Stock Research Report for Ambuja Cements Ltd

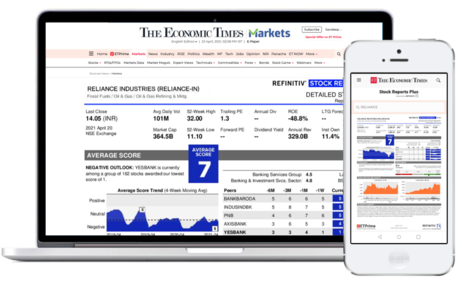

Stock score of Ambuja Cements Ltd moved down by 1 in a month on a 10 point scale (Source: Refinitiv). Get detailed report on Ambuja Cements Ltd by subscribing to ETPrime.

Get 4000+ Stock Reports worth₹ 1,499* with ETPrimeat no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Ambuja Cements Limited is an India-based cement company. The Company's principal activity is to manufacture and market cement and cement-related products. The Company's segments include Cement and Ready Mix Concrete. The Company's products include Ambuja Cement, Ambuja Kawach, Ambuja Plus, Ambuja Cool Walls, Ambuja Compocem, Ambuja Buildcem, Ambuja Powercem, Ambuja Railcem and Alccofine. The Company also offers support and services, including individual home builders, masons and contractors, and architects and engineers. Its cement capacity is 78.9 MTPA with 18 integrated cement manufacturing plants and 19 cement grinding units across the country. The Ambuja Plus product is a special cement for denser and leak-proof concrete. The Ambuja Compocem product is slag and silicate enriched composite (green) cement. The Company's subsidiaries include M.G.T Cements Private Limited, Chemical Limes Mundwa Private Limited, OneIndia BSC Private Limited, and others.