Company has sufficient cash reserves to pay off its contingent liabilities. (Source: Standalone Financials)

Valson Industries Share Price

Valson Industries Share...

Valson Ind share price insights

Sales de-grew by 4.46%. Company witnessed revenue contraction for the first time in last 3 years. (Source: Standalone Financials)

Stock gave a 3 year return of 84.34% as compared to Nifty Smallcap 100 which gave a return of 91.39%. (as of last trading session)

Company has spent 1.08% of its operating revenues towards interest expenses and 11.43% towards employee cost in the year ending Mar 31, 2024. (Source: Standalone Financials)

Valson Industries Ltd. share price moved up by 3.96% from its previous close of Rs 36.55. Valson Industries Ltd. stock last traded price is 38.00

Share Price Value Today/Current/Last 38.00 Previous Day 36.55

Key Metrics

PE Ratio (x) | 37.17 | ||||||||||

EPS - TTM (₹) | 1.02 | ||||||||||

MCap (₹ Cr.) | 29.11 | ||||||||||

Sectoral MCap Rank | 176 | ||||||||||

PB Ratio (x) | 1.04 | ||||||||||

Div Yield (%) | 0.00 | ||||||||||

Face Value (₹) | 10.00 | ||||||||||

Beta Beta

| 2.48 | ||||||||||

VWAP (₹) | 38.02 | ||||||||||

52W H/L (₹) |

Valson Ind Share Price Returns

| 1 Day | 3.96% |

| 1 Week | 4.83% |

| 1 Month | 3.29% |

| 3 Months | 47.29% |

| 1 Year | 37.58% |

| 3 Years | 89.53% |

| 5 Years | 90.0% |

Valson Ind News & Analysis

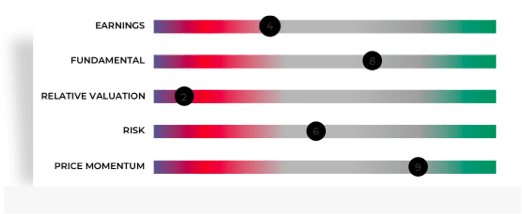

Valson Ind Share Recommendations

No Recommendations details available for this stock.

Check out other stock recos.

Valson Ind Financials

Income (P&L)

Balance Sheet

Cash Flow

Ratios

Insights

Topline Contraction

Sales de-grew by 4.46%. Company witnessed revenue contraction for the first time in last 3 years. (Source: Standalone Financials)Employee & Interest Expense

Company has spent 1.08% of its operating revenues towards interest expenses and 11.43% towards employee cost in the year ending Mar 31, 2024. (Source: Standalone Financials)

Quarterly | Annual Jun 2024 Mar 2024 Dec 2023 Sep 2023 Jun 2023 Total Income 28.87 28.10 29.26 34.57 33.19 Total Income Growth (%) 2.73 -3.97 -15.35 4.16 1.29 Total Expenses 28.49 27.77 28.95 34.00 32.60 Total Expenses Growth (%) 2.59 -4.08 -14.84 4.28 1.45 EBIT 0.38 0.33 0.31 0.57 0.58 EBIT Growth (%) 14.75 6.85 -45.55 -2.29 -6.69 Profit after Tax (PAT) 0.05 0.18 0.17 0.39 0.24 PAT Growth (%) -75.05 9.92 -56.62 57.64 13.81 EBIT Margin (%) 1.32 1.18 1.06 1.65 1.76 Net Profit Margin (%) 0.16 0.65 0.57 1.12 0.74 Basic EPS (₹) 0.06 0.24 0.22 0.50 0.32 All figures in Rs Cr, unless mentioned otherwise

Insights

Contingent Liabilities Coverage

Company has sufficient cash reserves to pay off its contingent liabilities. (Source: Standalone Financials)

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 55.12 55.26 56.28 53.01 54.31 Total Assets Growth (%) -0.25 -1.81 6.17 -2.39 -0.22 Total Liabilities 28.21 29.39 30.50 26.16 22.55 Total Liabilities Growth (%) -4.01 -3.64 16.59 16.01 0.13 Total Equity 26.91 25.87 25.79 26.85 31.76 Total Equity Growth (%) 4.02 0.31 -3.95 -15.46 -0.47 Current Ratio (x) 1.48 1.28 1.15 1.17 1.45 Total Debt to Equity (x) 0.63 0.63 0.61 0.48 0.34 Contingent Liabilities 0.07 0.74 1.45 0.31 0.16 All figures in Rs Cr, unless mentioned otherwise

Insights

Increase in Cash from Investing

Company has used Rs 2.64 cr for investing activities which is an YoY increase of 1579.85%. (Source: Standalone Financials)

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 3.35 1.90 0.47 0.10 5.10 Net Cash used in Investing Activities -2.64 -0.16 -1.80 -0.29 -3.68 Net Cash flow from Financing Activities -0.72 -0.75 0.30 1.14 -1.35 Net Cash Flow -0.01 0.99 -1.03 0.94 0.06 Closing Cash & Cash Equivalent 1.01 1.01 0.02 1.05 0.11 Closing Cash & Cash Equivalent Growth (%) -0.65 4,469.37 -97.89 835.70 119.92 Total Debt/ CFO (x) 5.07 8.63 33.66 135.77 2.09 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 3.64 0.06 -4.54 -18.63 2.22 Return on Capital Employed (%) 4.76 4.73 -0.59 -10.85 4.04 Return on Assets (%) 1.78 0.03 -2.08 -9.43 1.29 Interest Coverage Ratio (x) 3.25 3.39 2.29 -0.62 1.54 Asset Turnover Ratio (x) 2.26 2.34 2.09 1.18 168.55 Price to Earnings (x) 22.88 909.09 -11.81 -2.17 15.31 Price to Book (x) 0.83 0.59 0.54 0.40 0.34 EV/EBITDA (x) 8.76 6.96 11.24 -31.29 4.42 EBITDA Margin (%) 3.49 3.35 2.28 -1.12 5.17

Valson Ind Peer Comparison

Valson Ind Stock Performance

Ratio Performance

Insights

Stock Returns vs Nifty Smallcap 100

Stock gave a 3 year return of 84.34% as compared to Nifty Smallcap 100 which gave a return of 91.39%. (as of last trading session)

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...Insights

Stock Returns vs Nifty Smallcap 100

Stock gave a 3 year return of 84.34% as compared to Nifty Smallcap 100 which gave a return of 91.39%. (as of last trading session)

See All Parameters

MF Ownership

MF Ownership details are not available.

Corporate Actions

Valson Ind Board Meeting/AGM

Valson Ind Dividends

- Others

Meeting Date Announced on Purpose Details Aug 12, 2024 Aug 02, 2024 Board Meeting Quarterly Results May 29, 2024 May 21, 2024 Board Meeting Audited Results Feb 12, 2024 Feb 02, 2024 Board Meeting Quarterly Results Nov 09, 2023 Oct 30, 2023 Board Meeting Quarterly Results Sep 23, 2023 Aug 23, 2023 AGM A.G.M. Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 10% 1.0 Sep 20, 2019 May 30, 2019 Final 10% 1.0 Sep 21, 2018 May 21, 2018 Final 10% 1.0 Jul 27, 2017 Jun 27, 2017 Final 10% 1.0 Aug 04, 2016 May 30, 2016 Final 10% 1.0 Aug 07, 2015 May 22, 2015 All Types Ex-Date Record Date Announced on Details Bonus Dec 07, 2009 Dec 08, 2009 Oct 15, 2009 Bonus Ratio: 1 share(s) for every 1 shares held

About Valson Ind

Valson Industries Ltd., incorporated in the year 1983, is a Small Cap company (having a market cap of Rs 27.96 Crore) operating in Textiles sector. Valson Industries Ltd. key Products/Revenue Segments include Yarn (Dyed & Texturised), Processing Charges, Export Incentives and Waste Yarn for the year ending 31-Mar-2024. Show More

Executives

Auditors

- SM

Suresh Mutreja

Chairman & Managing DirectorKMKunal Mutreja

Director & CEOVMVarun Mutreja

Director & CFOAMAnkit Mutreja

Whole Time DirectorShow More - Bastawala & Associates

Key Indices Listed on

-

Address

Unit No. 28, Building No. 6,Mittal Industrial Estate,Sir M V Road,Mumbai, Maharashtra - 400059

More Details

Trending in Markets

Valson Ind Quick Links

Equity Quick Links

More from Markets

IPOStock market news

Budget 2022 Live Updates

Cryptocurrency

Currency converter

NSE holiday list

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.