure-play giants Palo Alto Networks and Fortinet.

Data by YCharts.

Co-founder and CEO George Kurtz says CrowdStrike is on the path to rivaling its two larger peers with the goal of generating $10 billion in annualized recurring revenue (ARR, a metric for subscription-based software businesses) by calendar year 2028.

However, with ARR increasing 33% year over year to $3.65 billion last quarter, there's no denying CrowdStrike's upward trajectory has cooled as it gets larger. To reach its lofty $10 billion ARR target, it will need to keep growing at an average annual clip of nearly 30% over the next four years.

That's a tall order, and one the market clearly thinks is doable based on the stock's current valuation. Shares of CrowdStrike trade for over 90 times trailing-12-month free cash flow (FCF), a figure that's justified only when factoring for 20%-plus revenue growth and also some FCF margin expansion for at least a few years.

This latter point, though, is where investors should really focus. Big revenue growth targets attract lots of attention, but ultimately, CrowdStrike's slowing top line is fine. In fact, just ignore the $10 billion ARR target if it can keep delivering on its profit progress.

The argument for CrowdStrike as a compounding machine

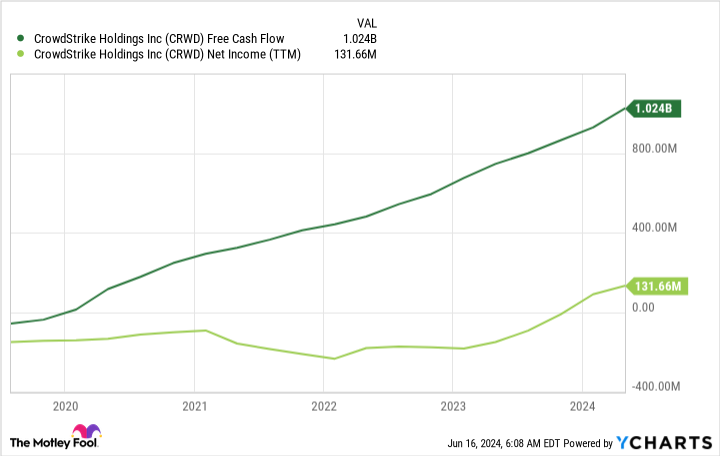

CrowdStrike has already been showing signs it can be a long-term profitability compounding machine. In its short existence as a publicly-traded company, FCF has steadily chugged higher. And in spite of high employee stock-based compensation expenses (a frequent problem for high-growth software businesses), CrowdStrike has also turned the corner on generally accepted accounting principles (GAAP) net income in the last year.

Data by YCharts.

Indeed, it's these profit metrics that can keep CrowdStrike's advance going. And with higher profitability, and as the company matures (and its growth rate naturally cools off), expect management to begin returning excess cash to shareholders at some point in the future -- through a stock repurchase plan, for example. The balance sheet also certainly supports this trajectory with $3.7 billion in cash and short-term investments and just $743 million in debt as of the end of April 2024.

That said, CrowdStrike's high valuation means investors should strap in for a volatile ride. Wild gyrations in stock price are the norm for young high-growth businesses like this one. However, for investors looking for a long-term bet on cybersecurity, it appears CrowdStrike has established itself as a leader with real staying power and an expanding product lineup that keeps winning over new customers. Rather than chasing the hot name and making a big CrowdStrike purchase, though, consider utilizing a dollar-cost average plan to build a position gradually over time.