Founded in 1988, BlackRock (BLK 0.91%) is a relative adolescent as an investment company. But it's become responsible for keeping tabs on more than $10 trillion in wealth, making it the world's largest asset manager. Keep reading for information about this investment giant, including its history, owners, managers, outlook, and how you can invest in BlackRock.

Overview

What is BlackRock?

For a company that manages more than $10 trillion in assets -- equivalent to 40% of all goods and services produced last year in the United States -- BlackRock has kept a relatively low public profile. The New York-based company was founded in 1988 to manage risk and fixed income assets. Since then, it's diversified to become one of the largest managers of index funds, managing the iShares group of exchange-traded funds (ETFs).

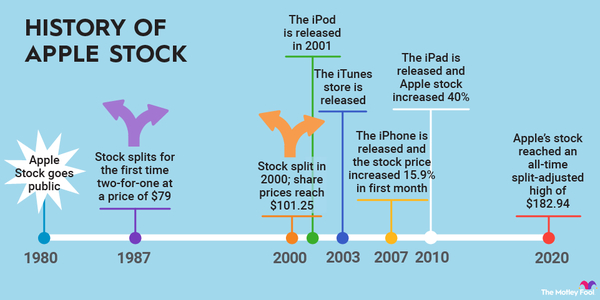

BlackRock launched its initial public offering in 1999 when it reported only $165 billion in assets under management (AUM). A series of mergers and acquisitions, however, dramatically increased the company's profile and assets.

BlackRock also was an integral part of the cleanup of toxic assets in the wake of the Great Recession, when the U.S. Treasury Department hired it to manage subprime securities held by Bear Stearns, American International Group (AIG 1.41%), Freddie Mac (FMCC -1.43%), and Morgan Stanley (MS -0.4%), among others.

The company became a major player in the ETF market in 2009 when it swung a $13.5 billion deal to buy a Barclays (BCS 0.61%) unit that included the iShares line of funds. It was added to the S&P 500 index in 2011.

The company was called on again by the federal government during the COVID-19 pandemic response effort, managing two corporate bond-buying programs and the purchase of mortgage-backed securities (MBS) guaranteed by Ginnie Mae, Fannie Mae (FNMA -2.65%), and Freddie Mac.

The scope and reach of BlackRock has recently been on display around the globe. It has reached an agreement to help Ukraine rebuild its economy after the war with Russia is over; its spot Bitcoin ETF was the first to reach $1 billion in volume; it was hired to sell the assets of Signature Bank and Silicon Valley Bank when they failed; and it became the first global asset manager to be approved for operations in China.

Board of Directors

Because of its ubiquity, BlackRock has been a lightning rod for politicians of all persuasions. Its environmental, social, and governance (ESG) policies have drawn fire from financial officials in Arkansas, Missouri, West Virginia, Florida, Utah, and Louisiana, with the states divesting from assets managed by BlackRock. While the company has touted a responsible approach to mitigating climate change, it has drawn the ire of environmentalists due to its ownership of more oil, gas, and coal reserves than any other investment management company on the planet.

Largest shareholders

Who are BlackRock's largest shareholders?

BlackRock, which has offered shares to the public since its 1999 IPO, is mostly owned by institutional investors, including the Vanguard Group, State Street Corp. (STT -0.01%), Bank of America (BAC -0.56%), and Temasek Holdings, a Singapore state-owned conglomerate. The largest investors include:

- Vanguard, 8.9%, 13.2 million shares valued at $10.9 billion.

- BlackRock, 6.5%, 9.6 million shares valued at $8 billion.

- State Street, 4%, 5.9 million shares valued at $4.9 billion.

- Bank of America, 3.5%, 5.2 million shares valued at $4.3 billion.

- Temasek, 3.4%, 5.1 million shares valued at $4.3 billion.

Although individual shareholders typically own far fewer shares than institutional investors, a handful of BlackRock officials own a considerable amount of the company's stock. The top individual investors include:

- Susan Wagner, 427,887 shares (0.28%)

- Laurence Fink, 414,146 shares (0.27%)

- Robert Kapito, 217,127 shares (0.14%)

- J. Richard Kushel, 67,107 shares (0.04%)

- Murry Gerber, 43,648 shares (0.02%)

Board of directors

Who is on BlackRock’s board of directors?

BlackRock has 16 members on its board of directors:

- Laurence Fink is the chairman, CEO, and co-founder of the company. The company describes his role as being responsible for senior leadership development and succession planning, defining and reinforcing BlackRock’s vision and culture, and engaging relationships with key strategic clients, industry leaders, regulators, and policy makers.

- Pamela Daley was a senior advisor to the chairman of General Electric (GE 2.01%) before her retirement in 2014. She was responsible for the company's worldwide mergers, acquisitions, and divestiture activities.

- William Ford has been CEO and chairman of General Atlantic since 2007. He has previously served on the boards of First Republic Bank, NYSE Euronext, E-Trade, Priceline, NYMEX Holdings, and Computershare.

- Fabrizio Freda has been president and chief executive officer of The Estee Lauder Companies (EL -0.38%) since 2009. Before joining the global beauty company, he worked for Procter & Gamble (PG -0.26%) and was director of marketing and strategic planning for Gucci SpA.

- Murry Gerber is the board's lead independent director. He worked as chief executive officer, president, chairman, and executive chairman for EQT Corp. (EQT -0.06%) between 1998 and 2011, and was CEO of Coral Energy (Shell Trading North America) from 1995 to 1998.

- Margaret Johnson has been CEO of Agility Robotics since March 2024. She was chief executive of Magic Leap Inc. from 2020 to 2023. She was executive vice president of business development at Microsoft (MSFT 0.94%) from 2014 to 2020.

- Robert Kapito has been the president of BlackRock since 2007. A co-founder of the company, he is responsible for the day-to-day oversight of operating units that include Investment Strategies, Client Businesses, Technology & Operations, and Risk & Quantitative Analysis.

- Cheryl Mills is the founder and CEO of the BlackIvy Group. She has been chief of staff for former Secretary of State Hillary Clinton, U.S. Department of State Counselor, and deputy counsel to former President Bill Clinton. She has served on the boards of Cendant Corp. (now Avis Budget Group) and Orion Power.

- Amin Nasser has been president and CEO of the Saudi Arabian Oil Co. (better known as Aramco) since 2015. He joined the company in 1982 as a petroleum engineer and is responsible for its efforts to produce cleaner energy.

- Gordon Nixon was president and CEO of the Royal Bank of Canada (RY 0.55%) from 2001 to 2014. He was chief executive officer of RBC Capital Markets from 1999 to 2001. He has been chairman of the board of BCE Inc. (BCE 0.2%) since 2016 and is on the advisory board of Kingsett Capital.

- Kristin Peck is chief executive officer of Zoetis Inc. (ZTS 0.38%) She held leadership roles at Pfizer (PFE -1.69%), Boston Consulting Group, Prudential Realty Group, and JPMorgan Chase (JPM -0.3%). She is a member of the Business Roundtable.

- Charles Robbins has been chairman and chief executive officer of Cisco Systems (CSCO 1.02%) since 2015. He is chairman emeritus of the U.S.-Japan Business Council and is on the board of directors of the Business Roundtable.

- Marco Antonio Slim Domit has been chairman of Grupo Financiero Inbursa, S.A.B. de C.V. (GPFOF -6.96%) since 1997, and served as its chief executive director from 1997 until 2012. He is also a board member of Grupo Carso, S.A.B. de C.V. (OTC:GPOVY) and Impulsora del Desarrollo y el Empleo en America Latina, S.A.B. de C.V. (OTC:IPSBF).

- Hans Vestberg has been CEO of Verizon Communications (VZ 0.14%) since 2019 and chairman since 2019. He was Verizon's chief technology officer and president of global networks from 2017-18. Before joining Verizon, Vestberg was president and CEO of Ericsson (ERIC 0.27%).

- Susan Wagner was vice chairman of BlackRock from 2006 to 2012. Before her retirement, she worked as BlackRock's chief operating officer and head of corporate strategy. She currently is a director at Color Health and Samsara.

- Mark Wilson was chief executive officer of Aviva plc (AVVIY 0.38%) from 2013 to 2018. Before joining Aviva, he was president and CEO of AIA Group Limited (AAIGF 4.17%).

How to invest

How to invest in BlackRock

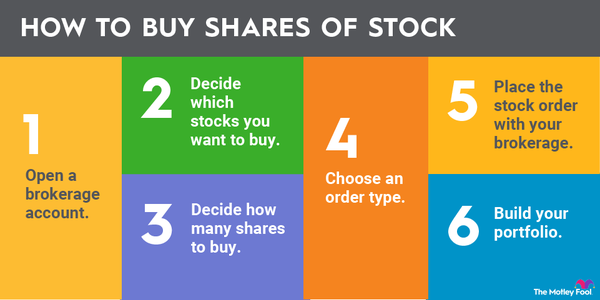

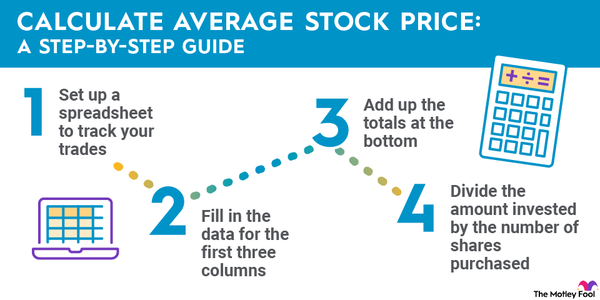

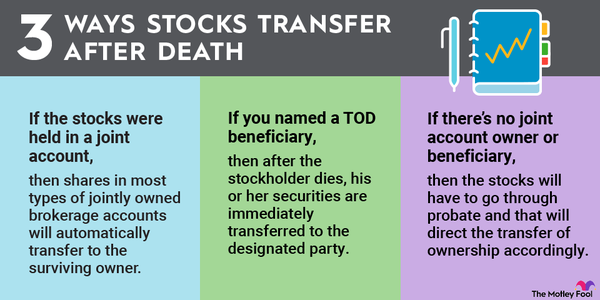

To buy shares of BlackRock, you'll need a brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying BlackRock stock using the five-star-rated platform Fidelity.

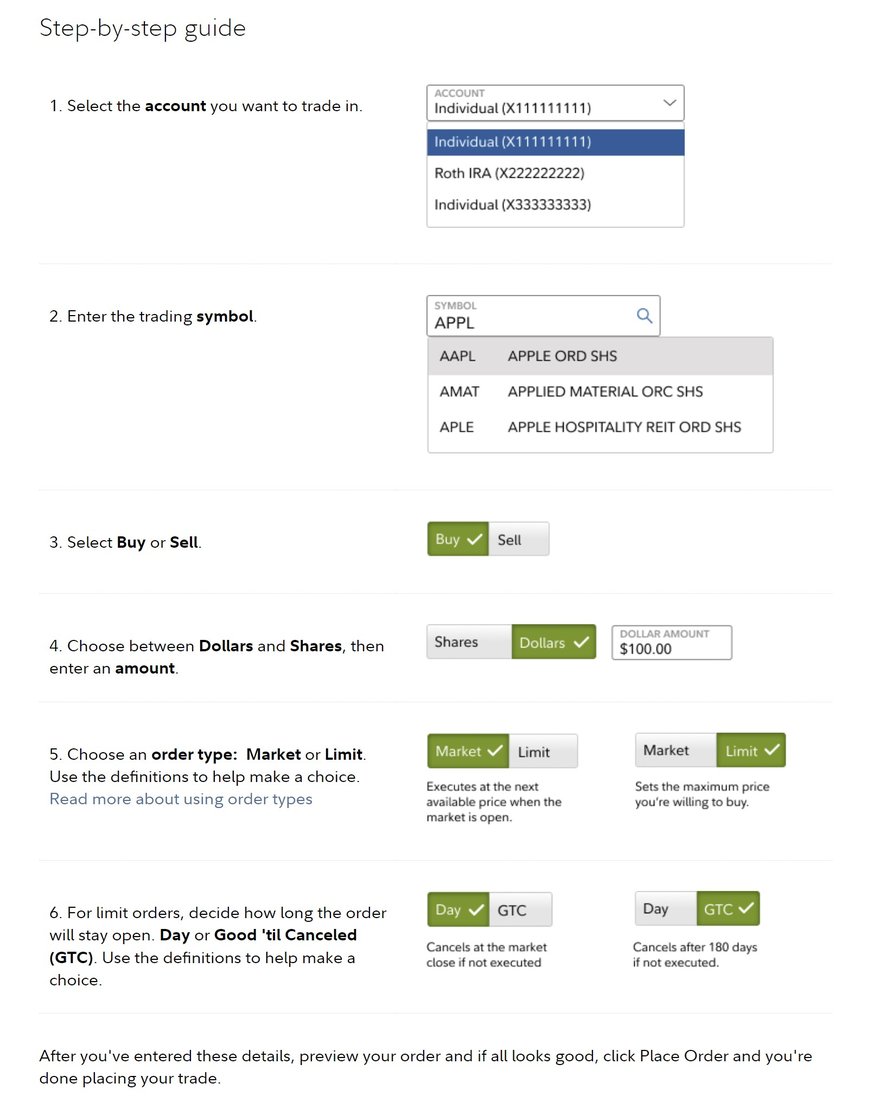

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

Shareholder

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (BLK for BlackRock).

- Whether you want to place a limit order or a market order. Know the difference between a market order and a limit order: The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Before you hit the "Place Order" button, figure out your budget. Are you in a position to invest in the market? Have you paid down high-interest credit card balances and created an emergency fund? How much can you spend? Do you want to buy all your BlackRock shares at once or periodically, with dollar-cost averaging? These are all very good questions for investors to ask -- and answer.

Next, do your homework. You may want to skip BlackRock stock if:

- You're skeptical of the company's ability to weather severe economic storms.

- You don't like the company's commitment to ESG investing.

- You think BlackRock's investments in fossil fuels will lose value.

- You believe interest in ETFs will eventually taper off.

- You think BlackRock shares are trading at unrealistically high prices.

- Your portfolio already has enough financial stocks.

On the other hand, you may want to go ahead and buy BlackRock stock if:

- You think BlackRock will continue to be the world's largest asset manager.

- You believe BlackRock's iShares ETFs will continue to be popular.

- You want to invest your money with a company that's trusted by the federal government.

- You'd like to balance your portfolio with a financial stock.

- You think BlackRock stock is undervalued and will rise as it expands into new markets.

- You're excited by BlackRock's expansion into cryptocurrency-related ETFs.

As with any other investment, there's a short answer to whether you might consider investing in this stock: It depends. Factors that might affect your decision include the level of your portfolio diversification, personal risk tolerance, company and industry knowledge, and assessment of BlackRock's competitive position.

If you've decided the pros of investing in the company outweigh the cons, then complete the order page, click the "Place Order" button at the bottom, and become a BlackRock shareholder.

Related investing topics

Bottom line on BlackRock

BlackRock may be the biggest asset manager on the block, but that doesn't always guarantee success. Although it was the first firm to record $10 trillion in assets under management, it's also posted the record for the most client money lost by a firm over a six-month period. As the market staggered in 2022, the company reported losing $1.7 trillion in assets. In addition, it's been whipsawed by criticism from both sides for its commitment to ESG investing and its role in financing climate change acceleration.

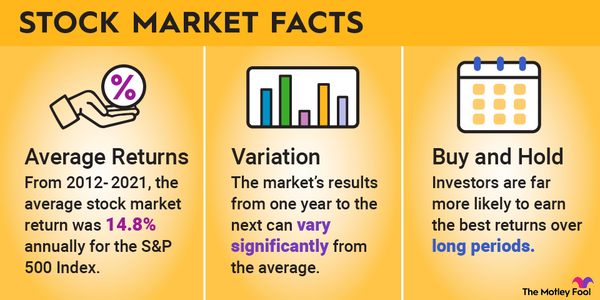

Keep in mind that if you invest in BlackRock, you're not investing in a company with $10 trillion in assets -- you're investing in a company that manages $10 trillion in assets. Although its role as one of the world's preeminent ETF managers may be extremely attractive, you should treat BlackRock like any other individual stock, as a long-term, buy-and-hold investment that's only part of a diversified portfolio.

FAQ

Blackrock FAQ

Who is the real owner of BlackRock?

No one person or company owns BlackRock. Five institutional investors -- Vanguard, BlackRock, State Street, Bank of America, Vanguard, and Temasek -- own about 25% of the company's stock.

Who is the majority shareholder of BlackRock?

No person or company owns a majority of BlackRock. The largest shareholder is the Vanguard Group, which owned 8.9% of the company's stock in mid-2024.

Is BlackRock the richest company in the world?

BlackRock is the world's leading asset manager and has a market capitalization of roughly $125 billion. According to CompaniesMarketCap, it was the 123rd-biggest company in the world in mid-2024.

Is BlackRock publicly traded?

BlackRock has been publicly traded since 1999.