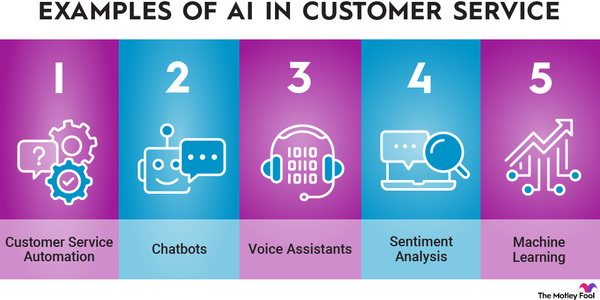

Short-form video platforms like TikTok have exploded in popularity in recent years. Triller offers a short video format similar to TikTok, but it got its start in the music video space. The platform prides itself on its AI-infused editing tools, allowing creators to edit faster.

In this article, you'll learn how to invest in Triller and the latest news surrounding its IPO.

Is it publicly traded?

Is Triller publicly traded?

Triller isn't publicly traded on the stock market as of yet. That means there's no opportunity to invest in Triller directly for most people.

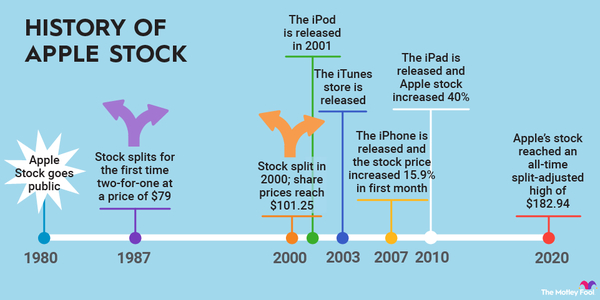

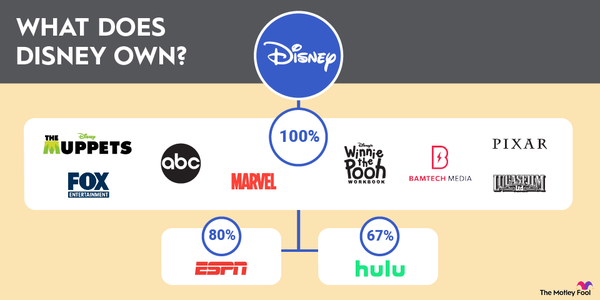

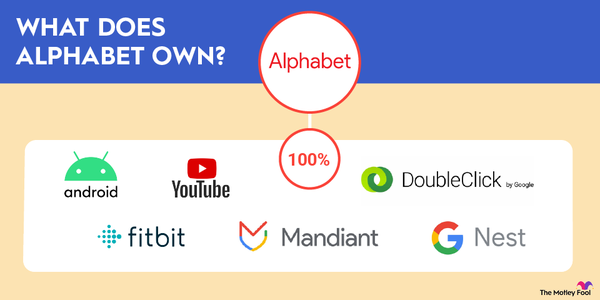

Instead of launching an initial public offering (IPO), Triller has opted to merge with AGBA Group Holding Limited (AGBA -1.75%), a NASDAQ-listed company. This merger will make Triller a wholly owned subsidiary of AGBA, similar to how YouTube is a wholly owned subsidiary of Google parent Alphabet (GOOGL 2.33%) (GOOG 2.23%).

IPO

IPO

When will Triller IPO?

Initially, Triller planned a direct listing and filed an S-1 registration statement for a public listing on the New York Stock Exchange under the ticker ILLR.

However, on May 6, 2024, Triller withdrew this filing ahead of a planned merger with AGBA, a Hong Kong-based conglomerate that focuses on financial services and healthcare. This decision means Triller will not IPO independently but will instead become part of AGBA. Once the merger is completed, investors will be able to get exposure to Triller by purchasing AGBA stock.

How to invest

How to buy Triller stock

Although you can't buy Triller stock directly, there are ways to gain indirect exposure to Triller by investing in companies within the same industry or those that provide related services.

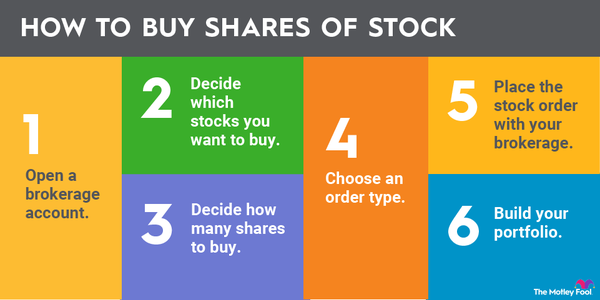

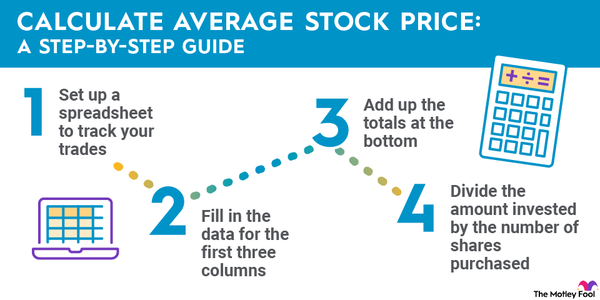

Step 1: Open a brokerage account

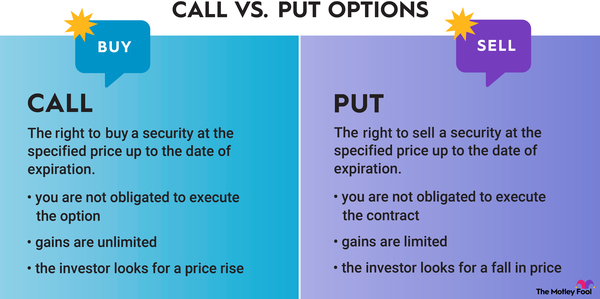

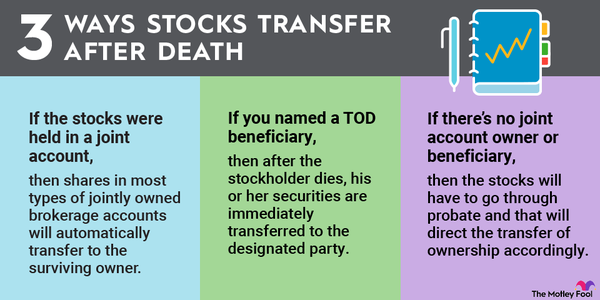

To start investing in either AGBA or companies related to Triller, you first need a brokerage account. You can buy and sell stocks, ETFs, and other securities with a brokerage account. Many brokers also provide access to products that are common with more advanced traders, like options and derivatives. Online brokers tend to offer user-friendly platforms with low fees, making them accessible to most investors.

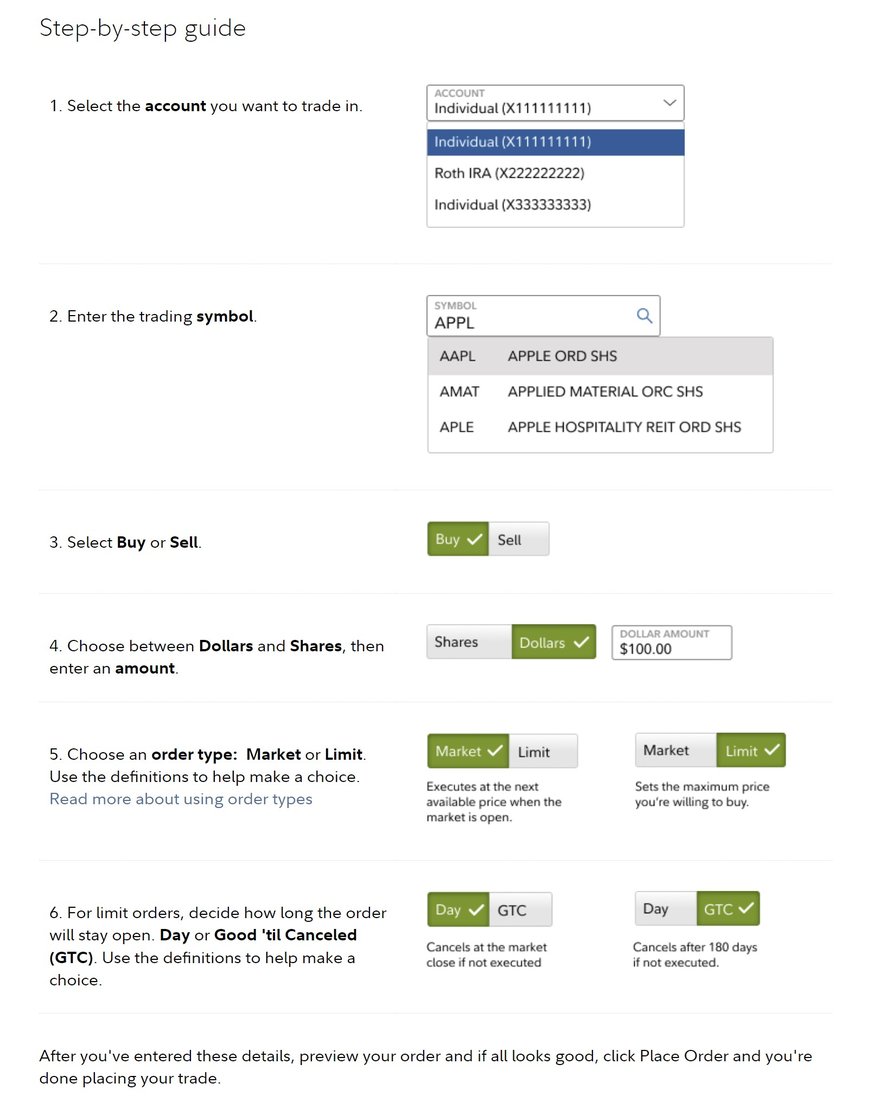

Below is an example of how one would buy stock through Fidelity:

Step 2: Figure out your budget

Before you start investing, it's important to figure out how much money you can afford to invest. It's wise to set a strict budget, especially when you're starting out. Whether you are trying to contribute on a monthly basis to a stock or you are investing a lump sum all in one stock, it's important to determine how much you can comfortably afford.

Consider spreading your investments across different companies and industries to reduce your level of risk. You might want to diversify with stocks and ETFs in different industries.

Step 3: Do research

Although Triller is not available for direct stock purchase, there are other companies in the same industry. Take time to research related companies' performance and outlook before making an investment.

Step 4: Place an order

With your brokerage account ready, budget in place, and research done, it's time to place your order. You'll have to enter the stock's ticker, the number or dollar value of shares you're buying, and the type of order you want to place.

Remember, you can't invest in Triller directly, so you'll need to either invest in AGBA or invest in companies or industries with indirect exposure to Triller. Here are three options to consider.

AGBA

Purchasing shares in AGBA is the most direct way to gain exposure to Triller, as Triller will become part of AGBA, assuming the upcoming merger is completed. AGBA is a Hong Kong diversified financial services company listed on NASDAQ, and its operational focus is on the Pearl River Delta in China. No, don't focus on any possible irony in how an American-based competitor is being sold to a company based in China when the fact that TikTok itself is a Chinese company is causing it a world of headaches.

However, do consider that AGBA is heavily exposed to the Chinese economy. Headwinds in China can affect AGBA's stock price, with or without Triller.

Meta Platforms

Meta Platforms (META 2.69%), the parent company of Facebook and Instagram, competes in the social media space and has been expanding its capabilities with AI-driven content creation and monetization tools similar to those that made Triller so popular. Meta offers a much greater reflection of advancements in the AI and short-form video space than the company that Triller is becoming a part of, AGBA, as Instagram has invested considerably in short-form video content to compete with the likes of TikTok.

Snap Inc.

Snap Inc. (SNAP 3.56%), the company behind Snapchat, is another player in the social media arena. It has a strong focus on augmented reality and user-generated content, providing exposure to the trends driving Triller's business. With a market cap of around $22 billion, Snap offers an alternative to some of the larger social media, internet, and tech companies out there.

Profitability

Is Triller profitable?

As of the latest reports, Triller is not yet profitable. In its S-1 filing, Triller reported a net loss of $90.6 million for the first nine months of 2023. Triller also said it has incurred net losses every year since its inception.

Should I invest?

Should you invest in Triller or companies with indirect exposure?

Only you can decide if investing in companies related to Triller is right for you. Here are a few reasons you might consider doing so:

- You think short-form video is the future: Short-form video has exploded around the globe -- at the cost of all of our attention spans. If you think that this space is still in its infancy, you might want to invest in stocks related to Triller, such as Meta and Snap.

- You don't care about losses in the near term: Like many tech companies, Triller is operating at a loss and has been for a while. Triller is not currently profitable and faces significant challenges in achieving profitability. Although the company is bringing in revenue, it is still operating at a net loss, primarily due to high operational costs and legal issues, including a lawsuit with Universal Music Group.

- You believe the AI boom will continue: Investing in companies like Triller is a way to invest in the AI boom. If you think that we are just in the nascent stages of AI, you might want to invest in companies similar to Triller.

Conversely, here are some reasons that you might want to pass on such an investment:

- You want a dividend: Traditionally, most tech stocks do not offer a dividend, as they reinvest any profits in growth. Remember, for many tech companies, users and the data they provide become an extremely valuable asset itself, whose worth can be measured further down the line. If you want a dividend, it's best to go with a more traditional dividend-yielding stock, such as CVR Energy Corporation (NASDAQ -CVI) or Insteel Industries (NASDAQ-IIIN).

- You don't want to invest in AGBA: Although AGBA is listed on the NASDAQ, much of its revenue is derived from China, particularly the Pearl River Delta region. China is dealing with deflationary pressures that coincide with extreme debt problems and a moribund property market. This could affect ABGA outside of its Triller acquisition.

- You think AI and streaming are overhyped: The constant presence of streaming services, both old and new, coupled with the constant hype around AI, could be the recipe for a bubble. If you think that AI and streaming as a whole are overvalued, you might want to stay away.

ETFs

ETFs with exposure to companies similar to Triller

| ETF Ticker | Name | Exposure to Tech/Short-Form Video Companies | AUM (in billions) | Expense Ratio |

|---|---|---|---|---|

| (NYSEMKT:ARKW) | ARK Next Generation Internet ETF | Invests in internet-based services, streaming, and digital media | $1.45 billion | 0.87% |

| (NASDAQ:ESPO) | VanEck Video Gaming and eSports ETF | Focuses on video game development and eSports | $247 million | 0.56% |

| (NYSEMKT:XLC) | Communication Services SPDR Fund | Holds interactive media and entertainment companies | $18.84 billion | 0.09% |

| (NASDAQ:HERO) | Global X Video Games & Esports ETF | Invests in video game developers and esports content | $117.63 million | 0.50% |

The bottom line on Triller

While you cannot invest directly in Triller, the merger with AGBA offers a viable pathway for indirect investment. You could consider investing in AGBA, Meta Platforms, or Snap Inc. to gain exposure to Triller's growth prospects and the broader social media and AI markets.

However, do follow the research and decide for yourself whether you think investing in the AI and streaming space has the potential to grow, or perhaps it's all a bit frothy at the moment. Only with solid research and analysis can you decide if these investments make sense for you.

Related investing topics

FAQ

Investing in Triller: FAQ

What is the stock symbol for Triller?

Triller's anticipated stock symbol was ILLR. However, following a merger with the Hong Kong-based AGBA, the new stock symbol will be AGBA.

What happened to the Triller IPO?

Triller initially planned an IPO and filed for a direct listing. However, due to market volatility and legal challenges, the company abandoned its IPO plans. Instead, Triller announced a merger with AGBA, making an IPO unlikely in the foreseeable future.

How does Triller make money?

Triller generates revenue through events, advertising, and e-commerce. The company has diversified its revenue streams by acquiring platforms like Fangage for fan engagement and monetization and launching Triller Fight Club for live event platforms.

What is Triller's IPO price prediction?

There is no specific IPO price prediction for Triller anymore, as the company has decided to merge with AGBA instead of pursuing a traditional IPO. The deal values Triller at around $3.2 billion.