1. What is Alfavision Over share price and what are the returns for Alfavision Over share?

Alfavision Over share price was Rs 17.42 as on 29 Aug, 2024, 03:31 PM IST. Alfavision Over share price was down by 0.85% based on previous share price of Rs. 17.3.

2. What's the market capitalization of Alfavision Over?

Market Capitalization of Alfavision Over stock is Rs 54.92 Cr.

3. What is the PE & PB ratio of Alfavision Over?

The PE ratio of Alfavision Over stands at -141.54, while the PB ratio is 1.31.

4. Is Alfavision Over giving dividend?

Alfavision Overseas (India) Ltd. announced an equity dividend of 5% on a face value of 1.0 amounting to Rs 0.05 per share on 05 Sep 2022. The ex dividend date was 29 Sep 2022.

5. What are the returns for Alfavision Over share?

Return Performance of Alfavision Over Shares:

- 1 Week: Alfavision Over share price moved up by 1.87%

- 3 Month: Alfavision Over share price moved up by 29.90%

- 6 Month: Alfavision Over share price moved up by 11.52%

6. What is Alfavision Over's 52 week high / low?

Alfavision Over share price saw a 52 week high of Rs 22.75 and 52 week low of Rs 11.00.

7. What is the CAGR of Alfavision Over?

The CAGR of Alfavision Over is -63.65.

8. Who's the chairman of Alfavision Over?

Vishnu Prasad Goyal is the Chairman & Managing Director of Alfavision Over

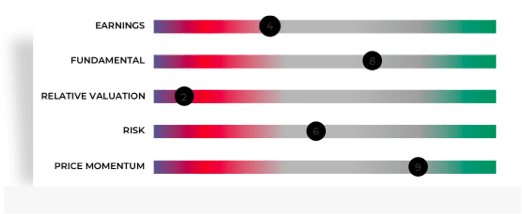

9. How can I quickly analyze Alfavision Over stock?

Key Metrics for Alfavision Over are:

- PE Ratio of Alfavision Over is -141.54

- Price/Sales ratio of Alfavision Over is 14.31

- Price to Book ratio of Alfavision Over is 1.31

10. What are the Alfavision Over quarterly results?

Total Revenue and Earning for Alfavision Over for the year ending 2024-03-31 was Rs 3.18 Cr and Rs 0.28 Cr on Standalone basis. Last Quarter 2024-06-30, Alfavision Over reported an income of Rs 0.97 Cr and profit of Rs 0.09 Cr.

11. Who are the key owners of Alfavision Over stock?

- Promoter holding has not changed in last 9 months and holds 24.8 stake as on 30 Jun 2024

- Other investor holding has not changed in last 9 months and holds 75.2 stake as on 30 Jun 2024

12. Who are peers to compare Alfavision Over share price?

Within Financial Services sector Alfavision Over, Zodiac Ventures Ltd., Yamini Investments Company Ltd., Ladderup Finance Ltd., P H Capital Ltd., Savani Financials Ltd., Mehta Housing Finance Ltd., Gogia Capital Services Ltd., Morgan Ventures Ltd., Shrydus Industries Ltd. and Gujarat Credit Corporation Ltd. are usually compared together by investors for analysis.