Shares of Coinbase Global (COIN 6.54%) rose 27.8% in the first half of 2024, according to data from S&P Global Market Intelligence.

Following the Securities and Exchange Commission's approval of spot Bitcoin ETFs earlier this year, the cryptocurrency exchange operator benefited from strong Bitcoin prices. Active cryptocurrency trading benefited Coinbase's platform, which saw volume surge higher in the first quarter.

Trading volume exploded early this year

As one of the largest cryptocurrency trading exchanges, Coinbase performs well when volume increases, since transaction revenue makes up a significant chunk of its overall business.

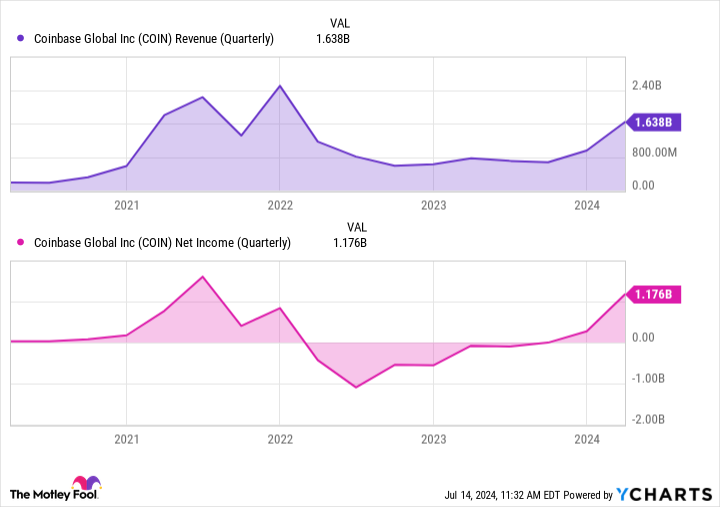

Its first-quarter earnings results crushed it, and the company saw an explosion of trading volume, with $312 billion passing through its platform. That was a 102% increase from the prior quarter and a 115% increase from the same period one year earlier. Its institutional trading platform, Coinbase Prime, saw record trading activity and an unprecedented number of active clients in the quarter.

The company also saw solid growth across its subscriptions and services revenue, a growing part of the business that can provide more stable, predictable income. As a result, its earnings rocketed higher, as revenue jumped 115% year over year. The company raked in $1.2 billion in net income, a dramatic increase from its $79 million loss a year ago.

COIN Revenue (Quarterly) data by YCharts

What's next for Coinbase?

In March 2023, the SEC issued Coinbase a Wells notice, signaling its intention to take enforcement action against the company for suspected violations of securities laws. The SEC alleges that certain digital assets on Coinbase's platform are securities and that the company should register as a securities exchange. This legal battle is ongoing, although recent legal developments could create a much more favorable environment for Coinbase in the long term.

Cryptocurrencies are a high-growth opportunity for investors with a high tolerance for risk and the ability to withstand the volatility that comes with it. Coinbase is a perfect example, falling 86% in 2022 while rising 417% in 2023 and again this year. Today, the stock's price-to-earnings ratio is 42.7, and the price-to-sales ratio is 14.5, putting its current valuation on the more expensive side and making it more vulnerable to volatile price swings.

However, Coinbase is at the heart of the crypto and digital currency economy, providing additional products and services such as stablecoins, staking, financing, and custodial services to diversify its volatile earnings, and its position in this high-growth industry makes it an appealing stock for long-term investors today.