In January 2024, the U.S. Securities and Exchange Commission (SEC) approved almost a dozen spot Bitcoin ETFs, including the iShares Bitcoin Trust ETF (IBIT 5.62%). The approval allowed investors to gain direct exposure to the world's largest cryptocurrency through a brokerage or retirement account. In this article, we'll cover the basics of how to invest in the IBIT ETF. You'll learn how this spot Bitcoin ETF works, as well as the pros and cons of investing in the fund.

Overview

What is the IBIT ETF?

The IBIT ETF is short for the iShares Bitcoin ETF Trust, a spot Bitcoin ETF launched by BlackRock (BLK 2.03%) in January 2024. IBIT is the ticker of the iShares Bitcoin ETF. The fund trades on the Nasdaq Stock Exchange.

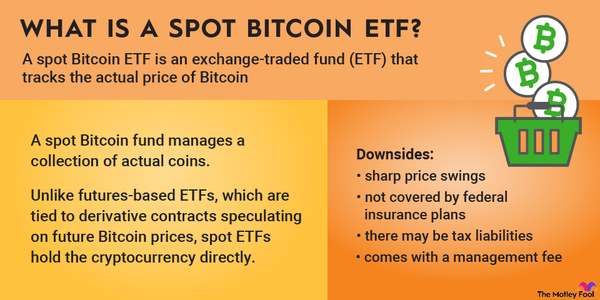

A spot Bitcoin ETF owns Bitcoin and closely tracks its price. It's similar to spot ETFs that own precious metals like gold and silver and track their price movements.

The January 2024 decision by the SEC to greenlight spot Bitcoin ETFs was a landmark for investors seeking cryptocurrency exposure. Prior to the approval, ETFs weren't allowed to directly own cryptocurrency. The only Bitcoin ETFs that existed were those that held Bitcoin futures rather than the crypto itself. The SEC's decision allows investors to gain direct crypto exposure through a brokerage account since the ETFs trade on stock exchanges. That, in turn, makes it easier to invest retirement funds in Bitcoin.

The IBIT ETF is the second-largest spot Bitcoin ETF, with more than $17 billion in assets under management. It's also highly liquid, with an average trading volume of about 42 million.

Exchange-Traded Fund (ETF)

How to invest

How to buy the IBIT ETF

The IBIT ETF trades on the Nasdaq. You can invest in ETFs like the IBIT ETF using the same steps you'd follow if you were trading individual stocks.

- Open a brokerage account. You can easily open a brokerage account online in just a few minutes. You'll need to provide a few pieces of personal information, like your name, contact info, date of birth, Social Security number, and possibly the name of your employer. If you earn money from working, you could also buy shares using an individual retirement account (IRA). Before you start trading, you'll need to deposit money into your account.

- Figure out your budget. Before you buy the iShares Bitcoin ETF, you'll want to make an investing budget. Because Bitcoin is still a speculative asset, consider limiting your investment to no more than 5% of your overall budget for investing. You'll also need to determine whether you want to invest all of the money you're allocating to Bitcoin at the same time, or if you're going to follow a dollar-cost averaging strategy and invest on a fixed schedule. Dollar-cost averaging can reduce the impact of volatility, which could be especially beneficial with a volatile asset like Bitcoin.

- Do your research. There's a lot of hype surrounding Bitcoin and other cryptocurrencies. Before you invest, it's important to do your research and feel confident that it's a sound long-term investment. Although the price of Bitcoin has surged by about 140% in the past year as of May 2024, investing solely on the basis of large price swings generally isn't advisable. Bitcoin also has a history of steep losses, so make sure you're willing to hold on for the long term before you invest.

- Place an order. To place an order, you'll need to enter the ETF's stock ticker, IBIT. You'll then specify how many shares of the fund you want to buy. If your brokerage allows you to buy fractional shares of ETFs, you could specify a dollar amount instead. Finally, you'll need to decide whether to place a market or limit order. A market order means you want to make the trade immediately, regardless of the price; a limit order instructs your broker to only place the trade at the price you specify.

Holdings of IBIT

Holdings of the iShares Bitcoin ETF Trust

Traditional ETFs offer a large collection of stocks or bonds with a single investment. However, the iShares Bitcoin ETF Trust and other spot Bitcoin ETFs invest solely in Bitcoin. The big advantage is the simplicity since you don't have to deal with storage, and you can buy and sell shares with a brokerage account. But you're not getting the diversified mix of investments you'd get with most top ETFs for long-term investors.

Like most other spot Bitcoin ETFs, the IBIT ETF uses the Coinbase (COIN 6.54%) crypto exchange to store its assets. Although there's no way to completely eliminate crypto custodial risks, the platform uses "cold" storage, or offline storage, which is far less vulnerable to hacking than online storage methods.

Should I invest?

Should I invest in the IBIT ETF?

Investing in a spot Bitcoin ETF has the potential for big rewards -- but also substantial losses. Although the recent SEC decision makes Bitcoin more of a mainstream investment, it's still a speculative asset. In other words, it doesn't produce anything of value. Instead, its value is based on investor speculation about what it might be worth in the future. A common recommendation in financial planning is to limit speculative assets to 5% of your total investments.

Consider investing in the IBIT ETF if:

- You're bullish on Bitcoin and wouldn't sell even if the price tanked. For example, Bitcoin's price peaked at more than $64,000 in November 2021 but later plummeted to less than $17,000 in late 2022 during the "crypto winter." Only invest in the IBIT ETF -- or any Bitcoin product -- if you wouldn't lose sleep over a large price drop.

- You want to own Bitcoin but don't want to deal with custody. If you're bullish on Bitcoin but don't want the headaches associated with storing it, investing in the IBIT ETF or a similar ETF can simplify things.

- You're seeking additional diversification for an already diversified portfolio. Bitcoin has long appealed to investors seeking additional diversification from traditional securities like stocks and bonds. You can get the same exposure to Bitcoin through the IBIT ETF that you'd get from directly buying the crypto.

Avoid investing in the IBIT ETF if:

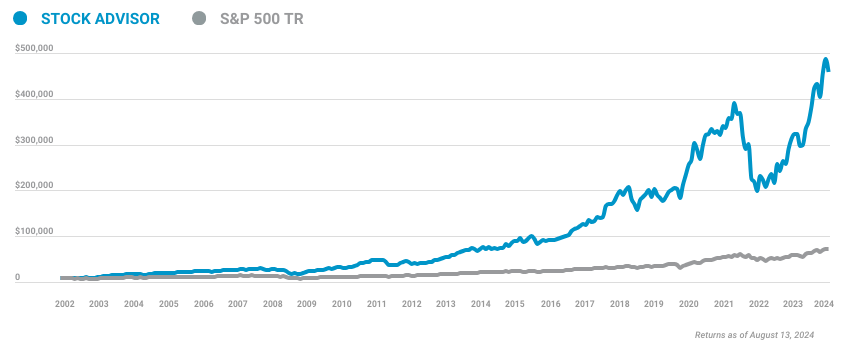

- You don't already own a diversified mix of investments. When you invest in an S&P 500 index fund, you're getting exposure to 500 historically profitable companies. If you invest in a total stock market ETFs or mutual funds, you're spreading your risk across thousands of stocks. The IBIT ETF invests solely in Bitcoin. While the stock market has a long history of generating profits, Bitcoin's limited history has been marked by volatility. If you're new to investing, consider starting with an ETF that tracks a broad segment of the U.S. stock market, then gradually add small positions in the iShares Bitcoin ETF trust.

- You're investing money that you can't afford to lose. If you're investing money that you're counting on in the next few years, the IBIT ETF probably isn't a great choice, given Bitcoin's history of wild price swings. If you may need to withdraw your money soon -- for instance, if you're getting close to retirement -- your money may not have time to recover if the price of Bitcoin plummets.

- You don't understand how Bitcoin works. If you're investing solely based on the fat returns you've heard about, resist the urge to join the bandwagon. Take time to research Bitcoin. Make sure you understand how Bitcoin works before you invest directly in the cryptocurrency or in a spot ETF. Don't invest with the expectation that the price will keep rising forever.

Dividends

Does the IBIT ETF pay a dividend?

The IBIT ETF doesn't pay dividends because Bitcoin doesn't produce dividends. Any profits you earn from investing in a spot Bitcoin ETF are due to increases in the price of Bitcoin.

That's important to keep in mind because when you invest in a stock ETF, you'll typically earn dividends that get reinvested unless you opt to receive them in cash, which can, in turn, boost your returns. Dividends can soften the impact of lousy stock market returns, but you won't get this cushion if you invest in the IBIT ETF. If dividends are important to your investment strategy, consider a top dividend ETF instead.

ETF Expense Ratio

Expense ratio

What is the IBIT ETF's expense ratio?

An ETF expense ratio is the percentage of an investment that goes toward fees. The best ETFs to invest in typically have low expense ratios. After all, a higher fee means less of your money gets invested.

The IBIT ETF charges a gross expense ratio of 0.25%. That amounts to a $25 fee on a $10,000 investment. However, due to a temporary fee waiver, the fund's net expense ratio is currently 0.12%, which works out to $12 on the same investment.

Other spot Bitcoin ETFs generally have gross expense ratios ranging from 0.19% to 0.25%. Like the IBIT ETF, many have temporarily waived some or all of their fees. One notable exception is the Grayscale Bitcoin ETF Trust (GBTC 5.68%), which converted from a Bitcoin futures ETF to a spot Bitcoin ETF following the SEC's decision. The fund still charges a 1.5% expense ratio, which isn't particularly surprising since it already had billions of dollars in assets under management when the SEC announced its decision in January. However, as investors have moved money out of the Grayscale ETF into cheaper Bitcoin funds like the IBIT ETF, Grayscale's CEO has said it plans to gradually lower the fee.

Historical performance

Historical performance of IBIT ETF

Since the SEC only approved spot Bitcoin ETFs in January 2024, there isn't much historical data we can look at to gauge the iShares Bitcoin ETF Trust's performance. The IBIT ETF is up about 41% in its first four months. Because they all track the same underlying asset, other spot Bitcoin ETFs have delivered very similar returns.

A 41% gain in just four months certainly sounds impressive. Bear in mind, though, that the SEC's decision is one of the key reasons Bitcoin's price has climbed in recent months, so the rising price of Bitcoin doesn't necessarily make the case for investing in a spot Bitcoin ETF.

Related investing topics

The bottom line on the IBIT ETF

The IBIT ETF and other spot Bitcoin ETFs make it easier to get direct Bitcoin exposure using a brokerage account. However, like Bitcoin, the IBIT ETF isn't appropriate for everyone. Only invest if you're comfortable with dramatic price swings and you're willing to hold the fund for the long term. Limit your stake to a small percentage of your overall investments, ideally 5% or less.

FAQ

Investing in the IBIT ETF FAQ

How do I buy iShares Bitcoin Trust?

You can buy the iShares Bitcoin Trust using a brokerage account. Enter the ticker IBIT, then indicate how many shares you want to buy (or the dollar amount if your broker supports fractional trading) and whether you're placing a market or limit order.

How do I invest in Bitcoin funds?

If you're investing in a Bitcoin fund that's an exchange-traded fund, you can invest using the same steps you'd take to invest in a regular stock or ETF. You'll need to open and fund a brokerage account. You'll then enter the ticker, the number of shares or dollar value that you want to buy, and the type of order you're placing before submitting your order.

What is the ticker for iShares Bitcoin Trust?

The iShares Bitcoin Trust trades on the Nasdaq stock exchange under the ticker IBIT.