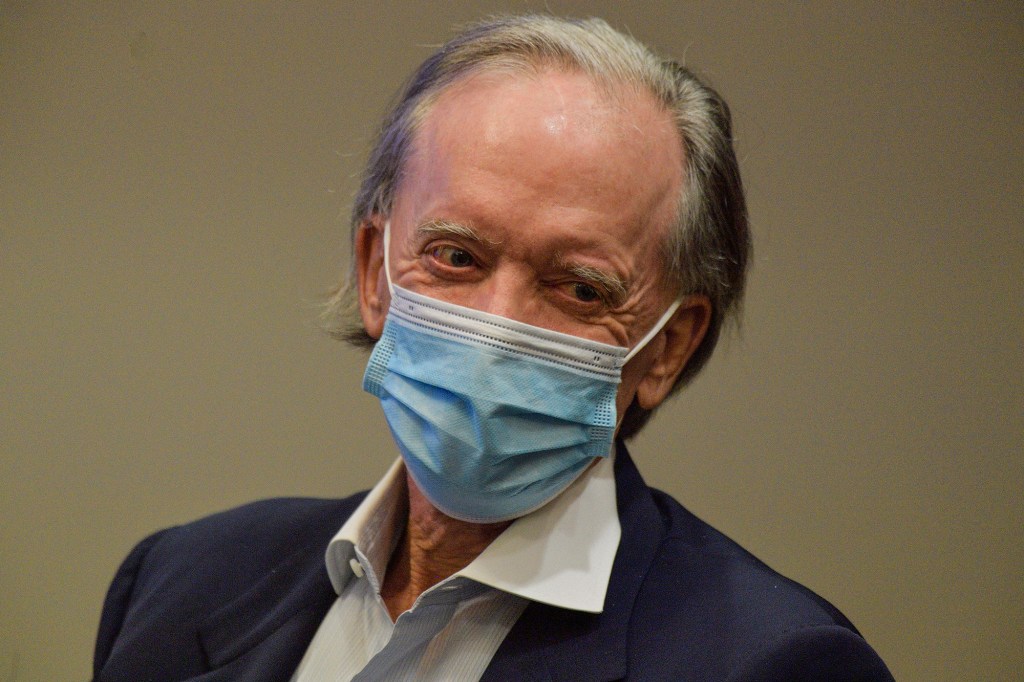

Bill Gross claims he was fired from PIMCO after insulting boss with F-bomb

Contact The Author

Bill Gross’s ouster from the PIMCO bond-trading empire was triggered in part by his insulting his boss with an F-bomb, according to a new, tell-all memoir from the prickly billionaire.

German-based investment giant Allianz had bought PIMCO in 2000, nearly 30 years after Gross founded it. Gross’s relationship with Allianz was often tense, but tensions reached a whole new level in 2014 when, in a meeting to discuss bonuses for top executives, Gross told Allianz CEO Michael Diekmann to “F–K OFF.”

Yes — the obscenity is quoted from Gross’s new, no-holds-barred memoir “I’m Still Standing,” which he is self-publishing on Amazon on Tuesday. And yes — the book does render it in all caps.

Gross says he is side-stepping a traditional publisher for the book because he wanted more editorial control and wanted to move quickly. Indeed, “control” appears to be a recurring theme in the book.

“I wanted to show that we were in control and we were the alphas at the table,” Gross writes of the incident with Diekmann. “At 72 years of age, I suspected I wasn’t indispensable, but it was the “F*** OFF” along with other issues that sealed my fate.”

Gross is releasing the book even after thinly veiled threats from PIMCO’s attorneys that they could sue him for potentially violating his settlement with PIMCO that includes a non-disparagement provision.

A source close to Gross says that, in response to the letter, he took some potentially “offending sections” out. Still, “PIMCO’s lawyers will probably still throw a fit,” the source adds.

PIMCO declined to comment.

While Gross acknowledges his behavior cost him; he also suggests the decision to axe him in 2014 cost Allianz “nearly $500 billion of assets” since investors pulled money out when Gross left.

Meanwhile, a key insult he endured from PIMCO, Gross writes, was the firm’s decision to rename and redecorate the Founders Room, a conference room at headquarters which had featured several pictures of him on the wall.

Gross says he got “payback” by revealing highly confidential information: the bonuses PIMCO partners received.

“I decided that sunlight was a great disinfectant. I made eight copies of the bonus summary and mailed them in a ‘confidential only’ envelope to eight random managing directors at the PIMCO address,” Gross writes. “A day later, I swear I could hear the screams from the 21st floor offices occupied by top executives. ‘Founders Room payback,’ I whispered to myself.”

Elsewhere, Gross admits he was likely inebriated when Treasury Secretary Timothy Geithner called him in 2009 asking for advice. While the men had never met in person, Geithner called Gross to take his pulse on “what to do about the US economy” — a call that was reported in an article by the New York Times.

“What the article didn’t write was the cellphone rang after I had consumed a few beers, Gross says. “The alcohol calmed me down I guess, but I’m not so sure about the advice.”

Gross left PIMCO in 2014 for Janus Capital group. At the time, he came under fire for PIMCO’s weak returns and media reports that he was domineering and unreliable. Gross sued PIMCO in 2015 alleging he had been ousted by a “greedy cabal” of executives who wanted his share of the company’s bonus pool and who wanted to move away from ultra-safe bonds and into riskier investments.

Gross, whose net worth is estimated by Forbes at $1.5 billion, alleged the company destroyed his reputation and demanded $200 million. In 2017, it was widely reported that PIMCO settled with Gross for $81 million which he donated to charity.

Meanwhile, journalist Mary Childs will be releasing a book on Gross later next month called “The Bond King”. PIMCO and Bill Gross cooperated in the fact-checking of the book but did not review a copy of the manuscript, people with knowledge told On The Money.