Meta Platforms' (META -0.74%) social media app Instagram became a hit with the masses shortly after it launched in 2010, generating 1 million downloads in fewer than three months. Today, Instagram has an estimated 2.4 billion active users worldwide. To understand who benefits from all that activity, let's explore Instagram's ownership story, including the company's founder and its current owner.

Social Media

Who owns it?

Who is the owner of Instagram?

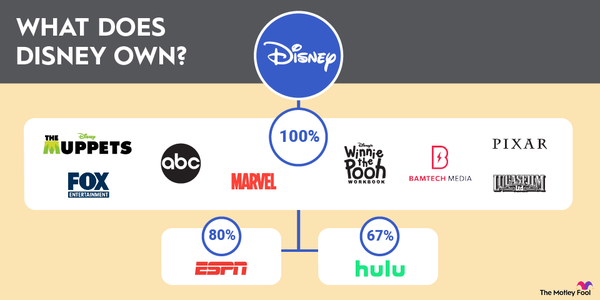

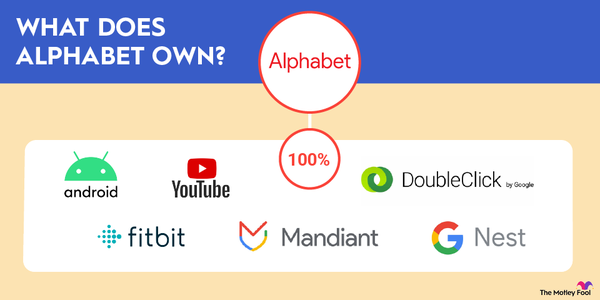

Facebook's parent company, Meta Platforms, also owns Instagram. The app has been part of the Meta empire since April 2012, when Meta purchased Instagram from its founders for roughly $1 billion in cash and stock.

Savvy decisions made by Instagram founders Kevin Systrom and Mike Krieger made the transaction possible. Systrom, a Stanford University graduate, left his job in 2009 to develop an app that allowed for photo-sharing and check-ins at venues serving fine whiskey. The app's name was Burbn.

Systrom quickly secured $500,000 in seed funding from venture capitalists he'd met at a party in Silicon Valley. He used the funding to build a team, and his first recruit was fellow Stanford graduate Krieger. Krieger previously worked as an engineer and user-experience designer for the instant messaging service Meebo.

Together, Systrom and Krieger assessed Burbn's strengths and most popular features in the competitive landscape. They saw an opportunity to blend the Hipstamatic app's photo-filtering functionality with Facebook's social sharing capabilities. They felt they could improve Facebook's photo-sharing features by streamlining the user experience.

Systrom and Krieger changed course to follow that opportunity. They renamed Burbn and restructured its features. Instagram was born as an easy way to share photos with the world. That course correction ultimately made Instagram a success with users and a coveted acquisition target among established social media companies.

Before selling the company to Meta, Systrom and Krieger raised $7 million in Series A funding and reportedly fielded an acquisition offer from X, formerly Twitter. After the Meta acquisition, Systrom and Krieger remained part of Instagram's leadership team until September 2018. Systrom served as CEO, and Krieger as head of engineering.

Largest shareholders

Who are the largest shareholders?

Since Instagram is owned entirely by Meta, Meta's shareholders are the true owners of Instagram.

Shareholder

Meta's largest individual shareholders

- Mark Zuckerberg is the founder and original developer of the social media application Facebook and is currently Meta's chairman and CEO. Zuckerberg owns 345 million Meta shares, most of which are Class B stock with expanded voting rights. His ownership position is 13.62%, worth more than $166 billion.

- Sheryl Sandberg served as Meta's chief operating officer (COO) between 2008 and 2022. She remained on the company's board but has announced she would vacate that position in the first half of 2024. Sandberg owns 1.3 million Meta shares, valued at $661 million. Her ownership stake is 0.05%.

- Christopher Cox is Meta's chief product officer, having joined Meta in 2005 as a software engineer. He left the company in 2019 to pursue new projects but returned in 2020. Cox's Meta share count is 379,336, worth $182 million. That translates to an ownership stake of 0.015%.

- Javier Olivan is Meta's current COO. He joined the company in 2007 and formerly held the role of chief growth officer. Olivan owns 0.0039% of Meta, or 100,187 shares, worth $48 million.

- Andrew Bosworth is Meta's chief technology officer, overseeing the company's Reality Labs team. Bosworth holds 78,700 Meta shares valued at $37 million. This equates to a 0.0031% ownership position.

Meta's primary institutional investors (as of March 31, 2024)

- Vanguard Group owns 187 million shares of Meta, worth roughly $90 billion and accounting for 7.38% of the company. Vanguard is a U.S. asset manager known for its low-cost index funds. The company is owned entirely by its funds, which are, in turn, owned by shareholders. Vanguard implemented that structure to ensure an alignment of interests among owners and customers. Vanguard funds that hold Meta stock include Vanguard Total Stock Market Index ETF (VTI 1.27%) and Vanguard S&P 500 ETF (VOO 1.08%).

- BlackRock (BLK 2.03%) owns 158 million Meta shares, 7.25% of the company, a position valued at about $76 billion. BlackRock, the world's largest asset manager, operates the popular iShares family of low-cost ETFs. The iShares Core S&P 500 ETF (IVV 1.08%) owns more than 22 million shares of Meta.

- FMR, LLC has a reported 6.24% ownership stake in Meta, amounting to 136 million shares worth about $65 billion. FMR LLC does business under the brand name Fidelity Investments. Fidelity runs exchange-traded funds (ETFs), mutual funds, and retirement accounts and provides wealth management services. The Fidelity 500 Index Fund (FXAIX -0.9%) holds 20 million Meta shares.

- State Street Corporation (STT 1.79%) has 86 million Meta shares valued at roughly $41 billion, about 3.41% of the company. Boston-based State Street runs ETFs under State Street Global Advisors (SSGA). SSGA's SPDR S&P 500 ETF Trust (SPY 1.06%) is the largest ETF in the U.S. in terms of net assets. The ETF owns 26 million shares of Meta.

- JPMorgan Chase (JPM 0.78%) holds 50 million Meta shares, or 2.29% of the company, a position valued at $24 billion. JPMorgan is a global financial services company that offers consumer and commercial banking and wealth management services.

The ownership percentages above are derived from an outstanding share count of 2,536,534,181 in Meta's 10-Q filing dated March 31, 2024. The total share count includes 2.19 million shares of Class A common stock and 345 million shares of Class B common stock, the Class B shares owned entirely by Zuckerberg. The values of each shareholder's position assume a share price of $481.54.

Board of directors

Who is on Instagram's board of directors?

Adam Mosseri is the head of Instagram. Prior to his leadership role at Instagram, Mosseri held executive roles in mobile app design and product management with Meta. He ultimately reports to Meta's leadership, who, in turn, report to Meta's board of directors.

Board of Directors

Meta currently has 11 members on its board of directors. Most are also shareholders, as explained below:

- Zuckerberg is the founder and current chairman and CEO of Meta.

- Sandberg is the former COO of Meta. She joined the board in 2012 and plans to exit the role in 2024. Sandberg was formerly the vice president of global online sales and operations at Alphabet's (GOOG 1.17%)(GOOGL 1.11%) Google. She is also an advocate for women's rights in the workplace.

- Peggy Alford joined Meta's board in 2019. She has held executive leadership roles at Paypal (PYPL 0.25%) and the philanthropic organization Chan Zuckerberg Initiative. Alford owns 6,844 Meta shares, worth just over $3 million.

- Marc Andreessen is a co-founder of venture capital firm Andreessen Horowitz and an early investor in Instagram. He also co-founded Netscape, which was later sold to AOL for $4.2 billion. Andreessen formerly held leadership roles at several technology companies, including AOL. He currently serves on the board for Coinbase (COIN 6.54%) and other companies. Andreessen has been on Meta's board since 2008 and owns 46,868 Meta shares. The position is valued at $22 million.

- John Arnold is co-founder and co-chair of philanthropic organization Arnold Ventures. He also founded the energy-focused investment fund Centaurus Capital and the large commodity hedge fund Centaurus Energy. Arnold does not own any Meta shares. He joined the board in February 2024.

- Andrew Houston is the CEO and chair of the collaboration application Dropbox (DBX 1.67%). He has served on Meta's board since 2020. Houston owns 9,818 Meta shares worth $4.7 million.

- Nancy Killefer came to the Meta board in 2020. Her background includes holding a senior partner role at management consulting firm McKinsey and several executive roles with the U.S. Treasury Department. Killefer holds 9,599 Meta shares worth about $4.6 million.

- Robert Kimmitt is the senior international counsel at international law firm Wilmer Cutler Pickering Hale and Dorr LLP. He has also held leadership roles with the U.S. Treasury Department, Time Warner, and Lehman Brothers. He joined Meta's board in 2020 and serves as the company's lead independent director. Kimmitt owns 9,532 Meta shares worth $4.6 million.

- Hock Tan is the president and CEO of S&P 500 tech company Broadcom (AVGO 2.48%). Prior to his role at Broadcom, Tan held senior leadership positions at Integrated Circuit Systems and Commodore International. Tan joined Meta's board in 2024. He does not own any Meta shares.

- Tracey Travis is executive vice president and CFO for Estée Lauder Companies (EL 2.47%), a global cosmetics brand. Prior to her tenure at Estée Lauder, she was senior vice president and CFO for luxury fashion company Ralph Lauren (RL 3.28%). Travis joined Meta's board in 2020 and owns 9,599 shares of the company. This position is worth $4.6 million.

- Tony Xu is the CEO, chairman, and co-founder of the delivery app DoorDash (DASH 0.01%). He joined Meta's board in 2022 and currently owns 3,814 shares of the company, a position valued at $1.8 million.

How to invest

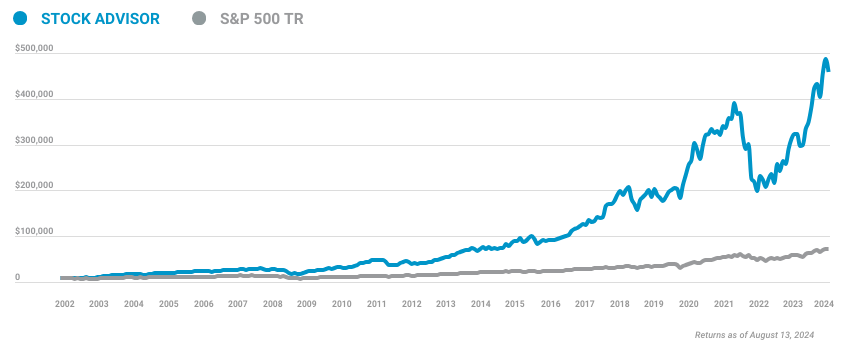

How to invest in Instagram

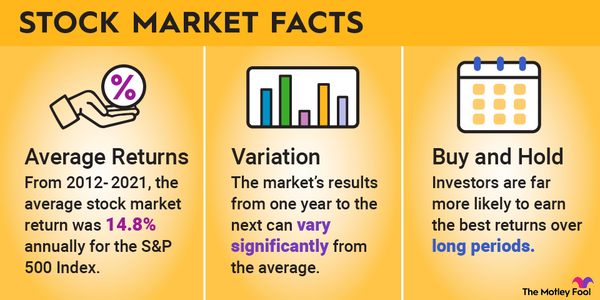

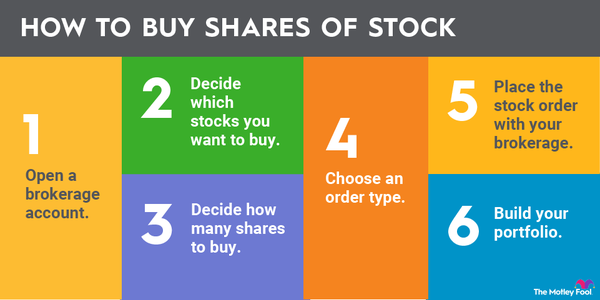

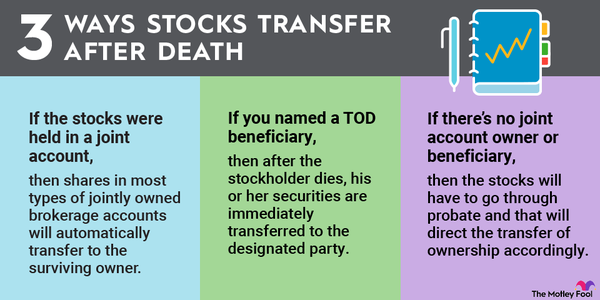

You can invest in Instagram by buying shares of Meta Platforms within your brokerage account. Many traditional and Roth IRAs may also allow you to buy Meta stock.

Related investing topics

If you prefer a more diversified approach to owning Meta, you can alternatively invest in shares of a mutual fund or ETF. Meta is readily available within equity funds because it is a member of the S&P 500, S&P 100, and the Nasdaq-100. Any fund that tracks these indexes will hold Meta as a top 10 position. Examples include:

- iShares Core S&P 500 ETF, a low-cost fund that replicates the S&P 500

- iShares S&P 100 ETF (OEF 0.86%), an ETF that focuses on the S&P 100 stocks

- Invesco QQQ (QQQ 1.08%), a popular ETF that tracks the Nasdaq-100

Another option is the Global X Social Media ETF (SOCL 0.84%), which invests exclusively in social media stocks.

Note that investing in Meta provides exposure to Instagram's and Meta's other products and services, including Facebook, WhatsApp, Messenger, and Meta Quest virtual reality headsets.

FAQ

Who owns Instagram FAQ

Is Mark Zuckerberg the owner of Instagram?

Zuckerberg is a majority shareholder in Meta, the company that owns Instagram.

Who owns Instagram right now?

Meta Platforms has owned Instagram since 2012, when it bought the photo-sharing app from its founders for $1 billion.

Who is Meta owned by?

Meta is a public company owned by its shareholders. Mark Zuckerberg, the company's founder, chairman, and CEO, is the largest shareholder, owning almost 14% of Meta's outstanding shares.

What does Mark Zuckerberg own?

Mark Zuckerberg's wealth comes primarily from his stake in Meta, the company he founded and runs. He owns some 345 million shares of Meta, worth more than $166 billion.