Meeting Agenda: Quarterly Results. Please add to watchlist to track closely.

Prima Industries Share Price

Prima Industries Share ...

Prima Ind share price insights

Company witnessed QoQ revenue growth of 92.69%, which is highest in the last 3 years. (Source: Consolidated Financials)

Stock gave a 3 year return of 25.0% as compared to Nifty Smallcap 100 which gave a return of 80.38%. (as of last trading session)

Company's annual revenue growth of 23.17% outperformed its 3 year CAGR of -17.97%. (Source: Consolidated Financials)

Prima Industries Ltd. share price moved up by 5.74% from its previous close of Rs 23.50. Prima Industries Ltd. stock last traded price is 24.85

Share Price Value Today/Current/Last 24.85 Previous Day 23.50

Key Metrics

PE Ratio (x) | 59.69 | ||||||||||

EPS - TTM (₹) | 0.42 | ||||||||||

MCap (₹ Cr.) | 26.82 | ||||||||||

Sectoral MCap Rank | 47 | ||||||||||

PB Ratio (x) | 1.29 | ||||||||||

Div Yield (%) | 0.00 | ||||||||||

Face Value (₹) | 10.00 | ||||||||||

Beta Beta

| 0.00 | ||||||||||

VWAP (₹) | 24.84 | ||||||||||

52W H/L (₹) |

Prima Ind Share Price Returns

| 1 Day | 5.74% |

| 1 Week | 15.53% |

| 1 Month | 5.16% |

| 3 Months | -15.79% |

| 1 Year | 63.49% |

| 3 Years | -9.64% |

| 5 Years | N.A. |

Prima Ind News & Analysis

News Sensex rises! But these stocks are down 5% or more on BSE

Sensex rises! But these stocks are down 5% or more on BSE- Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations, 2018

Announcements- Announcements

Prima Ind Share Recommendations

No Recommendations details available for this stock.

Check out other stock recos.

Prima Ind Financials

Income (P&L)

Balance Sheet

Cash Flow

Ratios

Insights

Quarterly Topline Performance

Company witnessed QoQ revenue growth of 92.69%, which is highest in the last 3 years. (Source: Consolidated Financials)Beating 3 Yr Revenue CAGR

Company's annual revenue growth of 23.17% outperformed its 3 year CAGR of -17.97%. (Source: Consolidated Financials)

Quarterly | Annual Mar 2024 Dec 2023 Sep 2023 Jun 2023 Mar 2023 Total Income 3.11 1.61 2.70 2.32 1.81 Total Income Growth (%) 92.69 -40.22 16.33 28.52 -23.05 Total Expenses 2.25 2.13 2.15 1.95 1.36 Total Expenses Growth (%) 5.35 -1.02 10.52 43.73 -41.35 EBIT 0.86 -0.52 0.55 0.37 0.45 EBIT Growth (%) - -194.87 46.77 -17.33 1,185.71 Profit after Tax (PAT) 0.31 -0.52 0.39 0.27 0.51 PAT Growth (%) - -231.47 46.47 -47.15 1,354.29 EBIT Margin (%) 27.78 -32.09 20.22 16.03 24.92 Net Profit Margin (%) 9.87 -32.09 14.59 11.59 28.18 Basic EPS (₹) 0.28 -0.48 0.37 0.25 0.47 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 24.65 25.38 25.12 21.84 16.21 Total Assets Growth (%) -2.88 1.07 14.99 34.72 20.31 Total Liabilities 5.05 2.95 3.22 2.26 1.14 Total Liabilities Growth (%) 71.12 -8.54 42.85 97.32 -61.17 Total Equity 7.40 11.24 10.69 7.38 2.86 Total Equity Growth (%) -34.13 5.09 44.92 157.87 - Current Ratio (x) 5.85 5.44 4.31 3.51 4.62 Total Debt to Equity (x) 0.37 0.14 0.13 0.06 0.00 Contingent Liabilities 0.00 10.60 10.60 0.00 0.00 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 0.53 0.94 0.78 0.00 0.00 Net Cash used in Investing Activities 2.59 -1.11 -1.72 0.00 0.00 Net Cash flow from Financing Activities -3.33 0.15 0.70 0.00 0.00 Net Cash Flow -0.21 -0.02 -0.25 0.00 0.00 Closing Cash & Cash Equivalent 0.01 0.22 0.24 0.00 0.00 Closing Cash & Cash Equivalent Growth (%) -94.04 -9.40 - - - Total Debt/ CFO (x) 5.14 1.63 1.74 - - All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 6.14 3.97 14.25 51.00 90.57 Return on Capital Employed (%) 5.42 1.60 8.53 18.03 17.12 Return on Assets (%) 1.84 1.75 6.06 17.23 15.98 Interest Coverage Ratio (x) 69.81 39.60 45.96 0.00 3,326.00 Asset Turnover Ratio (x) 0.32 0.30 - - - Price to Earnings (x) 45.25 39.53 21.10 4.36 3.29 Price to Book (x) 2.77 1.56 3.00 2.22 2.98 EV/EBITDA (x) 18.78 24.89 15.64 6.51 5.87 EBITDA Margin (%) 23.74 15.95 16.43 24.83 19.50

Prima Ind Peer Comparison

Prima Ind Stock Performance

Ratio Performance

Insights

Stock Returns vs Nifty Smallcap 100

Stock gave a 3 year return of 25.0% as compared to Nifty Smallcap 100 which gave a return of 80.38%. (as of last trading session)

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...Insights

Stock Returns vs Nifty Smallcap 100

Stock gave a 3 year return of 25.0% as compared to Nifty Smallcap 100 which gave a return of 80.38%. (as of last trading session)

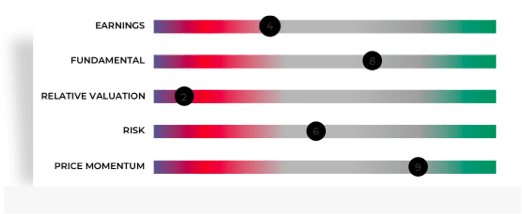

See All Parameters

MF Ownership

MF Ownership details are not available.

Corporate Actions

Prima Ind Board Meeting/AGM

Prima Ind Dividends

- Others

Meeting Date Announced on Purpose Details Jul 25, 2024 Jul 15, 2024 Board Meeting Quarterly Results May 30, 2024 May 21, 2024 Board Meeting Audited Results Feb 12, 2024 Feb 05, 2024 Board Meeting Quarterly Results Oct 20, 2023 Oct 10, 2023 Board Meeting Quarterly Results Sep 15, 2023 Jul 31, 2023 AGM A.G.M. Dividend announcements are not available.

No other corporate actions details are available.

About Prima Ind

Prima Industries Ltd., incorporated in the year 1994, is a Small Cap company (having a market cap of Rs 25.36 Crore) operating in Agro Processing sector. Prima Industries Ltd. key Products/Revenue Segments include Processing Charges, Palm Kernel Oil for the year ending 31-Mar-2023. Show More

Executives

Auditors

- SK

S K Gupta

Chairman & Managing DirectorLSLadhu Singh

Whole Time DirectorSGSwati Gupta

Non Executive DirectorSJSruti Jindal

Independent DirectorShow More - G Joseph & AssociatesJ Krishnan & Associates

Industry

Key Indices Listed on

-

Address

Door No: V/679-C,Industrial Development Area,Muppathadam P O,Cochin, Kerala - 683110

More Details

FAQs about Prima Ind share

- 1. What's Prima Ind share price today and what are Prima Ind share returns ?Prima Ind share price was Rs 24.85 as on 18 Jul, 2024, 09:40 AM IST. Prima Ind share price was up by 5.74% based on previous share price of Rs. 23.66. In last 1 Month, Prima Ind share price moved up by 5.16%.

- 2. What is the market cap of Prima Ind?Within the Agro Processing sector, Prima Ind stock has a market cap rank of 47. Prima Ind has a market cap of Rs 26.82 Cr.

- 3. What are the Prima Ind quarterly results?Total Revenue and Earning for Prima Ind for the year ending 2024-03-31 was Rs 9.75 Cr and Rs 0.46 Cr on Consolidated basis. Last Quarter 2024-03-31, Prima Ind reported an income of Rs 3.11 Cr and profit of Rs 0.31 Cr.

- 4. Who's the chairman of Prima Ind?S K Gupta is the Chairman & Managing Director of Prima Ind

- 5. What are the returns for Prima Ind share?Return Performance of Prima Ind Shares:

- 1 Week: Prima Ind share price moved up by 15.53%

- 1 Month: Prima Ind share price moved up by 5.16%

- 3 Month: Prima Ind share price moved down by 15.79%

- 6 Month: Prima Ind share price moved up by 8.28%

- 6. Who are the key owners of Prima Ind stock?Following are the key changes to Prima Ind shareholding:

- Promoter holding has not changed in last 9 months and holds 54.65 stake as on 31 Mar 2024

- Other investor holding has not changed in last 9 months and holds 45.35 stake as on 31 Mar 2024

- 7. Who are the peers for Prima Ind in Agro Processing sector?Within Agro Processing sector Prima Ind, Paos Industries Ltd., IEL Ltd., Natraj Proteins Ltd., N K Industries Ltd., Madhusudan Industries Ltd., Sarda Proteins Ltd., Ashiana Agro Industries Ltd., Poona Dal & Oil Industries Ltd., Khandelwal Extractions Ltd. and Naturite Agro Products Ltd. are usually compared together by investors for analysis.

- 8. What is the PE & PB ratio of Prima Ind?The PE ratio of Prima Ind stands at 56.11, while the PB ratio is 3.43.

- 9. What is the CAGR of Prima Ind?The CAGR of Prima Ind is -18.15.

- 10. What is 52 week high/low of Prima Ind share price?52 Week high of Prima Ind share is Rs 30.98 while 52 week low is Rs 13.95

- 11. How can I quickly analyze Prima Ind stock?Prima Ind share can be quickly analyzed on following metrics:

- Stock's PE is 59.69

- Price to Book Ratio of 1.29

Trending in Markets

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.