The iShares Russell 2000 ETF (IWM 3.19%) is a top exchange-traded fund (ETF) for investors seeking broad exposure to small-cap stocks. The ETF tracks the Russell 2000 index, a collection of 2,000 stocks with a median market capitalization of $879 million as of April 2024.

In this article, we'll cover how to invest in the iShares Russell 2000 ETF. You'll learn about the fund's holdings, expense ratio, and dividend history, as well as the pros and cons of adding the iShares Russell 2000 ETF to your investment portfolio.

Exchange-Traded Fund (ETF)

What is it?

What is the iShares Russell 2000 ETF?

The iShares Russell 2000 ETF is an ETF managed by BlackRock (BLK 2.03%) that tracks the 2,000 small-cap stocks in the Russell 2000 index. The index comprises the 2,000 smallest stocks in the Russell 3000 index. Overall, the Russell 2000 index represents just 7% of the market value of the Russell 3000.

The fund is passively managed, which means there's no one actively selecting investments. The goal is to replicate the performance of its benchmark index as closely as possible. Launched in 2000, the iShares Russell 2000 ETF is the second-largest small-cap ETF in the U.S., with about $61 billion in assets under management.

Like its benchmark index, the iShares Russell 2000 ETF is market-cap-weighted, meaning a company's weighting in the index is based on its market capitalization (i.e., the total value of its outstanding shares).

How to invest

How to invest in the iShares Russell 2000 ETF

It's pretty simple to invest in ETFs like the iShares Russell 2000 ETF, even if you don't have any investing experience. To get started, follow these four steps:

Step 1: Open a brokerage account

The first thing you'll need to do to buy shares of the iShares Russell 2000 ETF is open a brokerage account. If you're investing for the long haul, you could also invest using an individual retirement account (IRA).

You can open an account online in just a few minutes. Look for a brokerage that has commission-free trading and a low minimum investment. Once you've opened your account, you'll need to deposit funds to make your first trade.

Step 2: Figure out your budget

Before you invest, you need to make a budget. If you're a new investor, you should figure out how much you can afford to invest overall each month and how much of your budget you want to allocate to the iShares Russell 2000 ETF. Because small-cap stocks tend to be riskier, it's best to avoid making the iShares Russell 2000 ETF your sole investment.

Step 3: Do your research

The beauty of investing in ETFs and mutual funds is that you don't have to research company financials as you would if you were buying individual stocks. But before you invest in an ETF, you should understand how the underlying index works. It's also important to consider the alternatives, as any investment involves opportunity cost.

Opportunity Cost

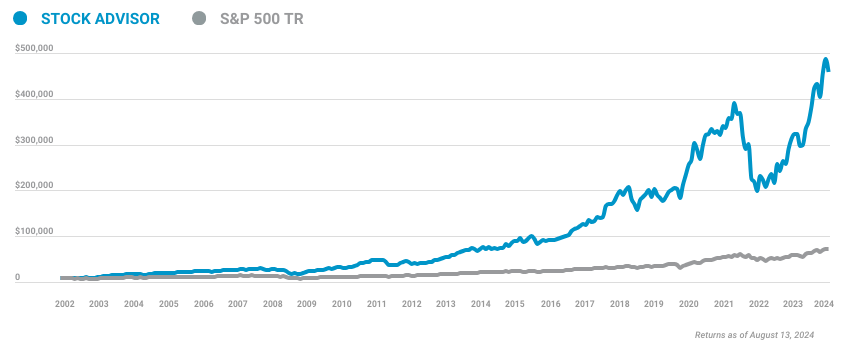

For example, the Russell 2000 ETF has generally underperformed the S&P 500 Index over the past 20 years. If you're new to investing, consider the pros and cons of investing in the iShares Russell 2000 ETF versus the top S&P 500 index funds.

Step 4: Place an order

If, after doing your homework, you've decided you want to invest in the iShares Russell 2000, it's time to place an order. You'll need to enter the ETF's stock ticker (IWM for the iShares Russell 2000 ETF) and how many shares you're purchasing. Or, if your broker allows fractional trading of ETFs, you could enter the dollar amount you want to invest.

Next, you'll need to specify whether you're placing a market order or a limit order. With a market order, your broker will place the trade right away for the current market price; with a limit order, you're telling your broker to place the trade only at a specified price. Then, you'll place your order to execute the trade.

Holdings

Holdings of the iShares Russell 2000 ETF

As of mid-May 2024, the iShares Russell 2000 ETF had 1,940 holdings. These holdings consist of stocks in the Russell 2000 index, which has a minimum market cap of $30 million.

The fund's top 10 holdings as of May 14, 2024 are:

Should I invest?

Should I invest in the iShares Russell 2000 ETF?

The iShares Russell 2000 ETF could be a good choice if you're seeking exposure to small-cap stocks. Small-cap stocks theoretically have higher potential returns than large-cap stocks because they have more room to grow.

In the past two decades, though, small-cap stocks in the Russell 2000 index have underperformed the S&P 500. The performance of small caps has been especially underwhelming recently as smaller companies have struggled with higher interest rates, while a few behemoth tech companies have accounted for much of the U.S. stock market's overall returns. Consider investing in the iShares Russell 2000 ETF if:

- You believe small-cap stocks are undervalued and have significant potential to grow.

- You already have a well-diversified mix of investments that includes large-cap and mid-cap stocks.

- You have at least a moderate risk tolerance and are comfortable with more volatility than you'd get with an S&P 500 index fund or a similar ETF that tracks large-cap stocks.

Dividends

Does the iShares Russell 2000 ETF pay a dividend?

The iShares Russell 2000 ETF pays a quarterly dividend based on the dividend payouts of the stocks in the fund. As of mid-May 2024, its annual dividend yield was 1.02%. For comparison, the S&P 500 index's annual dividend yield is about 1.35%.

Small-cap stocks generally aren't a great source of dividend income because smaller companies often need to reinvest their profits instead of distributing them to shareholders. If you're seeking investment income, consider a dividend ETF instead.

Expense ratio

What is the iShares Russell 2000 ETF expense ratio?

To choose the best ETFs to invest in, it's important to know the expense ratio, which is the percentage of your investment that goes toward fees. A high expense ratio can erode your investment returns over time.

Expense Ratio

The iShares Russell 2000 ETF has a 0.19% expense ratio. In other words, if you invested $10,000 in the fund, $19 would go toward fees, while the remaining $9,981 would be invested. That's slightly higher than the 0.16% average expense ratio for equity ETFs.

Related investing topics

Historical record

Historical performance of the iShares Russell 2000 ETF

It's important to consider historical performance in selecting an ETF. Although future returns are never guaranteed, past performance provides valuable insight into a fund's volatility and can help guide your decision about the proper allocation. Here's a breakdown of the iShares Russell 2000 ETF's historical performance as of April 30, 2024.

| 1-year returns | 13.13% |

| 3-year returns | (3.28%) |

| 5-year returns | 5.73% |

| 10-year returns | 7.18% |

The bottom line on investing in the iShares Russell 2000 ETF

The small-cap stocks in the iShares Russell ETF have higher growth potential than the large caps represented in the S&P 500, but their performance has been disappointing in recent years. If you're considering buying shares, be sure you plan to hold the ETF for the long term to give your money time to recover from the potential short-term volatility.

FAQ

Investing in the iShares Russell ETF FAQ

How do I invest in the Russell 2000 ETF?

You can invest in the Russell 2000 ETF in the same way you'd invest in individual stocks. You'll need to open a brokerage account and deposit funds. Then, you'll enter the ticker (IWM) and indicate how many shares you want to buy before placing your order.

Is the iShares Russell 2000 a good investment?

The iShares Russell 2000 ETF could be a good investment if you're seeking exposure to small-cap stocks. However, in the past two decades, large-cap stocks have outperformed small-cap stocks.

Which ETF is best for Russell 2000?

To find the best Russell 2000 ETFs, look for a fund with a low expense ratio and a high trading volume. Two of the best Russell 2000 ETFs are the iShares Russell 2000 ETF and the Vanguard Russell 2000 ETF (NASDAQ:VTWO).

Is there an index fund for Russell 2000?

Yes, there are several Russell 2000 index funds, including the iShares Russell 2000 Small-Cap Index Fund (BDBPX), the Fidelity Small Cap Index Fund (FSSNX), and the Vanguard Russell 2000 Index Fund (VTWO).