E-client support focused on solving problems and getting things done

LiveBank

benefits

Optimise and automate

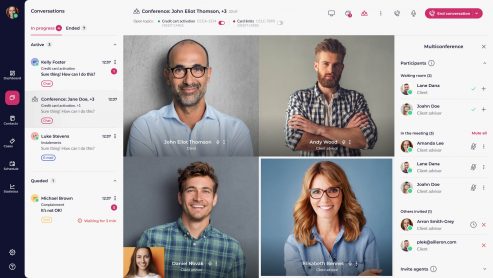

By ensuring secure browser-based access from all devices, LiveBank supports agents’ work from any location. Collaboration tools such as screen-sharing, co-browsing, or file exchange facilitate efficient remote customer support. LiveBank’s eKYC processes enable automated online onboarding of new clients as identity verification and authentication no longer require a visit to a physical branch.

Optimise and automateMeasure team performance

Customer support metrics and KPIs provide information on your team’s effectiveness, help identify bottlenecks, and make improvement plans. LiveBank enables reporting and monitoring KPIs such as SL, AHT, ASA/FRT, FCR.

Measure team performanceBoost customer satisfaction

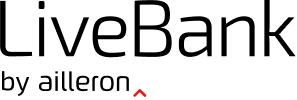

Efficiency in handling client issues and troubleshooting is fundamental to customer satisfaction. LiveBank’s solution puts clients at the centre of communication, ensures convenience and a great experience when interacting with a bank. Offer your clients a single sign-on, seamless switching between multiple channels and case-based communication, and watch your CSAT and CRR go up.

Boost customer satisfactionSolve your problems with LiveBank

How to increase client satisfaction with remote customer support?

Your clients use various devices, opt for particular solutions, and require help at different stages. Improve satisfaction and customer effort score with LiveBank.

How to reduce your ticket queue and shorten service time?

When requests for support are cumulating, agents are not able to respond to clients promptly, and the resolution time is too long, LiveBank will make a real difference.

How to provide agents with an aggregated history of interactions on different issues and respond on point?

Clients expect convenience, simplicity, and a sense of continuity. Agents need quick access to prior conversations and case context.

-

Real-time support

majority of clients expect real-time support regardless of the communication channel

-

Efficiency

significantly greater efficiency compared to telephone support

-

Throughput

2300 chat interactions serviced per month by a single agent

Our clients say it best

Test our solution or contact us to find out how LiveBank can help you

Why Do You Need Digital Customer Service Solutions?

Digital customer service solutions are an invaluable asset to any organization operating in the finance sector. Why exactly do you need them? Let’s take a look at this from your point of view – the problems your bank might struggle with and the ways such software solves them.

“`