Stock Research Report for Bajaj Auto Ltd

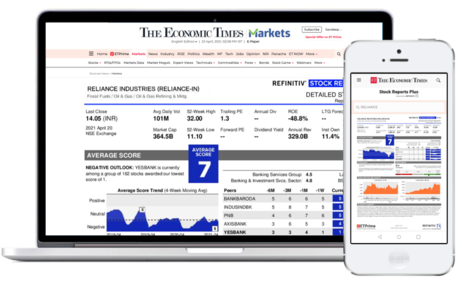

Stock score of Bajaj Auto Ltd moved up by 1 in a month on a 10 point scale (Source: Refinitiv). Get detailed report on Bajaj Auto Ltd by subscribing to ETPrime.

Get 4000+ Stock Reports worth₹ 1,499* with ETPrimeat no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Bajaj Auto Limited is an India-based company, which is engaged in the business of the development, manufacturing, and distribution of automobiles, such as motorcycles, commercial vehicles, electric vehicles, and parts. It is a manufacturer of two-wheelers, three-wheelers, and quadri-cycles. The Company sells its products in India as well as in various other global markets. Its segments include Automotive, Investments, Financing, and Others. The automotive segment includes all activities related to development, design, manufacture, assembly, and sale of two-wheelers/three-wheelers as well as sale of related parts and accessories. Its motorcycles include Boxer, CT, Platina, Discover, Pulsar, Avenger, KTM, Dominar, Husqvarna, and Chetak. Its commercial vehicles include Passenger Carriers, Good Carriers, and Quadricycle. Its subsidiaries include Citicore Fund Managers, Inc., Citicore Property Managers, Inc., Sikat Solar Holdco, Inc., and Citicore Solar South Cotabato, Inc.