🏦

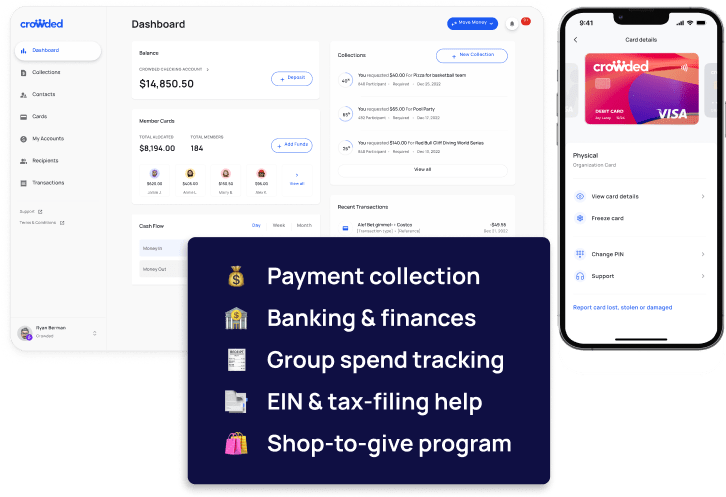

The best nonprofit bank account*

Handle all your banking digitally – from ACH & wire transfers to checks and officer handovers – while keeping track of your nonprofit’s finances

Manage dues, donations,

events & more

Manage dues, donations,

events & more

Manage spending with digital

debit cards

Set up a passive fundraising

program for consistent donations.

Stay compliant with tax regulations

Say goodbye to dozens of logins, overly-complicated apps, manual reimbursements and messy spreadsheets.

Crowded works with all kinds of nonprofits to make financial management stress-free.

Handle all your banking digitally – from ACH & wire transfers to checks and officer handovers – while keeping track of your nonprofit’s finances

Make the process convenient for you and your supporters alike using Crowded’s online payment links. Whether it’s dues, donations, event tickets, or other essentials, we’ve got you covered.

Spend from the same place you collect with Crowded’s Visa® debit cards designed for shared expenses. Issue cards to members with budgeted amounts on each card.

Utilize our shop-to-give initiative for generating extra revenue through cashbacks, while also rewarding your supporters.

Warminster, PA

National banking partner

Troop 8017

Banking partner to student clubs

Banking partner to student clubs

Dallas, Texas

Official banking partner across 40+ chapters

Official banking partner

Denver, Colorado

Randolph, New Jersey

New York, New York

Waupaca, Wisconsin

Rhinebeck, New York

Rochester, New York

Official banking partner

Official banking partner serving all active chapters

Official banking partner serving undergrad and alumnae chapters

Crowded Rewards partner

Official banking partner for camps across the south and southwest

Official banking partner serving 400 chapters

Official banking partner serving alumnae chapters

Cascade, Maryland

Official banking partner serving 300+ chapters.

Official banking partner serving 500 chapters.

Atlanta, Georgia

Tulane University & University of Chicago

University of North Carolina

Serving 13 Chapters Nationwide

Official banking partner serving 50 chapters.

Official banking partner serving 56 chapters.

University of North Carolina

Virginia Tech

University of North Carolina

Northwestern University

Connect all the platforms you use to Crowded.

“Since our guys are young volunteers gaining experience, it’s awesome to partner with a company that has tools to fit their needs. Things like transition assistance between officers or digital cards (the physical frat card always goes missing!) keep our guys focused on their mission and not bogged down administratively”

“It was great to have one place to pay international staff as well as reimburse other staff members when needed. We were able to drastically reduce the amount of petty cash we kept on site because we were able easily transfer money to staff when needed.”

“Crowded has given our fraternity the ability to develop financial strategies from the local to the national level. By partnering with Crowded on both the national and chapter level, we have not only achieved annual savings of approximately $10k but also experienced a reduction in reporting time by over 40 hours annually.”

“As PIKE transitioned from a ‘bank-less’ member billing solution to one that required a bank, Crowded was the missing piece to the puzzle. With seamless officer transitions, digital debit cards, and fantastic customer support, it was a no-brainer!”

“We needed a mainstream way to collect dues, as Venmo stopped supporting group accounts. We also liked the feature of allocating funds to team members’ virtual cards.”

Want to learn more? View All

Check out our guide on how to select the best bank that aligns with your needs as a nonprofit .

Explore the ins and outs of group exemptions and determine if it's the optimal path for your nonprofit's tax status.

Enter the world of nonprofit tax exemption and understand who qualifies, the benefits it offers, and the application process.

Learn more about the implications and risks of using peer-to-peer payment apps to collect funds or donations for your nonprofit.

Discover 10 tips for member retention and growth on how to engage and attract members.

Have more questions? Contact us.

Crowded is a financial platform that offers nonprofit membership groups easy ways to collect, spend and manage money online.

Some of our standout features include:

FDIC pass-through, insurance-eligible accounts* with no fee to open and no minimum balances, and FDIC insurance available on deposits up to $250k through our bank partners Blue Ridge Bank, N.A., and TransPecos Banks, SSB; Members FDIC.

Easy digital officer handovers.

Digital & physical Visa® debit cards with budgeted amounts for group member expenses.

Unified banking for multi-chapter organizations.

Payment collection links for dues, member fees and donations.

To set up a Crowded account for your group in minutes, create a free account online or book a demo with one of our team members for any questions or additional support.

Venmo & Paypal? Great for friends, not for your organization. Here’s why Crowded is the better app for collecting dues & for events:

Crowded is available for use by any membership group or nonprofit organization.

We work with a wide range of nonprofit groups, from national fraternities and sororities to individual booster clubs, PTAs, summer camps, sports teams, girls and boy scouts, and college clubs.

If you’re unsure whether Crowded would be the right fit for your group, schedule a time to speak with one of our team members here.

No. To sign up for Crowded’s platform and use our passive fundraising feature, you do not need an EIN.

If you would like to open a Crowded banking account, you will need an EIN. If your group currently does not have one or needs help locating or updating your EIN, Crowded’s team can help.

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When collecting payments, we charge 2.99% of the collection amount if paid by card and the lesser of 2.99% or $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our pricing page here.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank, N.A. and TransPecos Banks, SSB; Members FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by Blue Ridge Bank, N.A. and TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.