Fathom Consulting

Fathom is a consultancy specialising in global economic and financial market research. We make it our business to challenge conventional thinking and to convey rigorous analysis in plain English. Our clients include global asset managers, insurance companies, pension funds, retail banks, investment banks and hedge funds, and major corporates. We also advise governments in a number of countries including the UK, US and Japan. Our strength is undertaking ground-breaking research. We employ, adapt and create the best analytical tools to address questions that often go into previously uncharted territory.

Other recent articles by Fathom Consulting:

- Chart of the Week: UK holds rates despite hitting inflation target

- News in Charts: Rays of hope for South Africa’s sluggish economy

- Chart of the Week: A French election surprise

- News in Charts: How France is really doing under Macron?

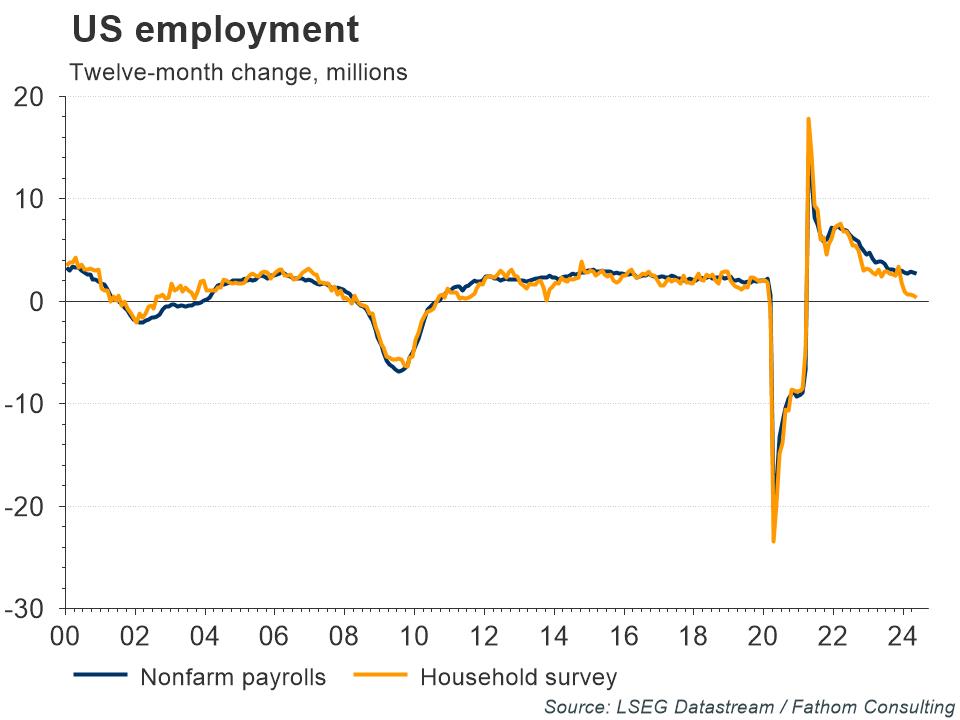

- Chart of the Week: Did the US labour market add or lose jobs?

- News in Charts: China looks to new pillars of growth