xAI is one of the hottest artificial intelligence (AI) start-ups on the planet. Elon Musk launched xAI in 2023, and it has raised billions of dollars from investors to build an AI company to help accelerate human scientific discovery.

Artificial Intelligence

Musk's AI start-up was worth a staggering $24 billion in mid-2024, just one year after its founding. That made it the second-most valuable AI start-up behind OpenAI, the developer of the popular AI chatbot ChatGPT. xAI has its own AI chatbot, Grok, which launched in late 2023 to subscribers of Musk's X social media platform.

Venture capital funds and other institutional investors have invested billions of dollars into xAI, hoping it will emerge as a leader in the AI age. Here's everything you need to know about xAI and how to potentially invest in the AI stock before it completes an initial public offering (IPO).

IPO

Publicly traded?

Is xAI publicly traded?

xAI wasn't a publicly traded company as of mid-2024. The AI start-up was a private company owned by Musk, his fellow X investors, and several institutional investors. Notable xAI investors, besides Musk, include Fidelity Management & Research, Andreessen Horowitz, Sequoia Capital, Saudi Prince al-Waleed bin Talal, and Kingdom Holding.

Will it IPO?

When Will xAI IPO?

xAI didn't have an IPO on the calendar as of mid-2024. The company completed its Series B funding round in late May 2024, raising a staggering $6 billion.

That valued the one-year-old AI start-up at a stunning $24 billion. It put xAI ahead of Anthropic's $18 billion valuation, although it was a distant second to OpenAI's $86 billion value. Given its early stage of development and the ease at which it can raise private capital, xAI likely won't go public anytime soon.

How to buy

How to buy xAI stock

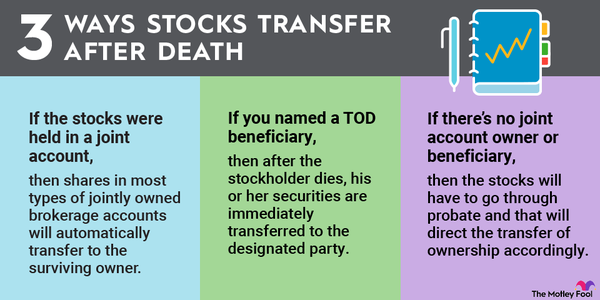

Since xAI is a private company, you can't buy shares in a brokerage account. However, accredited investors (i.e., those with a high net worth or high income) can sometimes buy shares of pre-IPO companies on secondary marketplaces, like Forge Global (FRGE 5.67%) and Hiive.

Accredited Investor

Accredited investors who really want to buy pre-IPO shares of xAI should check out those and other secondary marketplaces to see whether they have shares available to buy.

Another option to consider is investing in the ARK Venture Fund (NASDAQMUTFUND:ARKV.X). The venture capital fund managed by Cathie Wood is open to all investors for a relatively low minimum investment of $500.

It purchased shares of xAI in mid-2024 as part of its growing investment in AI companies (it also owned shares of OpenAI and Anthropic). While it's one of the few ways non-accredited investors can gain access to venture capital investments, the fund has a high management fee of 2.75% per year.

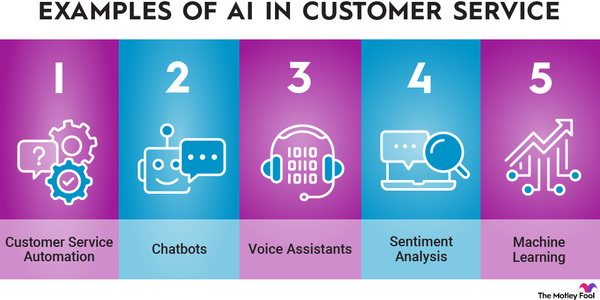

A different path to consider is investing in a publicly traded company focused on AI. Three top AI stocks are:

Nvidia

Nvidia (NVDA 4.55%) is a leading semiconductor company. It has developed many of the chips AI companies are using to power their models.

For example, Musk has ordered 85,000 of Nvidia's flagship AI chips (H100) for delivery in 2024 and is having some of those chips sent to xAI to accelerate its development. The growing purchases of Nvidia's AI chips are driving robust revenue and earnings growth for the semiconductor company.

Meta Platforms

Meta Platforms (META -0.74%) is spending aggressively on AI. It's building several AI services, including its AI assistant, Meta AI and plans to build AI products, scale them, and then monetize them, which has been a successful playbook in the past. The company believes it has the talent, data, and ability to scale infrastructure to build the world's leading AI models and services.

Tesla

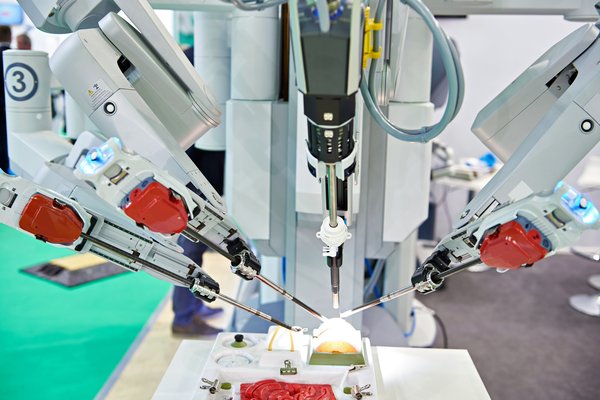

Musk's car company, Tesla (TSLA 4.59%), is investing heavily in AI. The company plans to spend $10 billion on AI initiatives in 2024, including buying chips from Nvidia. Tesla focuses on using AI to advance the development of full self-driving software and robotics. Musk would like to grow Telsa into a leader in AI and robotics.

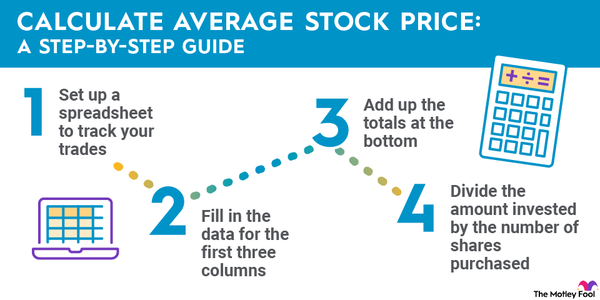

Investors who want to add one of these AI-focused companies can purchase shares in any brokerage account. Here's a step-by-step guide on how to invest in stocks that should benefit from the growing adoption of AI.

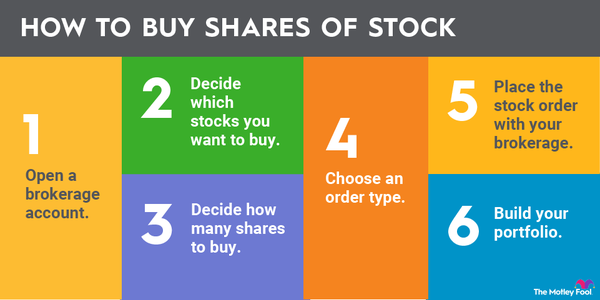

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you still need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Brokerage Account

Step 2: Figure out your budget

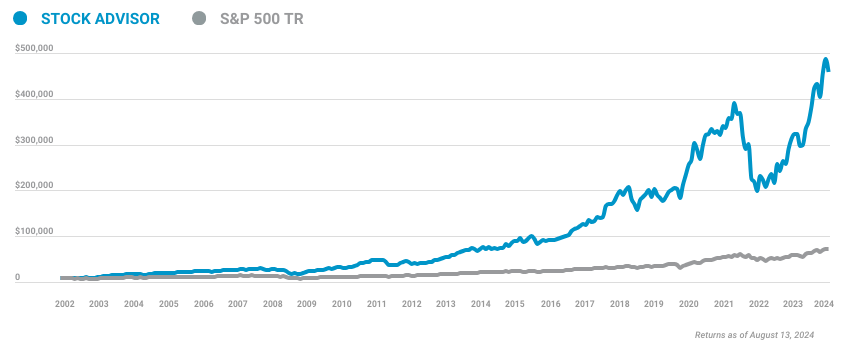

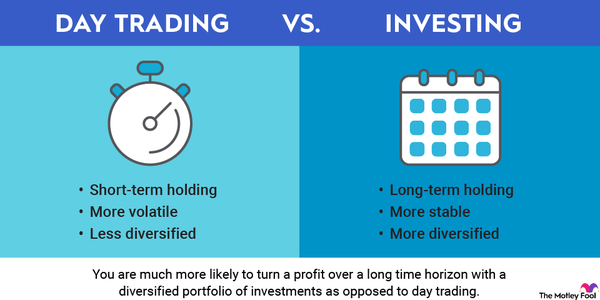

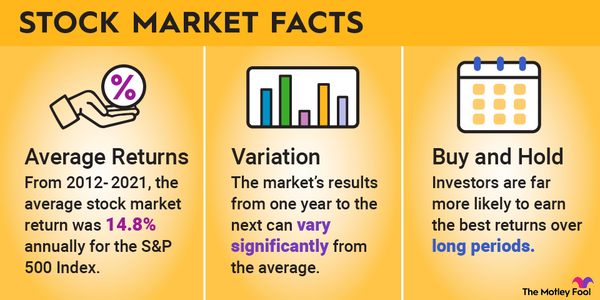

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to decide how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

That might seem like a daunting task for those starting out. However, you don't have to get there on the first day. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across around 10 stocks and then grow from there.

Step 3: Research related companies

It's essential to thoroughly research a company before buying its shares. You should learn how it makes money and study its balance sheet and other factors to ensure you have a solid grasp on whether the company can grow value for its shareholders over the long term. You should also research related companies.

Some notable competitors to xAI include OpenAI, Anthropic, and Meta Platforms. Investors should also research these rivals before buying shares of xAI or another AI stock.

Step 4: Place an order

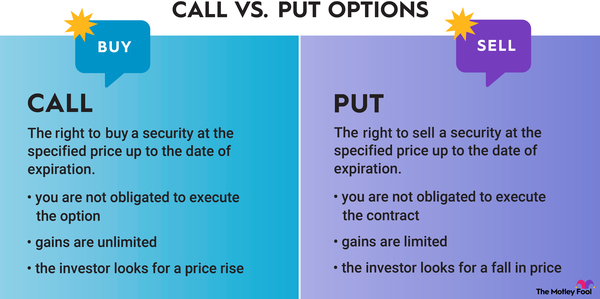

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock and its competitors, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill in all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (NVDA for Nvidia, META for Meta Platforms, and TLSA for Tesla).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order because it guarantees you buy shares immediately at the current market price.

Once you complete the order page, click to submit your trade and become a shareholder in one of these leading AI companies. Investors would follow a similar process to buy an IPO stock like xAI when it goes public. Once shares become available, fill out your brokerage account's order page with the AI company's selected stock ticker and submit your trade.

Profitability

Is xAI profitable?

The privately held xAI doesn't need to publicly disclose its financial information to investors, so there isn't any publicly available information about its revenue and profitability.

However, given that the company had only been operating for about a year by mid-2024, it likely wasn't profitable and was a long way from making money. The AI start-up probably isn't generating much, if any, revenue yet since its only product (Grok) is available for free to X subscribers.

Meanwhile, the company is investing heavily in buying chips from Nvidia to train AI models and hiring to grow its team. These heavy investments likely mean the company is losing a lot of money.

While xAI is presumably losing money, the company raised $6 billion in cash from investors in mid-2024 to help fund its investments. That gives it lots of money to fund product development, build infrastructure, and accelerate its research and development activities. However, it will eventually need to start making money to become a sustainable business and justify its lofty valuation.

Should I invest?

Should I invest in xAI?

Most investors can't buy shares of xAI directly yet. That gives you plenty of time to decide whether investing in the AI company will be right for you whenever it eventually does go public. With that in mind, here are some reasons you might want to invest in xAI's future IPO:

- You believe in xAI's mission of building AI to accelerate human scientific discovery.

- You think Grok is a better chatbot than rivals like ChatGPT, Claude, and Meta AI.

- You're a big fan of Musk and want to invest in companies he's backing.

- You believe xAI can develop, scale, and monetize commercially successful AI products.

On the other hand, here are some reasons you might decide that xAI isn't right for you:

- You're not really a fan of Musk.

- You're concerned that xAI is learning based on data generated by X users.

- You think the company's valuation is difficult to justify.

- You prefer other AI chatbots to Grok.

ETF options

ETFs with exposure to xAI

Because xAI isn't a publicly traded company yet, you can't passively invest in its stock through an exchange-traded fund (ETF). However, you can use ETFs to invest in the AI megatrend. Here are three top AI ETFs to consider investing in to capitalize on the AI boom driving xAI's growth potential:

- iShares Exponential Technologies ETF (XT 1.63%): The BlackRock (BLK 2.03%)-managed ETF allows you to invest broadly in companies with significant exposure to disruptive technologies, like AI. The ETF held shares of almost 200 companies in mid-2024, led by Nvidia at 1.2% of its net assets, and had a 0.46% ETF expense ratio.

- Global X Artificial Intelligence & Technology ETF (AIQ 1.46%): This fund invests in companies poised to capitalize on the growing development and usage of AI. In mid-2024, it had 84 holdings, including Nvidia (its top holding, at 5.5% of its assets) and Meta Platforms (its fifth-largest holding, at 3.5%). The ETF had a 0.68% expense ratio.

- First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT 2.32%): This ETF strives to track the performance of companies engaged in AI, robotics, and automation. In mid-2024, it had 108 holdings and a 0.65% expense ratio.

Related investing topics

The bottom line on xAI

xAI has burst onto the scene over the past year to become the second-most valuable AI start-up. The Musk-led AI company has a bold vision and lots of funding to execute its mission, so it appears to have a bright future.

Although most people can't invest in the stock yet, there are many ways to gain exposure to the company and the trends driving AI investment. Those investments could pay off if AI lives up to all the hype.

FAQ

Investing in xAI FAQ

What is the price of xAI shares?

xAI wasn't a publicly traded company as of mid-2024, so its share price wasn't publicly available. In late May 2024, the company raised $6 billion from investors, valuing it at $24 billion roughly a year after its launch.

How to invest in AI start-ups?

While most AI start-ups are privately held companies, there are a few ways to invest in this emerging sector. One option open to everyone is the ARK Venture Fund, which holds shares of xAI and several other AI start-ups. The venture capital fund has a $500 minimum investment.

The Fundrise Innovation Fund is another venture capital fund open to everyone. It has invested in several AI pioneers, including OpenAI, Anthropic, and Anyscale. The fund has a very low investment minimum of only $10.

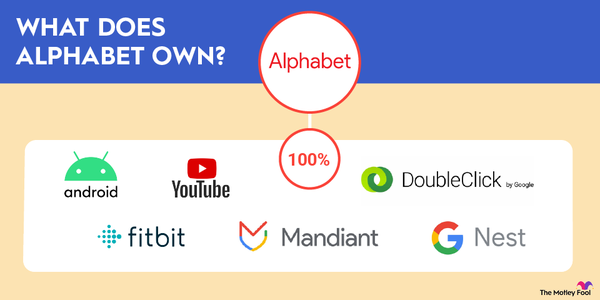

You can also invest in larger technology companies investing in AI start-ups. For example, Microsoft (NASDAQ:MSFT) is a leading investor in OpenAI, while Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) are early investors in Anthropic.

What company is behind xAI?

xAI is an AI start-up founded by Elon Musk. It's a separate company from his other endeavors, including his X social media platform (though it works closely with X, which has a 25% stake in the AI start-up).

Is xAI a publicly traded company?

xAI isn't a publicly traded company. It's a private company owned by Elon Musk, Musk's social media company X (formerly Twitter), and other institutional investors, such as venture capital and sovereign wealth funds.