Equal-weight funds have underperformed in recent years, but there are some good reasons to consider them today. Let's dive into what equal weighting means and the effects this strategy can have on a fund's performance.

Understanding equal-weight index funds

Overview

Equal-weight index funds hold their assets in identical proportions. This differs from weighting by market capitalization, which gives bigger companies more influence over the portfolio via higher exposure percentages.

Typically, the benchmark index of an equal-weight index fund is a secondary version of a cap-weighted index. An equal-weight S&P 500 fund, for example, tracks the S&P 500 Equal Weight Index. There are also equal-weight versions of the Russell 1000 and the MSCI USA.

An equal-weight S&P 500 portfolio holds the same percentages of all S&P 500 constituents. In other words, the fund's position in Microsoft (MSFT 0.94%) or Apple (AAPL 0.05%) has roughly the same value as its position in, say, Ulta Beauty (ULTA 0.21%) or Monster Beverage (MNST 0.52%).

Implications of equal weighting

Implications

Equal weighting does have strategy and performance implications:

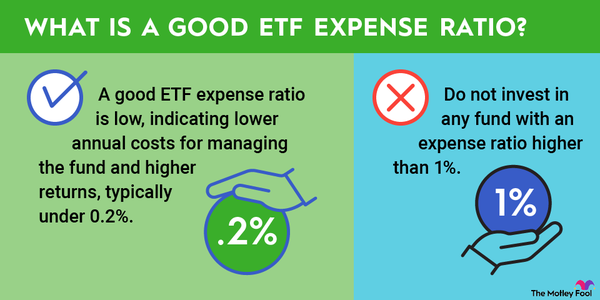

- More trading is required to keep a fund's positions weighted equally. This translates to higher expense ratios.

- In an equal-weight fund, smaller companies have the same influence on returns as larger companies. This can result in higher volatility. Returns vs. cap-weighting will be higher when smaller companies outperform. If large companies are growing quickly, the cap-weighted portfolios will do better.

- The fund will trim the share count of growing stocks and increase the share count of shrinking stocks. This aligns with the value-minded approach of buying when prices are low and selling when prices are high.

- Equal exposures across positions reduce the risk of concentration in overvalued stocks.

- Equal weighting relative to cap weighting changes sector exposure. In the era of dominant mega-cap tech stocks, for example, an equal-weight large-cap fund will have a smaller concentration in technology.

Three popular equal-weight funds

Three popular funds

The table below includes three equal-weight funds and their net assets, number of holdings, expense ratios, and 10-year average annual returns.

| Fund metrics and data | Invesco S&P 500 Equal Weight ETF (NYSEMKT:RSP) | Invesco Russell 1000 Equal Weight ETF (NYSEMKT:EQAL) | Direxion Nasdaq-100 Equal Weighted ETF (NYSEMKT:QQQE) |

|---|---|---|---|

| Net assets | $54.6 billion | $589 million | $1.2 billion |

| Number of holdings | 505 | 991 | 100 |

| Expense ratio | 0.20% | 0.20% | 0.35% |

| 10-year average annual return | 10.40% | 8.49% | 13.23% |

One quick takeaway from the data is the higher expense ratios relative to standard index funds. While there are many index funds with expense ratios less than 0.10%, that is a rarity for equal-weight funds.

Comparative performance of weighting

Comparative performance

Comparing the growth of an equal-weight index to its cap-weighted counterpart demonstrates more clearly how each strategy affects performance.

The table below shows average annual returns in the last 10 years for the Russell 1000 Equal Weight Index and the Russell 1000. Both indexes include the 1,000 largest companies by market capitalization.

| Time frame | Russell 1000 Equal Weight Index | Russell 1000 Index (Cap-Weighted) |

|---|---|---|

| 1-year return | 18.23% | 28.01% |

| 3-year return | 1.82% | 8.46% |

| 5-year return | 10.42% | 15.42% |

| 10-year return | 8.49% | 12.40% |

As you can see, equal-weighting has lagged cap-weighting throughout the last decade. In the last three years, the gap between the two strategies has widened. This isn't surprising, given the outsized gains from mega-cap tech stocks since 2021. Microsoft, Apple, and Nvidia (NVDA 1.92%) have eclipsed $3 trillion in market cap and are continuing to climb in the artificial intelligence (AI) investing race.

The question is whether they can continue growing faster than small and mid-caps. Historically speaking, big companies haven't always been the drivers of market growth.

Related investing topics

According to SSGA, the S&P 500 Equal-Weight index outperformed cap-weighted returns in 10 of the 20 years between 2003 and 2023. However, cumulative returns for the 20-year period are about the same across the two indexes.

Whether you choose an equal or cap-weighting strategy depends on which risks you'd rather avoid. If over-concentration in the largest companies and most dominant sectors is a concern, equal weighting may suit you. Know that with that choice, you also accept a greater reliance on smaller companies, potentially higher volatility, and contrarian trading activity.