The European elections are usually less dramatic than national elections, but in France in 2024 they took on something of the aura of a Greek tragedy. On Sunday 10 June the far-right party of Marine Le Pen emerged from voting as undisputed winners. President Emmanuel Macron then felt compelled to call snap elections for the French parliament, in a bid as he claimed to prevent the far right from winning the presidency in 2027. What he did not mention but is probably equally relevant was that the snap elections are intended to regain control of the legislature, to allow him to pass bills aimed at reforming the French economy. Macron’s second term in office has been far from plain sailing due to his party’s lack of a parliamentary majority. Successive French prime ministers have paid the price each time the administration has struggled to pass an important bill. The former prime minister Elisabeth Borne carried the can for the beating Macron’s immigration bill took in parliament, finally passing with many controversial changes imposed by the centre-right opposition. With hindsight, the snap elections should appear less of a surprise, given the great emphasis President Macron has always placed on his legacy as a reformer.

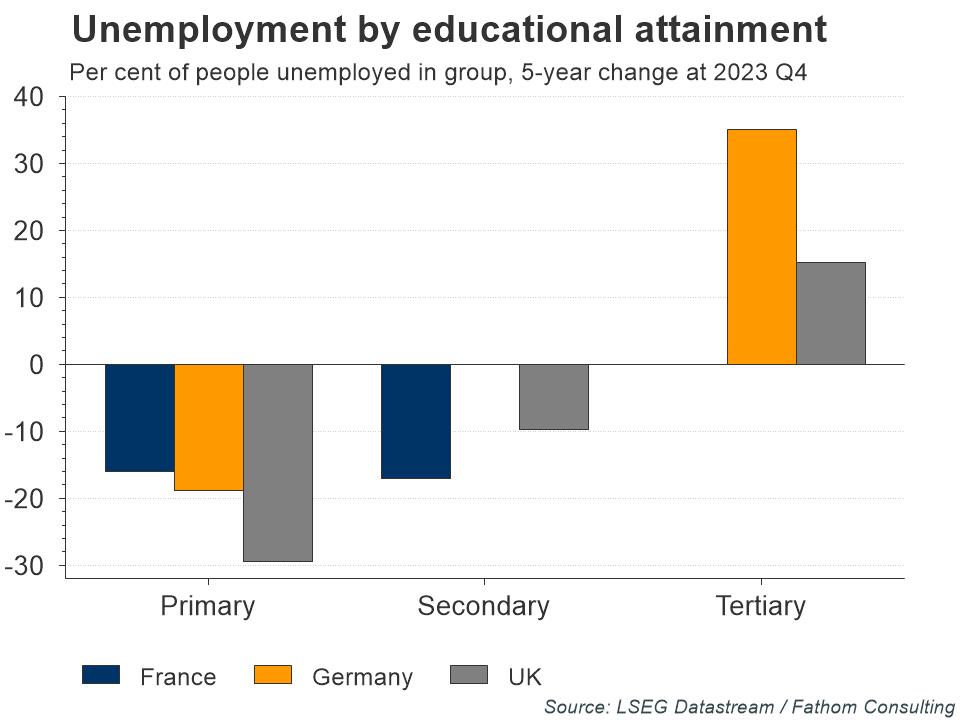

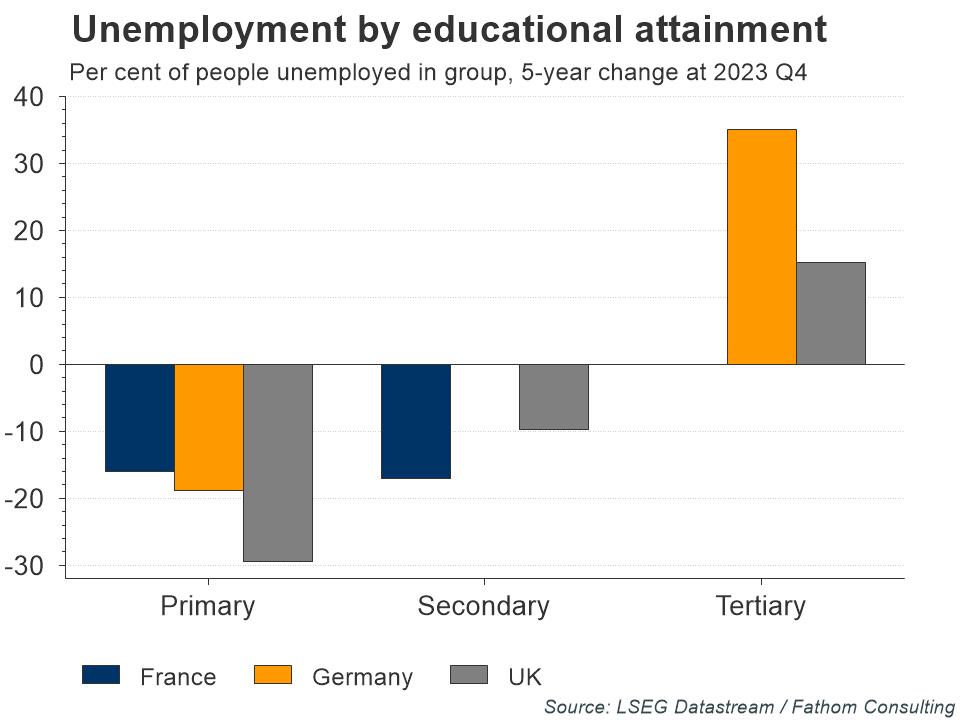

Since Mr Macron was first voted in in May 2017 he has made labour market reforms a high priority and, unlike his predecessors, initially he managed to pass them too. His changes have been aimed at making the market more flexible and bringing down the stubbornly high unemployment rate, by reducing barriers to hiring. Seven years after he took power, France’s unemployment rate has indeed dropped from 9.5% to 7.3%, just above its historic low of 7% back in 1983. More importantly, at the time of the European elections French unemployment had fallen for workers at all levels of educational attainment. Unlike Germany and the UK, where the numbers of people with higher educational training who are out of work have risen in the last five years, in France half-way through Macron’s second term the number of people with tertiary qualifications who are out of work has fallen by 3.5%.

Refresh this chart in your browser | Edit the chart in Datastream

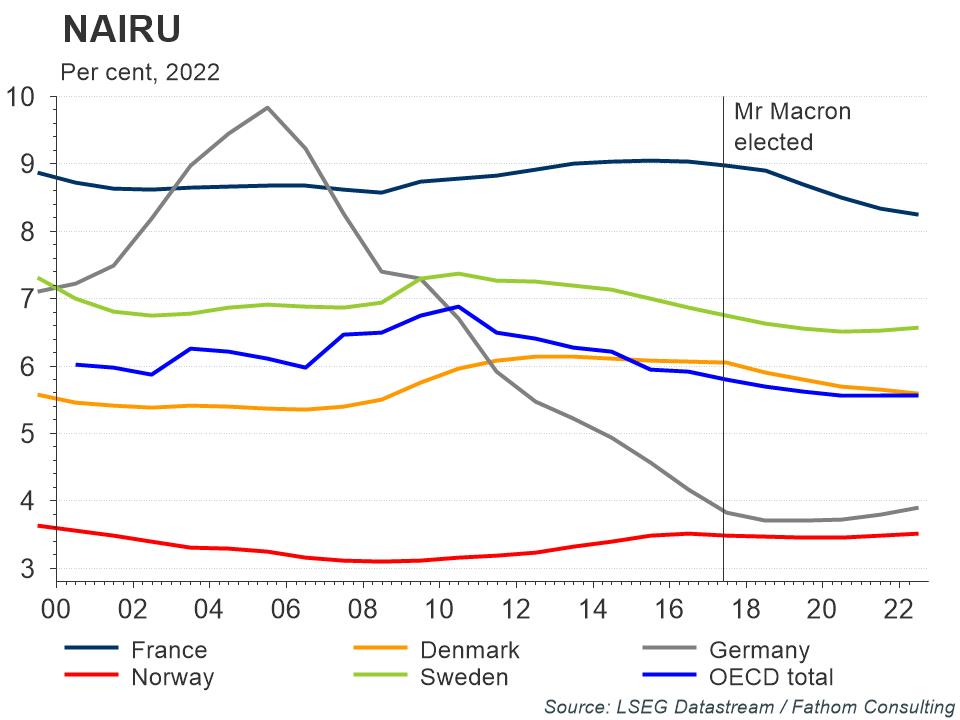

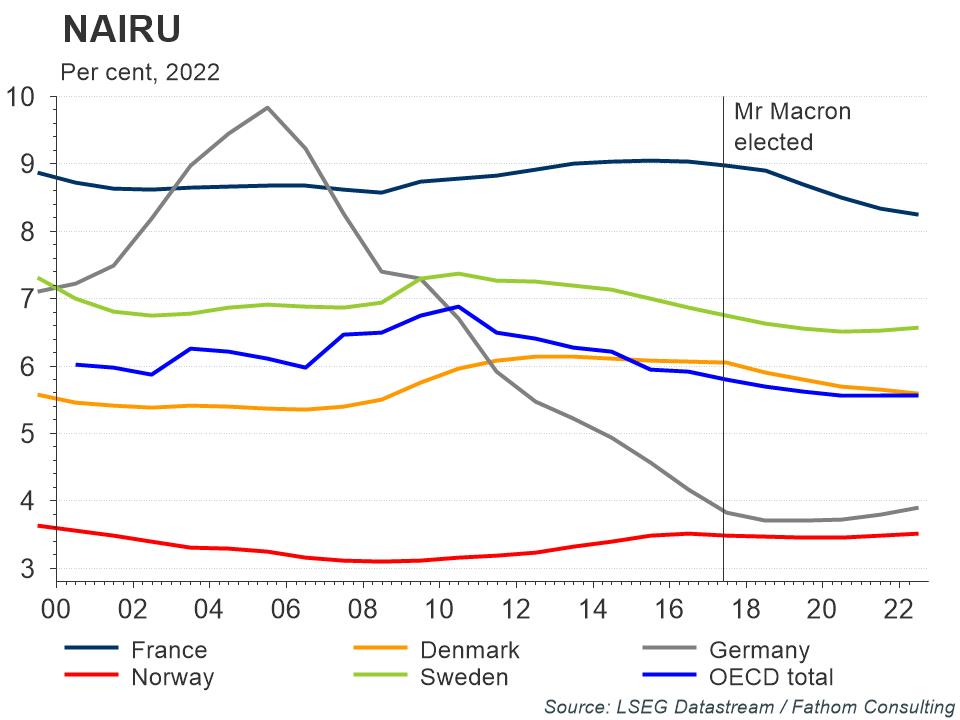

However, France’s non-accelerating inflation rate of unemployment (NAIRU), which captures sticky unemployment, remains stubbornly high – and indeed significantly higher than the OECD total or other comparable European economies such as Germany. With the NAIRU at 8.2% in 2022, only 0.7 percentage points lower than when he took office, Mr Macron still has some work to do to improve things in France’s labour market.

Refresh this chart in your browser | Edit the chart in Datastream

Want more charts and analysis? Access a pre-built library of charts built by Fathom Consulting via Datastream Chartbook in LSEG Workspace.

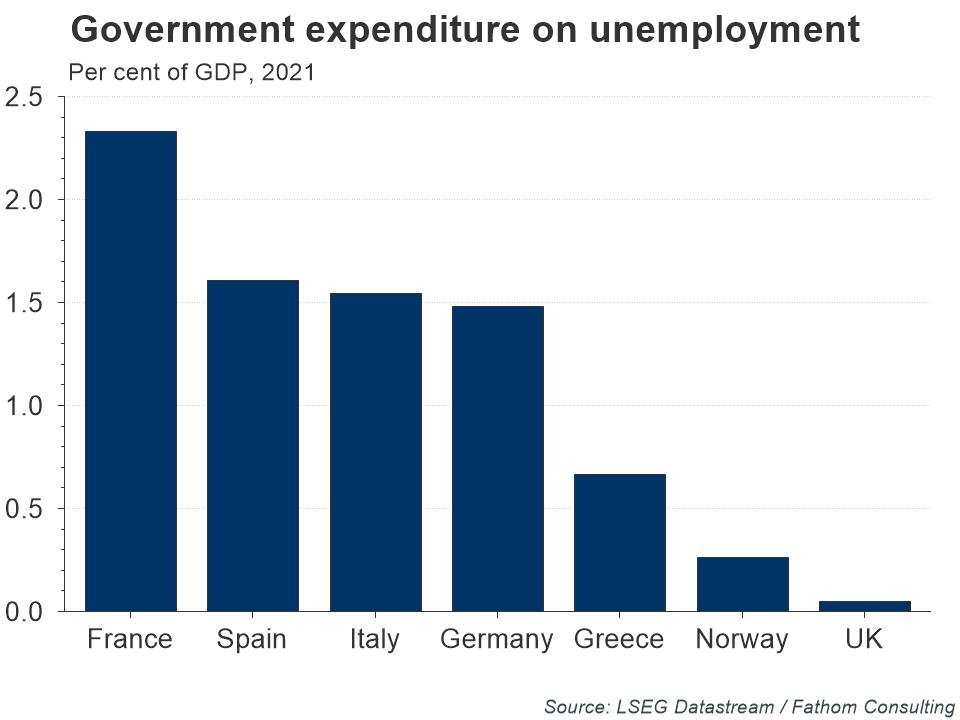

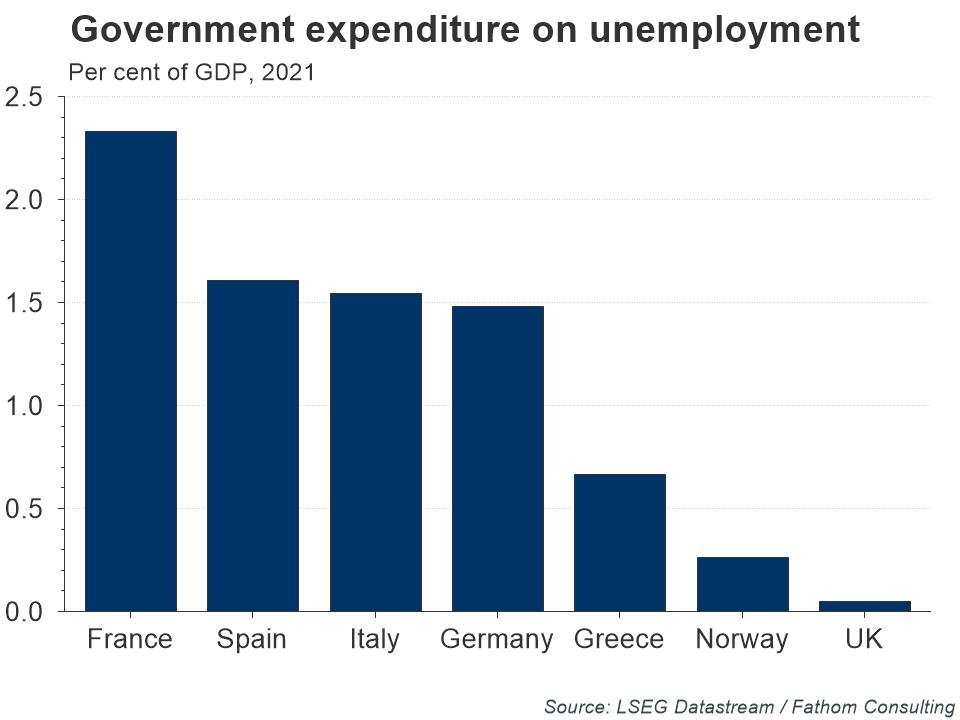

These structural problems are generally ascribed to the generosity of France’s unemployment benefits, that potentially puts people off seeking work. France is the most generous country in the euro area, spending the equivalent of 2.3% of its GDP to support the unemployed. That generosity – basically the result of loose fiscal policies related to the labour market – contributes to France’s large budget deficit, which lies somewhere between Germany’s and Italy’s.

Refresh this chart in your browser | Edit the chart in Datastream

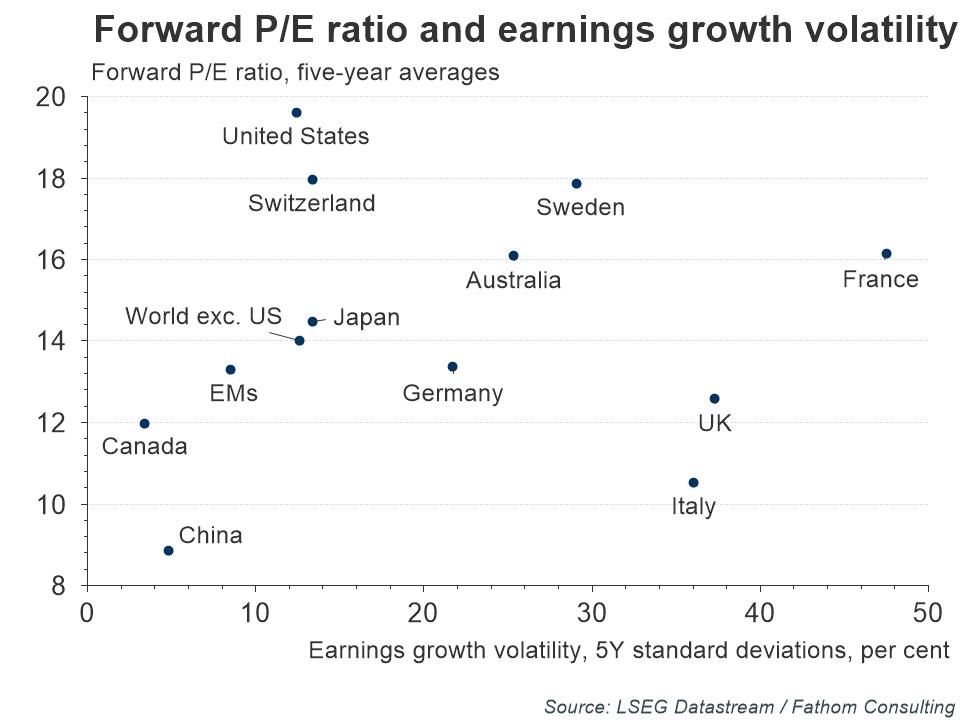

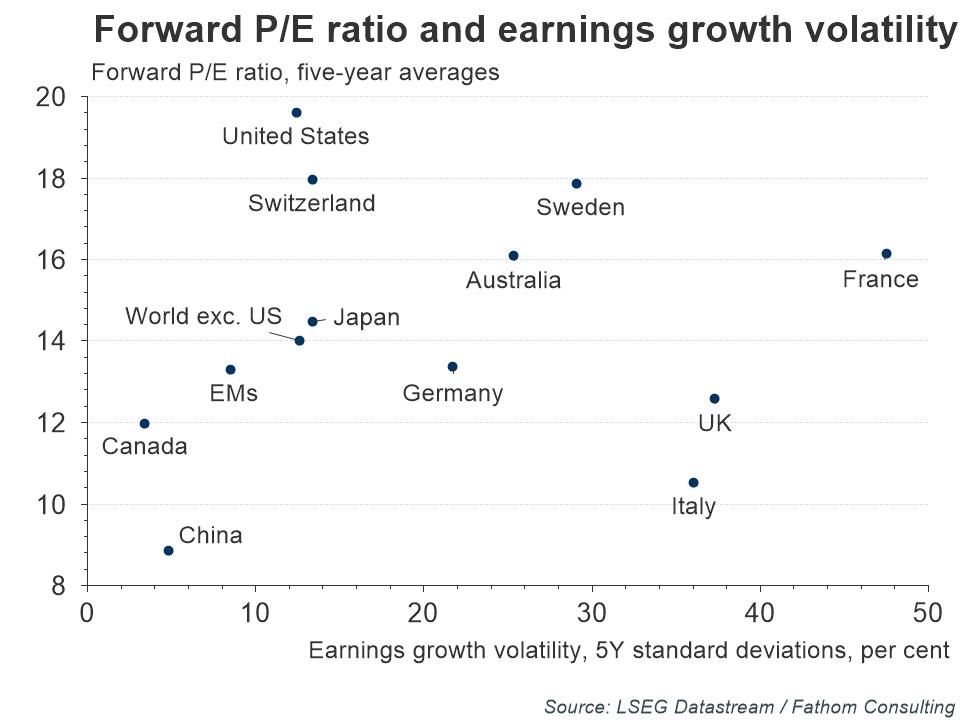

President Macron’s reforms have not transformed France yet, at least in the way the president may have envisaged. Nevertheless, the corporate sector seems comparatively unaffected and indeed is enjoying generous valuations. Corporate France is able to command high earnings multiples (16 times), despite also having a higher variability in earnings and therefore higher risks (48% earnings volatility). Countries with significantly lower volatility in earnings, like the UK and Germany, get a noticeable discount relative to France. Some of this may be due to seasonal factors, like the post-pandemic recovery in tourism earnings for France as the most visited country in the world, or the image boost it is enjoying due to the upcoming Paris Olympics. However, there are structural forces that could explain the generosity of France’s corporate valuations.

Refresh this chart in your browser | Edit the chart in Datastream

One of these structural forces is the market pricing of France’s corporate share of revenue generated abroad. All CAC 40 companies now generate at least 45% of their revenue outside France. In a world that just went through a massive, pandemic-related supply-chain disruption, and faces ongoing trade frictions as well as geopolitical tensions, the ability of French firms to retain market share abroad is a sign of quality that investors are willing to pay handsomely for. France’s largest corporates are exporting high value-added, luxury and cosmetics goods that are sought after globally. President Macron might not have a lot to do with this, but that feature of corporate France is feeding equity valuations.

Refresh this chart in your browser | Edit the chart in Datastream

Nevertheless, there are alarming signs in France’s value-added sectors that relate to research and development expenditure (R&D), the main input of innovation and technological change and a driver of long-term economic growth. The ability of high R&D intensity corporates to translate these expenditure outlays to future revenue lost significant ground in the latest four-year window. Some of this may have to do with the disruption that Artificial Intelligence (AI) is creating in all R&D-intensive sectors. The increased employment of people with tertiary education, discussed above, might be aimed to remedy that disruption.

Refresh this chart in your browser | Edit the chart in Datastream

The crude reality for President Macron is that he first needs to win the parliamentary elections before he can think of a legacy of labour market transformation, or of stopping the far-right from taking over the presidency when his term ends. Perhaps his ambitious, five-year national AI strategy might be enough to inspire what appears at the moment to be an unconvinced electorate; he might need to draw attention to it over the remainder of the month.

The views expressed in this article are the views of the author, not necessarily those of LSEG.

____________________________________________________________

LSEG Datastream

Financial time series database which allows you to identify and examine trends, generate and test ideas and develop viewpoints on the market.

LSEG offers the world’s most comprehensive historical database for numerical macroeconomic and cross-asset financial data which started in the 1950s and has grown into an indispensable resource for financial professionals. Find out more.