Fat FIRE is one of the many strategies of the Financial Independence, Retire Early (FIRE) movement. This approach requires building a large (fat) nest egg to enable a more lavish retirement lifestyle that includes traveling, dining out, and enjoying entertainment. Here's a closer look at the Fat FIRE strategy, how to achieve it, its pros and cons, and an example.

What is it?

Understanding Fat FIRE

The FIRE movement aims to break away from the traditional retirement strategy of working until 65 by saving and investing enough money to retire early. Many popular FIRE strategies focus on keeping expenses to a bare minimum to retire as early as possible with a minimalist lifestyle. Fat FIRE is for those who want to enjoy the finer things in life during their earlier retirement.

The traditional FIRE strategy aims to minimize expenses to maximize your savings and investments. You could retire as soon as you build a big enough nest egg to support your frugal lifestyle. However, this approach means you need to maintain a meager lifestyle throughout retirement.

A lean lifestyle isn't for everyone. Those who want to enjoy retirement by traveling the world, eating out at nice restaurants, and enjoying entertainment will need to build a much bigger -- or fatter -- nest egg to maintain a higher annual spending level.

Hot to do it

How to achieve the Fat FIRE lifestyle

The Fat FIRE strategy requires building a much bigger nest egg than a leaner strategy. While many FIRE adherents seek to have about $1 million in investments before they retire, Fat FIRE requires amassing millions of dollars for retirement. Many Fat FIRE followers aim to have $2.5 million or more, depending on their target living expenses in retirement.

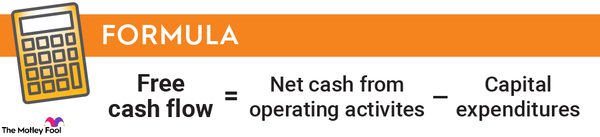

For example, many retirees (early or regular) abide by the 4% rule of withdrawing around 4% of their investment portfolio each year to cover taxes and living expenses. So, if you have $1 million, you're withdrawing $40,000 each year. That's not a lot of money to live on these days.

A bigger nest egg of $2.5 million would enable you to take out about $100,000 each year. That's a more comfortable level for some, but it might not be enough to live a lavish retirement lifestyle. If you want to spend at a higher level in retirement, you'd need to build a bigger nest egg.

A Fat FIRE approach likely means you and your spouse or partner will need to be high-income earners. You'll also likely need to work longer than someone following the lean FIRE method since you have a bigger nest egg to build. In addition, you might need to take on more risk to earn higher investment returns and try to grow your portfolio's value faster.

Pros and cons

What are some of the pros and cons of Fat FIRE?

The biggest benefit of Fat FIRE is the financial freedom to not need to work. You can spend that time enjoying the retirement nest egg you built, traveling, pursuing hobbies, spending time with friends and family, and volunteering. Other pros of this approach are the added financial ability to live in a higher-cost city, buy luxury goods, own a bigger house or vacation home, or live abroad.

The Fat FIRE strategy also has its drawbacks. You'll likely need to work longer in a job you might not like to continue building your bigger retirement nest egg. You also might need to take on more risk in your investments to earn a higher return and grow your portfolio faster. Those risks might not pay off, and you could lose a significant portion of your investments if you're not careful.

Meanwhile, your relationship with your spouse or partner might change over the years, resulting in a divorce or breakup wherein you must split the assets. Finally, you might realize you didn't save enough to maintain your desired lifestyle once you retire. You also might miss the social connections you had at work.

An example

A Fat FIRE example

Fat FIRE is one of the many approaches to becoming financially independent so you can retire early. It requires building bigger savings and investment accounts to fund a more lavish retirement lifestyle.

Related investing topics

For example, a recently married couple in their early 20s wants to retire early so they can live and travel throughout Europe (where they honeymooned) while they're still young enough to enjoy it. They decide to adopt the Fat FIRE approach.

The couple estimates they'll need about $150,000 of annual income to live and travel comfortably in Europe by the time they're in their mid-40s. They both have high-paying jobs and plan to live comfortably enough to raise a future family while saving aggressively for retirement.

They estimate they'll need between $3.5 million and $4 million to reach their income target using around a 4% annual withdrawal rate. They set that goal and begin aggressively saving and investing for retirement.