Databricks is one of the most widely followed and highly valued companies in the start-up world. Its Lakehouse platform, which makes it easier for companies to access and analyze their data, is driving its growth.

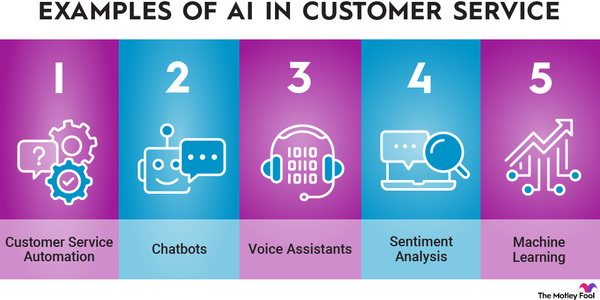

Lakehouse is a cloud-based platform used by data scientists and analysts. It enables companies to keep their data stored on third-party cloud servers like Amazon (AMZN 0.52%) Web Services. Companies looking to use artificial intelligence (AI) increasingly use the company's platform.

With AI technology accelerating, Databricks should have much more growth ahead of it. Given that growth potential, many investors can't wait to get their hands on its shares.

Here's a look at how to invest in Databricks and some factors to consider when evaluating the company.

Is Databricks publicly traded?

Is Databricks publicly traded?

As of mid-2024, Databricks wasn't a publicly traded company. Investors can't currently buy the company's shares on a stock exchange with their brokerage accounts.

Publicly Traded Company

Will it IPO?

Will Databricks have an IPO?

Databricks didn't have an initial public offering (IPO) on the calendar as of mid-2024. According to an article by the Wall Street Journal in early 2024, it was waiting for market conditions to improve before launching an IPO. However, Databricks' CEO said at the time that "the markets seem pretty shut."

Databricks has considered going public in the past. The company was on a path to complete an IPO in 2021 after its last private funding round. That would have been a prime time to go public due to sky-high investor interest in technology start-ups. However, with investor appetite for IPO stocks having cooled since then, the company may remain private until the IPO market heats back up.

Even though Databricks isn't a publicly traded company, some investors can still buy an interest in its upside potential through an online platform called EquityBee, used for many privately owned companies.

How to invest

How to invest in Databricks

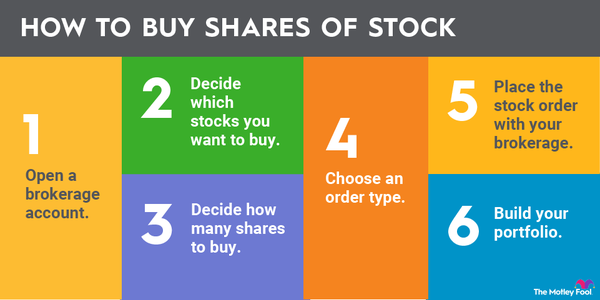

Even though Databricks isn't a publicly traded company, some investors can still buy an interest in its upside potential through a secondary platform like EquityBee or Forge Global (FRGE 5.67%). The online platforms allow accredited investors (i.e., those with a high net worth or a high income) to invest in venture capital-backed startups.

Accredited investors on EquityBee can fund employee stock options. In exchange, they will receive a percentage of the option's sale price when the company completes a liquidity event, like a sale or an IPO. Databricks is one of the most popular startups with investors on the EquityBee platform.

Meanwhile, anyone can gain exposure to Databricks through the Fundrise Innovation Fund. The venture capital fund is open to all investors. It also has a very low investment minimum (about $10 per share). Databricks is one of several pre-IPO companies held by the fund, which also owns shares of Canva, Anyscale, Anthropic, and OpenAI.

Artificial Intelligence

Alternative investments

Alternative options to investing in Databricks

There are alternative investment options for people who aren't accredited investors and want to gain upside exposure to the fast-growing cloud data sector before Databricks' IPO. They can invest in a publicly traded database company that competes with Databricks. Here are a couple of alternative options investors might want to consider:

- Snowflake (SNOW 0.56%): Snowflake's data cloud enables customers to store, process, and analyze data faster, more easily, and with greater flexibility than legacy solutions.

- MongoDB (MDB 0.41%): MongoDB is a document database. Its flexible approach enables clients to start building applications without spending time configuring their database.

Should I invest in Databricks?

While most investors can't invest in Databricks yet, here are some factors to consider before investing in the company if it launches an IPO.

Profitability

Is Databricks profitable?

Since Databricks is still a private company, it doesn't need to publicly report its profitability. As of mid-2024, the company still hadn't disclosed any information on its profitability.

The company likely wasn't profitable yet. According to an article by The Stack in late 2023, it hadn't yet reached profitability. At the time, the company was generating $1.5 billion in annualized revenue. While revenue was growing briskly (50% year over year), it was investing heavily to scale its business.

If revenue continues to surge, Databricks should eventually reach profitability.

Revenue

Databricks' revenue

Databricks' annual recurring revenue (ARR) run rate crossed the $1.6 billion milestone in 2023. The company is increasing revenue at a rapid clip; it surged 50% in the past year.

Databricks revenue will likely continue growing briskly. It had signed several deals with technology companies, including a $1.3 billion sales contract with generative AI startup MosaicML.

Databricks' valuation

Databricks last raised money from private investors in September 2023. The funding round raised $500 million at a $43 billion valuation. That's a $5 billion increase since its last funding round in 2021.

ETF options

ETFs with exposure to Databricks

Exchange-traded funds (ETFs) can be a great way to gain passive exposure to a company without directly owning shares. But since it's not publicly traded, investors can't use an ETF to gain passive exposure to Databricks stock.

However, they can invest in ETFs to capitalize on the same market trends as Databricks. Here are two ETFs to consider:

- Spear Alpha ETF (NYSEMKT:SPRX): This ETF invests in companies benefiting from breakthrough technology trends, like AI. Notable holdings include Snowflake and Nvidia (NVDA 4.55%), the latter of which is an investor in Databricks. The fund has a 0.75% ETF expense ratio.

- TrueShares Technology, AI & Deep Learning ETF (LRNZ 1.62%): This fund focuses on holding companies it believes possess innovative AI and deep learning solutions. It also counts Snowflake and Nvidia among its largest holdings. The ETF has a 0.69% expense ratio.

Related investing topics

The bottom line on investing in Databricks

Databricks is one of the most exciting up-and-coming companies. It's increasing revenue rapidly as more companies use Lakehouse to manage their data, especially for AI applications. It's a highly anticipated IPO.

However, since it's not yet public, investors can take their time to fully analyze the company before buying shares. They can also consider some of its already-public competitors like Snowflake and MongoDB, which are also growing fast and are closer to being profitable. They could be better investments over the long term, especially if Databricks launches at a rich valuation.

FAQ

FAQ on investing in Databricks

Can I buy shares of Databricks?

You can't buy shares of Databricks in your regular brokerage account. However, accredited investors (i.e., those with a high income or high net worth) can sometimes buy shares of pre-IPO companies like Databricks on a secondary platform like EquityBee or Forge Global.

In addition, anyone can invest in the Fundrise Innovation Fund. This venture capital fund invests in pre-IPO companies, including Databricks. The minimum investment is around $10 per share.

Should I invest in Databricks?

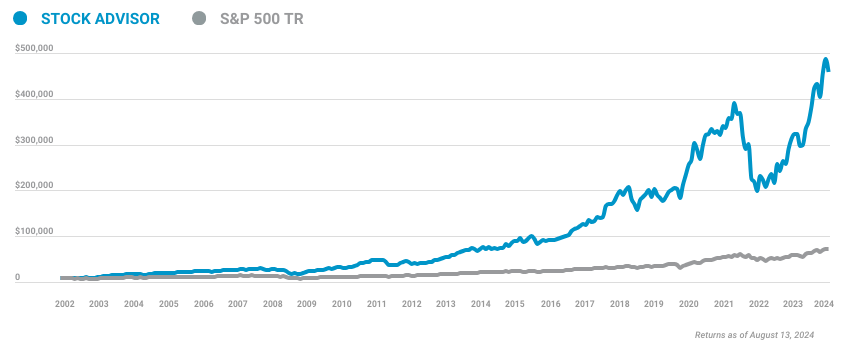

Because Databricks isn't publicly traded, you can't invest in its stock. However, if it does complete an IPO, it could be a good investment. The company is growing its revenue fast, which helps fuel investment outperformance.

Is Databricks publicly listed?

Databricks was not publicly traded as of mid-2024, so you can't buy shares on the stock market in a brokerage account. The company has not set an IPO date.

How much is Databricks' IPO worth?

Databricks had yet to IPO as of mid-2024, so we don't yet know how much its IPO will be worth.

However, the company raised fresh capital from investors in September 2023 at a $43 billion valuation. That's $5 billion more than its 2021 valuation. It would likely seek an even higher valuation in an IPO.

Is Databricks going to IPO?

Databricks would eventually like to go public. However, the IPO market remained largely closed to startups in mid-2024, so the company plans to wait until market conditions improve before completing an IPO.