If you're considering becoming a mortgage-backed securities investor, there's a lot about mortgage lending that you might want to learn. Along with interest rates and how notes are engineered, it's important to be able to do calculations like the single monthly mortality rate. This figure can help you better understand what's happening with your investment.

If you're considering becoming a mortgage-backed securities investor, there's a lot about mortgage lending that you might want to learn. Along with interest rates and how notes are engineered, it's important to be able to do calculations like the single monthly mortality rate. This figure can help you better understand what's happening with your investment.

Definition

What is single monthly mortality?

When it comes to mortgage-backed securities (MBS), it's important to treat them like they're controlled by real people and aren't just economic models. Since mortgage-backed securities are based on real-life mortgage notes, a lot can happen with them.

For example, if someone refinances a note that's included in the bundle in your MBS, that changes the composition of your investment since the note has been paid in full and is no longer providing interest to your security. Enter single monthly mortality.

Single monthly refers to a single month, which is the time span for the measurement. Here, mortality reflects the reality that mortgages don't live as long as people and are often paid in full before they fully mature. When their lives are cut short, that becomes a calculation worth your attention. The single monthly mortality is a measurement of how much of your MBS is no longer going to be providing interest before it ends its life.

Prepayment ramps

Single monthly mortality and prepayment ramps

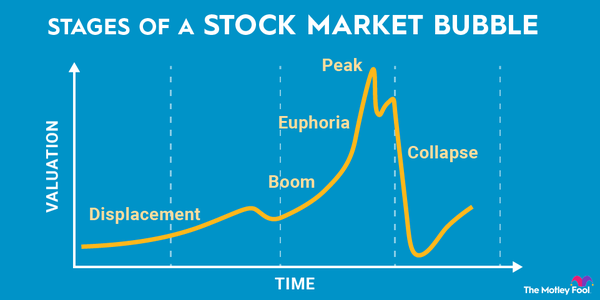

When you buy a mortgage-based security, it's expected that it will have two parts to its life. The first part is considered "on the ramp" and is a time when prepayments are coming in fast and quick, raising the single monthly mortality rate. It might be due to refinancing adjustable-rate mortgages (ARMs), refinancing to lock in a better rate, or even just selling a home early and moving elsewhere.

When the model was first designed, this period was expected to last about 30 months, but that was back in the 1980s, before the Great Recession, before ARMs lost a lot of their popularity, and long before borrowers could see mortgage rates changing in real time and easily refinance their loans online. So today, the initial ramp is expected to be shorter, though it will be difficult to say how recent interest rate increases will affect this.

Regardless of the window's length, once the single monthly mortality rate levels off, the MBS is considered to be "off the ramp," and most of the drama is over since most people will continue to pay their notes more steadily.

How to calculate

How to calculate single monthly mortality

Single monthly mortality rates are very simple to calculate, if you know how much outstanding debt is contained within your mortgage-backed security, the payment owed for the month, and the actual payment received.

If:

- D = outstanding debt of $1 million.

- P = payment owed of $100,000.

- A = actual payment of $110,000.

The process looks like this:

First, subtract the payment owed from the actual payment.

A - P = $110,000 - $100,000 = $10,000

Then divide the result by the outstanding debt to figure out how much of an overage you're dealing with:

(A - P) / D = $10,000 / $1 million = 0.01

Now multiply that by 100 to get a percentage:

0.01 x 100 = 1%

You'll need to do this for several months in a row to see if your single monthly mortality is growing, shrinking, or staying the same.

Related investing topics

Why it matters

Why does single monthly mortality matter to investors?

In a way, single monthly mortality is a measurement of how long a mortgage-backed security is going to continue to reliably pay out. Since mortgages are removed from an MBS when they're paid off and not replaced with similar investments, an MBS will shrink over time, either through loans being paid off or going into foreclosure. The end result of every MBS is zero dollars.

Going into an MBS investment knowing this is one thing, but the thing you can't ever know for sure is the rate at which investment will shrink. It might shrink very quickly if it's mostly made up of mortgages written at a high rate and much lower mortgage rates are suddenly offered, or it might shrink at a very slow and steady rate as people simply pay off their notes over time.

You want a slow and steady pace that maximizes interest and the value of your MBS. But since there's no guarantee that everyone will become a zombie and pay their minimum every month for 30 years, you have to have some idea of how your investment is going.

Using the single monthly mortality rate, along with other calculations like the conditional payment rate, allows you to assess your investment, predict where it's going, and decide if it's worth continuing on that path.