Colorado Proposition 116, Decrease Income Tax Rate from 4.63% to 4.55% Initiative (2020)

| Colorado Proposition 116 | |

|---|---|

| |

| Election date November 3, 2020 | |

| Topic Taxes | |

| Status | |

| Type State statute | Origin Citizens |

Colorado Proposition 116, the Decrease Income Tax Rate from 4.63% to 4.55% Initiative, was on the ballot in Colorado as an initiated state statute on November 3, 2020. It was approved.

A "yes" vote supported decreasing the state income tax rate from 4.63% to 4.55% for individuals, estates, trusts, and foreign and domestic C corporations operating in Colorado. |

A "no" vote opposed decreasing the state income tax rate, thereby maintaining the current rate of 4.63% for individuals, estates, trusts, and foreign and domestic C corporations operating in Colorado. |

Election results

|

Colorado Proposition 116 |

||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1,821,702 | 57.86% | |||

| No | 1,327,025 | 42.14% | ||

Reactions

The following is a list of reactions to the approval of Proposition 116:

- Colorado Governor Jared Polis (D) said, "We would love to cut the income tax more. But even with what the voters did, we’re interested in working with them to backfill it by eliminating tax loopholes and tax expenditures, to make sure that there's no revenue loss to the state by reducing the income tax level."[1]

Overview

How did Proposition 116 change the state income tax rate?

- See also: Text of measure

Proposition 116 decreased the state income tax rate for individuals, estates, and trusts from 4.63% of federal taxable income to 4.55% for tax years commencing on and after January 1, 2020. The measure also reduced the tax rate for domestic and foreign C corporations operating in Colorado from 4.63% of Colorado net income to 4.55%.[2]

Who supported and opposed Proposition 116?

- See also: Support, Opposition, and Campaign finance

President of the Independence Institute Jon Caldara and Colorado State Senator Jerry Sonnenberg (R) sponsored the initiative. Sonnenberg said, “Small business owners all over Colorado are feeling the pain of these shutdowns, and their incomes have suffered as a result. In many rural communities, there are no big-box stores, just small businesses. An across the board income tax rate reduction will allow these business owners and their employees to keep and spend more of their own money. State government doesn’t need to increase its already bloated budget.” Caldara said, “Coronavirus has crippled our state. Colorado needs to get moving again. Desperately. We must energize our economy. And in order to do that people need to be able to use more of their own money. It’s time to lower taxes. The state legislature could do it. But they won’t. So, we will do it for them." Ballotpedia identified two committees registered to support the initiative: Energize our Economy (306 Real Fair Tax) and Americans for Prosperity Colorado Issue Committee. Together, the committees reported $1.55 million in contributions. The top three donors (which gave 99.64% of the total contributions) were Unite for Colorado, Independence Institute, and Colorado Rising State Action.

Protect Colorado's Recovery and Fair Tax Colorado registered to oppose the measure. The committees reported $3.19 million in contributions. The top donor was the North Fund, which provided $750,000. Great Education Colorado also opposed the measure and said the initiative "is bad news for Colorado: in the midst of a recession, massive job loss, and a diminishing tax base, education and other public services have already suffered near irreparable damage. We cannot afford to lose more funding."[3]

Text of measure

Ballot title

The ballot title for Proposition 116 was as follows:[2]

| “ | Shall there be a change to the Colorado Revised Statutes reducing the state income tax rate from 4.63% to 4.55%?[4] | ” |

Summary and analysis

The summary and analysis provided for this measure in the 2020 State Ballot Information Booklet are available on page 46 at this link.

Fiscal impact statement

The fiscal impact statement was as follows:[5]

|

Full text

Readability score

- See also: Ballot measure readability scores, 2020

| Using the Flesch-Kincaid Grade Level (FKGL and Flesch Reading Ease (FRE) formulas, Ballotpedia scored the readability of the ballot title and summary for this measure. Readability scores are designed to indicate the reading difficulty of text. The Flesch-Kincaid formulas account for the number of words, syllables, and sentences in a text; they do not account for the difficulty of the ideas in the text. The Colorado Title Board wrote the ballot language for this measure.

|

Support

Real Fair Tax led the campaign in support of the initiative.[6]

Supporters

Officials

- Colorado State Senator Jerry Sonnenberg (R)

Political Parties

Organizations

- Americans for Prosperity-Colorado

- Americans for Tax Reform

- Colorado Rising State Action

- Colorado Union of Taxpayers

- Independence Institute

- Unite for Colorado

Individuals

- Jon Caldara - President of the Independent Institute

Arguments

Official arguments

Opposition

Fair Tax Colorado led the campaign in opposition to Proposition 116.

Opponents

Organizations

- Bell Policy Center

- Colorado Children's Campaign

- Democracy for America

- Great Education Colorado

- Progress Now Colorado

Arguments

Official arguments

Campaign finance

| Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures | |

|---|---|---|---|---|---|

| Support | $2,255.72 | $1,553,952.61 | $1,556,208.33 | $11.10 | $1,553,963.71 |

| Oppose | $2,859,570.38 | $334,106.02 | $3,193,676.40 | $2,859,570.38 | $3,193,676.40 |

Ballotpedia identified two committees registered to support the initiative: Energize our Economy (306 Real Fair Tax) and Americans for Prosperity Colorado Issue Committee. Together, the committees reported $1.55 million in contributions and $1.55 million in expenditures. The top three donors were Unite for Colorado, Independence Institute, and Colorado Rising State Action. Americans for Prosperity Colorado Issue Committee is also supporting Proposition 117.[7]

Protect Colorado's Recovery and Fair Tax Colorado registered to oppose Proposition 116 as well as Proposition 117. The committees reported $3.19 million in contributions and $3.19 million in expenditures.[7]

Support

The following table includes contribution and expenditure totals for the committee in support of the initiative.[7]

| Committees in support of Proposition 116 | |||||

|---|---|---|---|---|---|

| Committee | Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures |

| Americans for Prosperity Colorado Issue Committee | $0.00 | $786,919.27 | $786,919.27 | $0.00 | $786,919.27 |

| Energize our Economy (306 Real Fair Tax) | $2,255.72 | $767,033.34 | $769,289.06 | $11.10 | $767,044.44 |

| Total | $2,255.72 | $1,553,952.61 | $1,556,208.33 | $11.10 | $1,553,963.71 |

Donors

The following were the top donors to the support committees.[7]

| Donor | Cash Contributions | In-Kind Contributions | Total Contributions |

|---|---|---|---|

| Americans for Prosperity | $0.00 | $786,919.27 | $786,919.27 |

| Unite for Colorado | $0.00 | $664,996.25 | $664,996.25 |

| Colorado Rising State Action | $50,000.00 | $0.00 | $50,000.00 |

| Independence Institute | $0.00 | $38,997.05 | $38,997.05 |

| Madsen and Associates | $0.00 | $5,000.00 | $5,000.00 |

Opposition

The following table includes contribution and expenditure totals for the committee in opposition to the initiative.[7]

| Committees in opposition to Proposition 116 | |||||

|---|---|---|---|---|---|

| Committee | Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures |

| Protect Colorado's Recovery | $2,066,002.35 | $128,145.26 | $2,194,147.61 | $2,066,002.35 | $2,194,147.61 |

| Fair Tax Colorado | $793,568.03 | $205,960.76 | $999,528.79 | $793,568.03 | $999,528.79 |

| Total | $2,859,570.38 | $334,106.02 | $3,193,676.40 | $2,859,570.38 | $3,193,676.40 |

Donors

The following were the top donors to the opposition committees.[7]

| Donor | Cash Contributions | In-Kind Contributions | Total Contributions |

|---|---|---|---|

| North Fund | $750,000.00 | $0.00 | $750,000.00 |

| Strategic Victory Fund | $500,000.00 | $0.00 | $500,000.00 |

| Colorado Fund for Children and Public Education | $200,000.00 | $0.00 | $200,000.00 |

| Sixteen Thirty Fund | $200,000.00 | $0.00 | $200,000.00 |

| Merle Chambers | $106,000.00 | $0.00 | $106,000.00 |

| Conservation Colorado | $100,000.00 | $740.91 | $100,740.91 |

Methodology

To read Ballotpedia's methodology for covering ballot measure campaign finance information, click here.

Media editorials

- See also: 2020 ballot measure media endorsements

Support

If you are aware of any media editorials that should be included here, please send an email with a link to [email protected].

Opposition

Polls

In an October 2020 poll conducted by Daily Kos and Civiqs, 1,013 likely voters were asked the following question:[8]

| “ |

If the election were held today, how would you vote on state Proposition 116, which would decrease the state income tax rate from 4.63% to 4.55%?[4] |

” |

Poll results are shown below.

| Colorado Proposition 116 | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Yes | No | Unsure | Margin of error | Sample size | ||||||||||||||

| Daily Kos/Civiqs poll 10/11/20 - 10/14/20 | 51.0% | 35.0% | 14.0% | +/-3.6 | 1,013 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to [email protected]. | |||||||||||||||||||

Background

Colorado individual income tax rate history

Prior to 1987, the individual income tax rates were graduated, meaning those with higher incomes paid higher taxes, and those with lower incomes paid less in taxes. The Colorado individual income tax rate has been a flat tax rate since 1987. The flat tax was 5% from 1987 to 1998. It was lowered to 4.75% in 1999. The rate has been 4.63% since 2000. According to the Colorado Legislative Council Staff, the rates were lowered to "reduce the TABOR surplus."[9]

The following table shows the history of Colorado's individual income tax rates.[9]

Colorado individual income tax revenue

The following table shows income tax revenue in Colorado from 1998 through 2019.[9]

Types of individual income tax rates in other states

As of 2019, 32 states had graduated income tax rates, nine states had a flat tax rate, two states (Tennessee and New Hampshire) only taxed income from dividends and rent, and seven states did not have an income tax. As of 2019, flat tax rates ranged from 3.1% in Pennsylvania to 5.25% in North Carolina.[9][10]

The following map from the Tax Foundation shows income tax rates by state.[11]

Click "Show" to expand the map.

| Tax Foundation: 2020 income tax rates by state | |||||

|---|---|---|---|---|---|

Colorado corporate income tax rate history

In Colorado, C corporations must pay a tax on the Colorado net income. The following table shows the history of Colorado's corporate income tax rates since the corporate income tax was enacted in 1937. The corporate income tax rate was a flat rate of 4% from 1937 to 1946. The rate was a flat rate of 5% from 1947 to 1980. From 1981 to 1993, the rates were graduated. From 1993 to 1998, the rate was returned to a flat rate of 5%. The flat rate was decreased to 4.75% in 1999 and to 4.63% in 2000.[12]

Colorado corporate income tax revenue

The following table shows the history of Colorado's corporate income tax revenue from 1998-99 to 2018-19.[12]

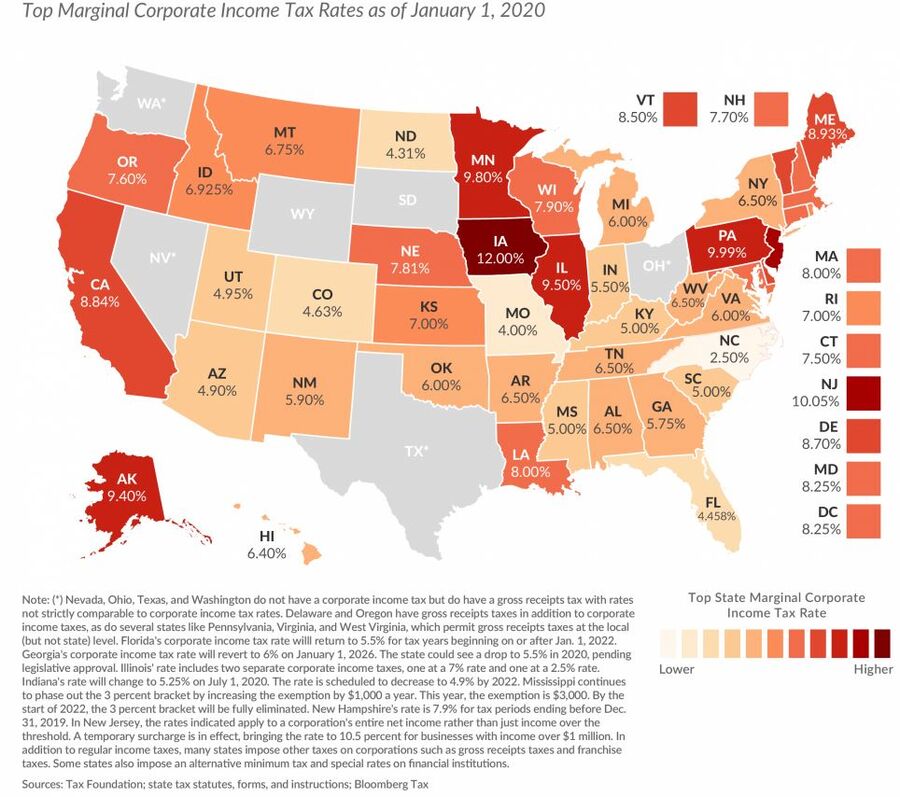

Types of corporate income tax rates in other states

As of 2019, 44 states and Washington, D.C., had a corporate income tax. Nevada, Ohio, Texas, and Washington levy a tax on gross receipts instead of levying a tax on corporate income. South Dakota and Wyoming do not levy a corporate income or gross receipts tax. Of the 44 states with a corporate income tax, 32 states and Washington, D.C., levied a flat corporate income tax rate and 12 states levied a graduated tax rate.[12]

The following map from the Tax Foundation shows corporate income tax rates by state.[13]

Tax policies on the ballot in 2020

- See also: Taxes on the ballot

In 2020, voters in 14 states voted on 21 ballot measures addressing tax-related policies. Ten of the measures addressed taxes on properties, three were related to income tax rates, two addressed tobacco taxes, one addressed business-related taxes, one addressed sales tax rates, one addressed fees and surcharges, and one was related to tax-increment financing (TIF).

Click Show to read details about the tax-related measures on statewide ballots in 2020.

| Tax-related policy ballot measures in 2020 | |||||

|---|---|---|---|---|---|

|

Income Tax

Business-Related Taxes

Property-Related Taxes

In Florida, Georgia, Louisiana, New Jersey, and Virginia, voters also decided eight ballot measures related to exemptions, adjustments, and payments: Florida Amendment 5, Florida Amendment 6, Referendum A, Louisiana Amendment 2, Louisiana Amendment 5, Louisiana Amendment 6, New Jersey Question 2, and Virginia Question 2. Sales Tax

Tobacco

Fees

TIF

| |||||

Path to the ballot

The state process

In Colorado, the number of signatures required to qualify an initiated state statute for the ballot is equal to 5 percent of the total number of votes cast for the office of Colorado secretary of state in the preceding general election. State law provides that petitioners have six months to collect signatures after the ballot language and title are finalized. State statutes require a completed signature petition to be filed three months and three weeks before the election at which the measure would appear on the ballot. The Constitution, however, states that the petition must be filed three months before the election at which the measure would appear. The secretary of state generally lists a date that is three months before the election as the filing deadline.

The requirements to get an initiated state statute certified for the 2020 ballot:

- Signatures: 124,632 valid signatures

- Deadline: August 3, 2020[33]

The secretary of state is responsible for signature verification. Verification is conducted through a review of petitions regarding correct form and then a 5 percent random sampling verification. If the sampling projects between 90 percent and 110 percent of required valid signatures, a full check of all signatures is required. If the sampling projects more than 110 percent of the required signatures, the initiative is certified. If less than 90 percent, the initiative fails.

Details about this initiative

- Jon Caldara of the Independence Institute and Jerry Sonnenberg filed the initiative on April 3, 2020. A ballot title was set for it on April 15, 2020.[2]

- Proponents reported submitting around 197,000 signatures on July 31, 2020.[34]

- The measure was certified for the ballot on August 17, 2020. The Colorado Secretary of State's office found that, of the 198,538 signatures that were submitted, 140,058 were projected to be valid.[35]

- Changes to Colorado ballot initiative process due to COVID-19: On May 17, 2020, Colorado Governor Jared Polis (D) signed Executive Order D 2020 065, which authorized the Colorado Secretary of State to establish temporary rules allowing for ballot initiative petitions to be signed through mail and email. The order also temporarily suspended the state law requiring signatures to be submitted six months after ballot language finalization. Under the order, signatures for 2020 Colorado initiatives were due by August 3, 2020.[36] Legal challenges were filed against the order, specifically challenging the mail and email signature gathering provisions. Those provisions of the order were ultimately struck down by the Colorado Supreme Court on July 1, 2020, meaning proponents needed to collect signatures in person.[37][38] [39][40][41]

Cost of signature collection:

Sponsors of the measure hired an unknown petition gathering company to collect signatures for the petition to qualify this measure for the ballot. A total of $664,996.25 was spent to collect the 124,632 valid signatures required to put this measure before voters, resulting in a total cost per required signature (CPRS) of $5.34.

How to cast a vote

- See also: Voting in Colorado

Click "Show" to learn more about voter registration, identification requirements, and poll times in Colorado.

| How to cast a vote in Colorado | |||||

|---|---|---|---|---|---|

Poll timesIn Colorado, polls are open from 7:00 a.m. to 7:00 p.m. local time for those who choose to vote in person rather than by mail. An individual who is in line at the time polls close must be allowed to vote.[42][43] Registration requirements

In Colorado, an individual can pre-register to vote if they are at least 15 years old. Voters must be at least 18 years old to vote in any election. A voter must be a citizen of the United States and have established residence in Colorado to vote.[44] Colorado voters can register to vote through Election Day. However, in order to automatically receive a absentee/mail-in ballot, a voter must register online, through the mail, at a voter registration agency, or driver's license examination facility at least eight days prior to Election Day. A voter that registers through a voter registration drive must submit their application no later than 22 days before the election to automatically receive an absentee/mail-in ballot. A voter can register online or submit a form in person or by fax, email, or mail.[44][45] Automatic registrationColorado automatically registers eligible individuals to vote through the Department of Motor Vehicles and certain other state agencies. Online registration

Colorado has implemented an online voter registration system. Residents can register to vote by visiting this website. Same-day registrationColorado allows same-day voter registration for individuals who vote in person. Residency requirementsColorado law requires 22 days of residency in the state before a person may vote. Verification of citizenshipColorado does not require proof of citizenship for voter registration. Verifying your registrationThe site Go Vote Colorado, run by the Colorado Secretary of State office, allows residents to check their voter registration status online. Voter ID requirementsColorado requires voters to present non-photo identification when voting in person. If voting by mail for the first, a voter may also need to return a photocopy of his or her identification with his or her mail-in ballot. Click here for more information. The following list of accepted forms of identification was current as of July 2024. Click here for the most current information, sourced directly from the Office of the Colorado Secretary of State.

}} | |||||

See also

External links

- Colorado Secretary of State: Initiative Filings, Agendas & Results

- Initiatives filed with the Legislative Council Staff

- Initiative 306 full text

- Colorado Ballot Information Booklet (Blue Book)

Support |

Opposition |

Footnotes

- ↑ Colorado Public Radio, "‘A Great Outcome For Colorado’: Gov. Polis Sees Priorities Pass At The Ballot Box," accessed November 17, 2020

- ↑ 2.0 2.1 2.2 Colorado Secretary of State, "2019-2020 Initiative Filings, Agendas & Results," accessed April 17, 2020

- ↑ Great Education Colorado, "Tell the Governor and Legislators: Protect Schools from an Unfair Tax Cut!" accessed August 20, 2020

- ↑ 4.0 4.1 4.2 4.3 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Colorado State Legislature, "2020 Blue Book," accessed September 21, 2020

- ↑ Real Fair Tax, "Home," accessed August 24, 2020

- ↑ 7.0 7.1 7.2 7.3 7.4 7.5 Colorado Secretary of State TRACER, "Campaign finance committee search," accessed August 4, 2020

- ↑ Civiqs, "October 2020 Colorado poll," accessed October 19, 2020

- ↑ 9.0 9.1 9.2 9.3 Colorado Legislative Council Staff, "Individual Income Tax," accessed August 14, 2020

- ↑ The Balance, "States With Flat Income Tax Rates for Tax Year 2019," accessed August 25, 2020

- ↑ Tax Foundation, "Individual Income Tax Rates and Brackets for 2020," accessed August 25, 2020

- ↑ 12.0 12.1 12.2 Colorado Legislative Council Staff, "Corporate Income Tax," accessed August 25, 2020

- ↑ Tax Foundation, "State Corporate Income Tax Rates and Brackets for 2020," accessed August 25, 2020

- ↑ Arizona Secretary of State, "Initiative 31-2020," February 14, 2020

- ↑ Colorado Secretary of State, "2019-2020 Initiative Filings, Agendas & Results," accessed April 17, 2020

- ↑ Illinois State Legislature, "Senate Joint Resolution Constitutional Amendment 1," accessed May 2, 2019

- ↑ Illinois State Board of Elections,"Committee Search," accessed May 28, 2019

- ↑ Alaska Division of Elections, "Alaska's Fair Share Act," accessed January 13, 2020

- ↑ Anchorage Daily News, "Group says it has enough signatures to put Alaska oil tax initiative on ballot," January 14, 2020

- ↑ APOC, "Online Reports," accessed January 7, 2020

- ↑ Nebraska Secretary of State, "Initiative Petition text," accessed August 22, 2019

- ↑ California Attorney General, "Initiative 19-0008," September 17, 2019

- ↑ California the Legislative Analyst's Office, "A.G. File No. 2019-0008," February 5, 2018

- ↑ California State Legislature, "Assembly Concurrent Resolution 11," accessed May 8, 2019

- ↑ Colorado General Assembly, "SCR 20-001," accessed June 10, 2020

- ↑ Arkansas State Legislature, "House Joint Resolution 1018," accessed March 7, 2019

- ↑ UA Little Rock Public Radio, "Arkansas Governor Signs $95 Million Highway Funding Bill Into Law," accessed March 25, 2019

- ↑ Arkansas Ethics Commission, "Filings," accessed August 18, 2020

- ↑ Colorado State Legislature, "House Bill 20-1427," accessed June 15, 2020

- ↑ Oregon State Legislature, "HB 2270," accessed June 25, 2019

- ↑ Colorado Secretary of State, "2019-2020 Initiative Filings, Agendas & Results," accessed February 10, 2020

- ↑ Nebraska State Legislature, "LR14CA," accessed April 5, 2019

- ↑ On May 17, 2020, Colorado Governor Jared Polis (D) signed Executive Order D 2020 065, which temporarily suspended the state law requiring signatures to be submitted six months after ballot language finalization. Under the order, signatures for 2020 Colorado initiatives were due by August 3, 2020.

- ↑ The Center Square, "Signatures turned in for ballot initiatives on voter approval of fees, income tax cut measures," accessed July 31, 2020

- ↑ Colorado Secretary of State, "Proposed Initiative #306 (“State Income Tax Rate Reduction”) Qualifies For 2020 General Election Ballot," accessed August 18, 2020

- ↑ Colorado Governor Jared Polis, "Gov. Polis Signs Executive Orders to Protect Access to Ballot & Ensure Elections Can Proceed Safely," accessed May 18, 2020

- ↑ Colorado Concern, "Lawsuit against Polis' executive order," accessed May 19, 2020

- ↑ Denver Post, "Colorado group seeking to ban late-term abortions sues over governor’s order," accessed May 22, 2020

- ↑ Reporter Herald', "Court upholds Colorado Governor Polis’ power to change ballot initiative rules," accessed May 29, 2020

- ↑ Colorado Politics, "Colorado Supreme Court to hear challenge to Polis order on petition-gathering," accessed June 12, 2020

- ↑ Fort Morgan Times, "Colorado Supreme Court rules against Polis on signatures for ballot measures," accessed July 1, 2020

- ↑ Colorado Secretary of State, "Mail-in Ballots FAQs," accessed July 16, 2024

- ↑ Colorado Revised Statutes, "1-7-101," accessed July 16, 2024

- ↑ 44.0 44.1 Colorado Secretary of State, "Voter Registration FAQs," accessed July 16, 2024

- ↑ Colorado Secretary of State, "Go Vote Colorado," accessed July 15, 2024

- ↑ Colorado Secretary of State, "Acceptable Forms of Identification," accessed July 17, 2024

|

State of Colorado Denver (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2024 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |