On this page is an ETF return calculator and CEF return calculator which automatically computes total return including reinvested dividends. Enter a starting amount and time-frame to estimate the growth of an investment in an Exchange Traded Fund or Closed End Fund, or use the tool as an index fund calculator. Additionally, simulate periodic investments into a fund by year, month, week, or day.

There are thousands of exchange traded funds in our database, accurate to within the last 7 trading days.

ETF Total Return Calculator with Dividend Reinvestment and Periodic Investments

Next, try the ETF Drawdown Calculator to see past drawdowns in an ETF investment. Or, try the ETF Daily Moving Average calculator to compare two trendlines.

How To Use the ETF Total Return Calculator

To begin, you need to enter at least an ETF's ticker. As you type, it will auto-complete active exchange traded fund tickers.

Basic Exchange Traded Fund Details and Inputs

- Ticker: Enter a valid, active ETF ticker [ZIP] from Tiingo (or CEF ticker)

- Starting Amount ($): In dollars, an initial investment amount

- Starting Date: Enter when an investment was first made °

- Ending Date: Enter when an investment was sold °

° Depending on the ETF data (see more below), we might adjust the starting date and ending date. Check again after your calculation.

Advanced Dividend and Periodic Investment Options

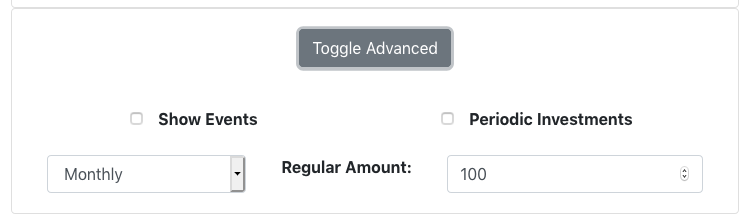

Click 'Toggle Advanced' to open the advanced ETF dividend and investment panel.

- Show Events: Check the box and we'll list all our dividend and split information for the ETF in your timeframe. We'll also include (optionally) periodic investment information.

- Periodic Investments: Select the box if you'd like to model periodic investments into an exchange traded fund.

- "Monthly": If you are simulating periodic investments, select the timeframe for the ETF or CEF investments from the dropdown menu.

- Regular Amount: The amount invested every period in the simulation.

Interpreting ETF Model Results

- Final Value ($): The value of the ETF or CEF investment on the 'Ending Date'. Again, note we may change that date depending on the database refresh limit.

- Annual Return: Our estimate of the annualized percentage return by the investment, including any periodic investments. The final value will show the actual ending balance if you want to compute a total return instead. (See our compound annual growth calculator)

- Graph: The value of the ETF investment over time. If you're on desktop, hover over a point to see the investment value snapshot on any day in your scenario.

How do the periodic ETF and CEF investments work?

The tool is backed by a database with OHLC prices on exchange traded funds, with entries for splits and dividends. For your choice of dates, we model an investment at the open price – for the initial lump sum and any dividends – then calculate the portfolio value at daily close.

If you choose to model periodic investments, they are also added at daily open prices. To make the logic simple, we invest(the next legal market day) 1, 7, 30, or 365 days after the previous investment respective to your time frame choice. If dividends and periodic investments would have occurred on the same day, those calculations are independent.

Modeling Dollar Cost Averaging

Using the tool and periodic investments, you can also model dollar cost averaging. Dollar cost averaging is our preferred normal style of investing, where you invest on a regular basis.

For periodic windfalls you receive, we prefer investing the lump sum all at once.

Source and Methodology of the Exchange Traded Fund Total Return Calculator

The ETF return calculator is a derivative of the stock return calculator. Much of the features are the same, but (especially for smaller funds) the dividend data might be off.

The tool uses the Tiingo API for price and dividend data. Tiingo isn't free, so we have some very modest limits in place:

- ETF and CEF data may be up to 7 trading days old. Note: weekend refreshes and market holidays might mean this is over 7 'actual' days'.

- Always check the tool ending date after a scenario to see data recency of the ETF.

- Here are the rate limits in place:

- Maximum 50 calculations per day

- Maximum 10 calculations per minute

- Limits apply across all of the Tiingo calculators

Limitations and Disclaimers

The exchange traded fund total return calculated contains idealized return data. It is based on closing and opening prices and would not match a real investor's gains exactly.

The tool is for informational purposes only. We cannot warrant any results. ETF outputs are good for initial research, but please verify any information the tool outputs independently.

Note that there are other factors the tool is ignoring:

- Taxes

- Your portfolio management fees

- Dividend timing

- Slippage

- Other things

It is very possible that the price or dividend datasets are wrong too (please report it if you find a bug).

Using the tool as an Index Fund return calculator

Many ETFs track published indexes, so the tool is very useful as a quick comparison on index funds. (Yes, we know – many more are in mutual fund form.)

For the gold standard of index fund returns – perhaps with less resolution – see the prospectus of the fund. This calculator will give you a reasonable approximation of index fund returns, but your ETF provider probably calculated them exactly.

Bug Reports, Feature Requests, and Requests to Help with the ETF Total Return Calculator

Let us know if you find a bug. Include the fund with the issue so I can debug it.

Feel free to send enhancement requests, just know that the bar is very high. Outside of ads, I'm not paid to build or maintain this tool. For significant requests, please make a contracting inquiry.

Again, this information is for informational and research purposes only. We cannot and will not be able to help in a legal capacity. We can only help you with research inquiries. For legal inquiries, this data might be a useful starting point, but you probably need a professional known as a "forensic accountant".

ETFs, CEFs, Dividends, and Total Returns

We've maintained some version of a stock return calculator for some time now. After a mutual fund return calculator, an ETF return tool has been one of our most popular requests.

As we like to stress on this site, dividend adjusted returns are the most important returns. Unless you are shoveling your dividend checks into your fireplace (or shredder), dividends are real money which you can use to reinvest. Those additional shares also lead to real money. Dividends make up a huge amount of return when you trace them back over a long enough timeframe.

This tool, in many ways, is better than some of our popular index total return calculators. ETFs (and mutual funds) are the most common ways to track an index, although they include fees and slow down dividend timing. However, they are the most common way to track an index... making them more accurate for individual investors.

If you'd like to compare:

- Dow Jones Industrial Average Calculator

- S&P 500 Calculator

- Wilshire 5000 Calculator

- ETF or Mutual Fund Fee Calculator

Adjust Your CEF and ETF Returns for Total Returns

ETFs are relatively new when compared to common stocks and mutual funds. Still – at least for ETFs that pay dividends – we often see returns quoted out of context. When you buy VTI or DIA, don't only look at the price return on your fund. Be sure to factor in any additional shares you buy from the dividends you receive.

(Or, at least, know that you're spending the dividends.)

We hope you enjoyed the CEF and ETF total return calculator. Use it in good health, and tell your friends!