Apple (AAPL 1.03%) is one of the world's most powerful companies, with an installed base of over 2 billion devices, including its iPhones, Macs, iPads, and wearables. There are a number of reasons for its dominance, but part of it can be attributed to its walled garden, or closed-platform approach.

What is it?

What is Apple's Walled Garden, exactly?

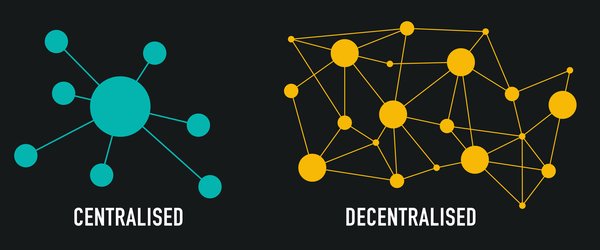

Apple's walled garden is a metaphor for its closed-platform software approach. Apple's ecosystem has earned the moniker "walled garden" due to its protective approach to its ecosystem and technology, including high-security measures. There are also a number of restrictions on developers and users of its devices.

Advantages

What are the advantages of the walled garden?

The walled-garden approach, which differs from open-source platforms like Alphabet's (GOOG 1.17%)(GOOGL 1.11%) Google, has several advantages for both Apple's customers and its business. For example, compared to PCs, Apple's Macs are known for being less buggy and less prone to crashes.

The walled-garden approach gives Apple more control over its devices and software, and they arguably tend to function better. The walled garden also makes it easier for Apple devices to work with other Apple devices. Airpods, for example, are designed to pair well with the iPhone, iPad, or Mac, and the Apple Watch works seamlessly with the iPhone, and its data lives on the iCloud.

The walled garden also has several advantages for Apple as a business. It helps the company earn wide profit margins by blocking out competition and protecting its App Store commissions, which are currently 30% for most payments and transactions on the platform.

While Apple could possibly be successful with an open-source model, the walled-garden approach has worked well for the company. It's allowed it to control every aspect of its product line, including the design and software, and helps it stand out against competitors like Android and Microsoft (MSFT 0.3%).

Finally, Apple's walled garden helps lock in users since once you have one Apple device, there's a large incentive to buy another and upgrade your existing one with a newer one.

Will it disappear?

Will Apple's walled garden ever go away?

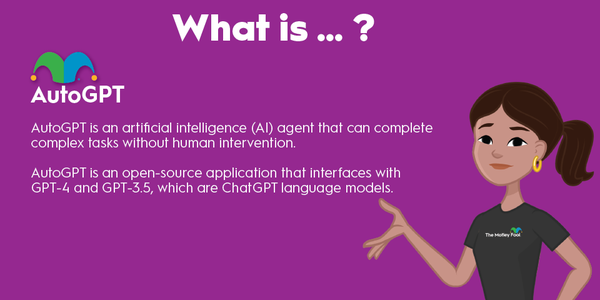

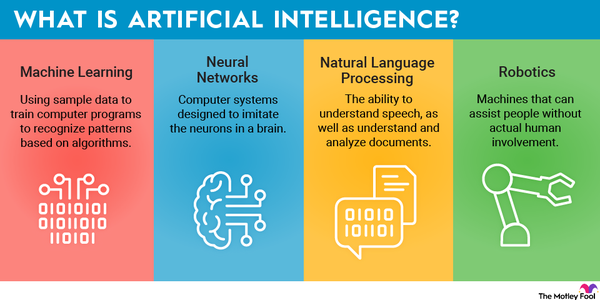

Not everyone likes Apple's walled garden. Some consumers complain that it makes Apple devices less compatible with other devices. Still others argue that it allows Apple to be risk-averse, which explains why it's been later than its competitors to launch an artificial intelligence (AI) product, although it just announced Apple Intelligence.

There are, however, some signs that Apple's walled garden isn't as strong as it once was. Legislation passed in the European Union will force Apple to take steps to open its App Store and make other things more compatible. For example, Apple said it would bring Rich Communication Services (RCS), an interoperable messaging system, to the iPhone. Doing so will make it easier for iPhone users to send messages to Android devices and vice versa.

However, Apple is likely to fight to maintain the walled garden. The strategy has worked well for it and underpins the interconnectivity of its ever-growing family of devices. While Apple might tweak that strategy, especially to appease regulators, investors should expect the walled-garden approach to persist.

Related investing topics

An example

What's an example of the walled garden?

The walled garden includes the large number of Apple's proprietary products, like iMessage, Apple Pay, the App Store, and iCloud, designed to function primarily with Apple devices. Trying to access a product like iCloud from a non-Apple device would give users less functionality.

Similarly, Apple uses proprietary software to run on proprietary hardware, an important difference from rivals like Google and Microsoft, which partner with other hardware companies to run their software. By enabling Apple to own the entire ecosystem, the walled-garden approach has given the company a strategic approach and is a key driver of its success.