Investing is full of jargon, and one of the more popular phrases you're likely to hear is "smart money," which is used in contrast to "dumb money."

You might guess that smart money refers to those holding more money, and you'd be right, but there's more to it than that.

Overview

What is smart money, exactly?

In investing, smart money refers to professional investors like Wall Street analysts, hedge fund managers, institutional investors, and others who follow the market on a day-to-day basis and invest large sums of money.

The term is used in contrast to "dumb money," which refers to retail investors, especially those who may not know much about investing or stocks.

How to follow smart money

How do you follow the smart money?

Investors are typically split into two classes. The first is the professional class, sometimes referred to as smart money. Then there's the retail or individual class of investors, which is sometimes called dumb money.

It's only natural then to wonder if you can follow the moves of the so-called smart money.

It's not easy to do so in real time. Occasionally, an activist investor will reveal a stake in a company in which they're looking to make changes, or an investor will file a Form 4 or related filing as a result of taking a stake of 10% or more in a stock. However, once this information becomes public knowledge, the stock tends to react immediately.

You can also follow along with the top investors' stock purchases and sales every quarter with their 13-F filings, which come out within 45 days after the end of the quarter.

While you won't know the purchases in real time, you'll notice that many of their holdings are consistent from quarter to quarter, so it's easy to invest like investors you want to follow.

Should you follow it?

Should you follow the smart money?

While you can follow the smart money and invest along with billionaire investors, a better question to ask might be whether you should follow those investors.

After all, even investors struggle to beat the market. On average, most hedge funds underperform the S&P 500 index in a given year, which shows how elite the S&P 500 is itself.

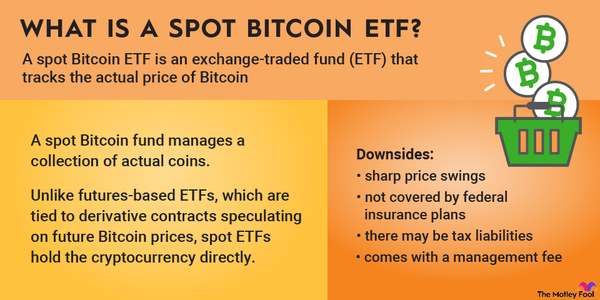

Although some hedge fund managers do consistently beat the S&P 500, it's not easy to do. Most investors are probably better off investing in an S&P 500 exchange-traded fund (ETF) rather than trying to beat the market by following a hedge fund manager.

Investing in an S&P 500 ETF is a good enough strategy that Warren Buffett recommended that most of his personal wealth be put into a S&P 500 index fund.

ETFs also have the advantage of avoiding many of the fees that come with investing directly with professional investors.

Related investing topics

Example

What's an example of smart money?

Warren Buffett is one of the best-known investors, and he's also a good example of smart money.

Although he may not present as a typical Wall Street billionaire, Buffett has been a master investor for roughly 60 years, and he's built Berkshire Hathaway (BRK.A 1.13%) (BRK.B 1.03%) into a conglomerate that's worth almost $1 trillion.

Buffett is also a highly sophisticated, disciplined investors, and his decades of experiences inform his decision-making. Buffett is so successful that Berkshire's returns have essentially doubled the S&P 500 an average return basis, crushing the broad-market index over the long term. He's also known for coining popular investing concepts like an "economic moat."

It's no surprise, then, that so many investors closely follow Buffett's move each quarter. Investing with him or in Berkshire directly has historically paid off.