Due to the expectation that the lithium-ion battery market will soar in the coming years, investors on the prowl for growth opportunities are turning their attention to Sila Nanotechnologies. According to Allied Market Research, the global lithium-ion battery market was valued at $46.2 billion in 2022, and the firm projects the industry will grow to $189.4 billion by 2032, representing a compound annual growth rate of 15.2% from 2023 to 2032.

Unlike conventional lithium-ion battery makers, Sila Nanotechnologies has developed a nano-composite silicon anode it calls Titan Silicon. The company argues that this innovative battery chemistry can be used in lithium-ion batteries and provides greater energy density than traditional lithium-ion batteries that use graphite anodes. For instance, when used in electric vehicles (EVs), greater energy density would translate to increased range and reduced charging time.

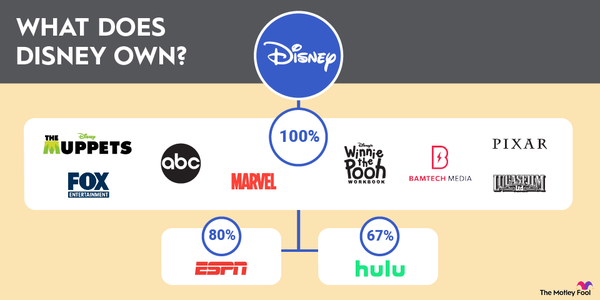

Incorporated in 2011, Sila Nanotechnologies has already landed some notable customers in its short history. In 2019, Mercedes-Benz (MBGY.Y 1.79%) invested in the company and inked a supply agreement for Titan Silicon to be used in the company's future EVs. And in 2023, Panasonic (PCRH.Y 3.08%) entered into a supply agreement for Titan Silicon to be used in Panasonic's EV batteries.

There may be some compelling reasons to consider an investment in Sila Nanotechnologies, but there are also some essential things to consider. For instance, how do investors buy shares of Sila Nanotechnologies, when will it hold its potential initial public offering (IPO), and are there alternative investment opportunities?

IPO

Publicly traded?

Is Sila Nanotechnologies publicly traded?

As of mid-2024, Sila Nanotechnologies stock was not available on public markets. So, investors looking to pick up shares are currently out of luck.

In addition to the equity insiders hold in the company, a variety of organizations have stakes in it. Investment management firm T. Rowe Price (TROW 0.36%) has equity in Sila Nanotechnologies, as do venture firms like Sutter Hill Ventures and 8VC and auto manufacturer Mercedes-Benz.

Will it IPO?

When will Sila Nanotechnologies IPO?

People on the prowl for investments with the potential for serious growth will often consider IPO stocks since they represent unique investment opportunities. Investors who have an eye on Sila Nanotechnologies may be especially motivated to buy the stock during its IPO.

Sila Nanotechnologies management, however, has not clarified whether the company plans to hold an IPO in the near future. Many exciting companies are planning for IPOs this year, but Sila Nanotechnologies is not on the IPO calendar.

How to buy

How to buy Sila Nanotechnologies stock

Although many people looking to buy Sila Nanotechnologies stock are currently out of luck, accredited investors may be able to pick up shares even before the stock holds an IPO. Platforms like Forge Global (FRGE 5.67%) allow accredited investors to invest in privately held companies, such as Sila Nanotechnologies.

Accredited Investor

If you aren't an accredited investor but still want exposure to battery companies like Sila Nanotechnologies, you still have options since there are many similar publicly traded companies to consider.

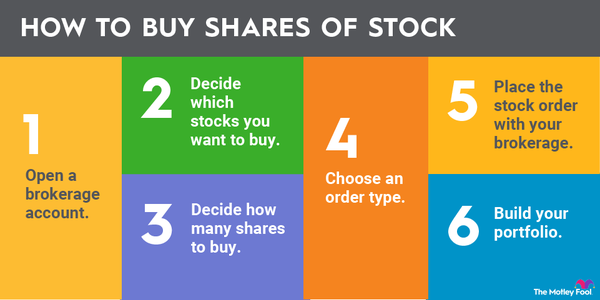

Step 1: Open a brokerage account

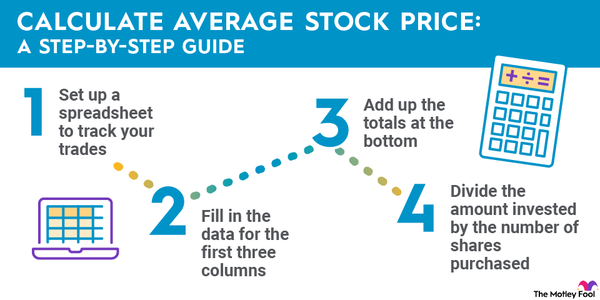

One of the first moves on your voyage toward building a robust investing portfolio is to open a brokerage account. There are a variety of options, but people new to investing may be best off opening a brokerage account that offers zero-commission online stock trades.

Step 2: Figure out your budget

Whether you pay close attention to your monthly expenses or not, investors must decide how much capital they'd like to allocate toward investing. Maybe a single stock purchase is a smart move for you, or maybe you'd be better off building a position over time. Regardless, it's vital to review your financial position and ensure you've taken care of basic needs, such as establishing an emergency fund.

Step 3: Do your research

Now more than ever, investors have ample resources at their fingertips to help them identify potential stock purchases. Although Sila Nanotechnologies may not be an investment option for ordinary retail investors, there are similar companies they may find appealing. Here are a few of them.

1. Mercedes-Benz

As one of the world's largest EV companies, Mercedes-Benz provides indirect exposure to Sila Nanotechnologies since the luxury auto manufacturer invested in the start-up in 2019. After scaling up operations at its Moses Lake, Washington, production facility, Sila Nanotechnologies will provide Mercedes-Benz with Titan Silicon anode produced at the facility.

Start-Up

Mercedes-Benz plans on using the nanocomposite silicon anode in batteries for its electric G-class. According to Sila Nanotechnologies, the company's Titan Silicon provides 20% greater energy density than the leading graphite battery cells currently used in EVs, resulting in greater range. Mercedes-Benz will be the first automaker to use the nanocomposite silicon anode from the Moses Lake facility in its EVs.

2. Enovix

Just as Sila Nanotechnologies is working to provide a better alternative to traditional battery chemistry, Enovix (ENVX 3.32%) is attempting to offer an enhanced option to traditional lithium-ion batteries by using silicon anodes.

Founded in 2007, Enovix is only a few years older than Sila Nanotechnologies, making it a good option for quenching the thirst of growth investors who are interested in Sila Nanotechnologies -- especially since the company just transitioned to the revenue-generating phase of its development in 2022.

Enovix recognizes the potential for its battery architecture to be used in EV batteries. However, it plans on supplying smartphone manufacturers in the immediate future.

In May 2024, Enovix announced a development agreement for its smartphone battery cells with one of the world's five largest smartphone original equipment manufacturers (OEMs) based on unit volume. Enovix expects to deliver the first samples of the EX-1M smartphone battery cells to the customer in the second quarter of 2024.

3. QuantumScape

One would be remiss to discuss disruptive battery stocks and leave QuantumScape (NASDAQ:QS) out of the conversation. The company is the poster child for investors seeking to disrupt the conventional lithium-ion battery market.

In developing solid-state batteries, QuantumScape has made significant progress toward achieving commercial-scale production despite the formidable production challenges that have stymied the progress of similar companies.

Attaining a 2024 goal, QuantumScape began shipping prototype battery cells to carmakers at the beginning of the year. During the year, it plans to start low-volume production of its first commercial product, QSE-5. In 2025, QuantumScape hopes to expand operations in preparation for commercial production of its batteries.

Further demonstrating the company's prominent position in the race to make solid-state batteries a viable option for EVs, QuantumScape has signed six commercial agreements with OEMs.

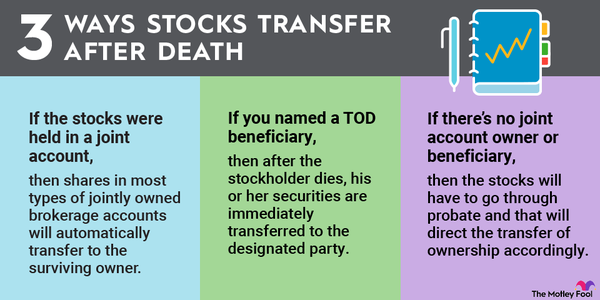

Step 4: Place an order

With most of the hard work done, you only have to make some final decisions before you can call yourself a stock investor. After choosing how many shares to purchase, you'll have to decide what type of order you want to make: a market order or a limit order. And now, it's time! Click the buy button and congratulate yourself on taking a step toward building personal wealth.

Profitability

Is Sila Nanotechnologies profitable?

Unlike publicly traded companies, which are obligated to submit regulatory filings, Sila Nanotechnologies is not required to provide insight into its financials. Thus, it's impossible to know for certain whether the company is generating a profit.

Although details regarding the company's financial health are scant, Sila Nanotechnologies has likely begun to generate revenue since it provided its battery technology for the wearable fitness device Whoop 4.0 in 2021. The company will make greater strides toward achieving profitability -- if it hasn't done so already -- when it begins to supply Mercedes-Benz with the Titan Silicon anode in 2025.

Should I invest?

Should I invest in Sila Nanotechnologies?

Because Sila Nanotechnologies hasn't held an IPO, most investors can't power their portfolios with the company's stock. If management decides to proceed with an IPO, however, the company will have to submit regulatory filings. At that point, investors will have a better understanding of the company's financial health, helping them decide whether an investment in the company is a smart choice.

Accredited investors may be able to gain exposure to Sila Nanotechnologies currently. Since the company is still a speculative investment, those who can invest in it should be comfortable exposing themselves to a higher-risk investment.

ETF options

ETFs with exposure to Sila Nanotechnologies

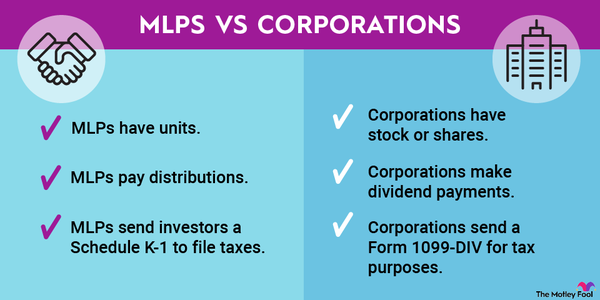

As a privately held company, Sila Nanotechnologies isn't held in exchange-traded funds (ETFs). Fortunately, for investors eager to gain exposure to similar types of companies, several lithium and battery tech ETFs provide exposure to stocks closely related to Sila Nanotechnologies.

Exchange-Traded Fund (ETF)

- Global X Lithium & Battery Tech ETF (LIT 2.08%): From lithium production companies like Albemarle (ALB 4.17%) to battery manufacturers like EnerSys (ENS 2.14%) to EV stocks like Tesla (TSLA 4.59%), there are 40 holdings in the Global X Lithium & Battery Tech ETF that span the lithium battery value chain. Most notably for investors interested in Sila Nanotechnologies, the ETF includes one of the company's customers, Panasonic, which represents 3.7% of the ETF's holdings. The ETF has a 0.75% expense ratio.

- Amplify Lithium & Battery Technology ETF (BATT 2.38%): In addition to lithium, the Amplify Lithium & Battery Technology ETF provides broad exposure to other metals involved in battery production, such as cobalt, rare earth metals, and nickel. True to its name, it also includes stocks that represent battery technology, representing about 24% of the ETF. As of June 2024, the ETF had 94 holdings and an expense ratio of 0.59%.

- iShares Global Clean Energy ETF (ICLN 2.85%): For investors interested in exposure to battery stocks and renewable energy stocks in general, the iShares Global Clean Energy ETF is an excellent option. Besides solar stocks, such as First Solar (FSLR 5.87%) and Enphase Energy (ENPH 6.5%), the ETF has stocks that span wind power, geothermal, and battery storage, as well as green energy powerhouses like Brookfield Renewable (BEPC 3.54%). The iShares Global Clean Energy ETF has 100 holdings and a 0.41% expense ratio.

Related investing topics

The bottom line on Sila Nanotechnologies

From EVs to wearable fitness devices to smartphones, lithium-ion batteries continue to be increasingly present in our lives. Demand for these power sources shows little sign of tapering off anytime soon, so it's no surprise that growth investors have Sila Nanotechnologies on their radars.

The company remains privately held, however, and there's no indication that management plans to take it public anytime soon. There are other options out there, though.

For indirect exposure to Sila Nanotechnologies, investors can pick up shares of Mercedes-Benz. For another innovative battery materials company, they can opt for Enovix. And, of course, QuantumScape is a worthy consideration for investors seeking a disruptive battery stock. Alternatively, investors looking to mitigate the risk of individual stocks may find an ETF a better way to charge up their portfolios.

FAQ

Investing in Sila Nanotechnologies FAQ

How do I buy Sila Nanotechnologies stock?

As of June 2024, Sila Nanotechnologies was not listed on public markets, so most investors cannot buy stock in the company.

Is Sila Nanotechnologies stock publicly traded?

As of mid-2024, Sila Nanotechnologies wasn't a publicly traded company, and it hasn't indicated plans to hold an IPO anytime soon.

What is the stock symbol for Sila Nanotechnologies?

As a privately held company, Sila Nanotechnologies has not held an IPO and does not have a stock ticker. If it holds an IPO, the company will determine its stock symbol then.

Who are the investors in Sila Nanotechnologies?

Sila Technologies has various investors, including T. Rowe Price, Mercedes-Benz, and Sutter Hill Ventures.