Traders outraged as Ryan Cohen bags $68M selling Bed Bath & Beyond stock

‘Meme stock’ icon Ryan Cohen infuriated some Redditors after bagging an eight-figure payday while dumping his entire activist stake in struggling retailer Bed Bath & Beyond.

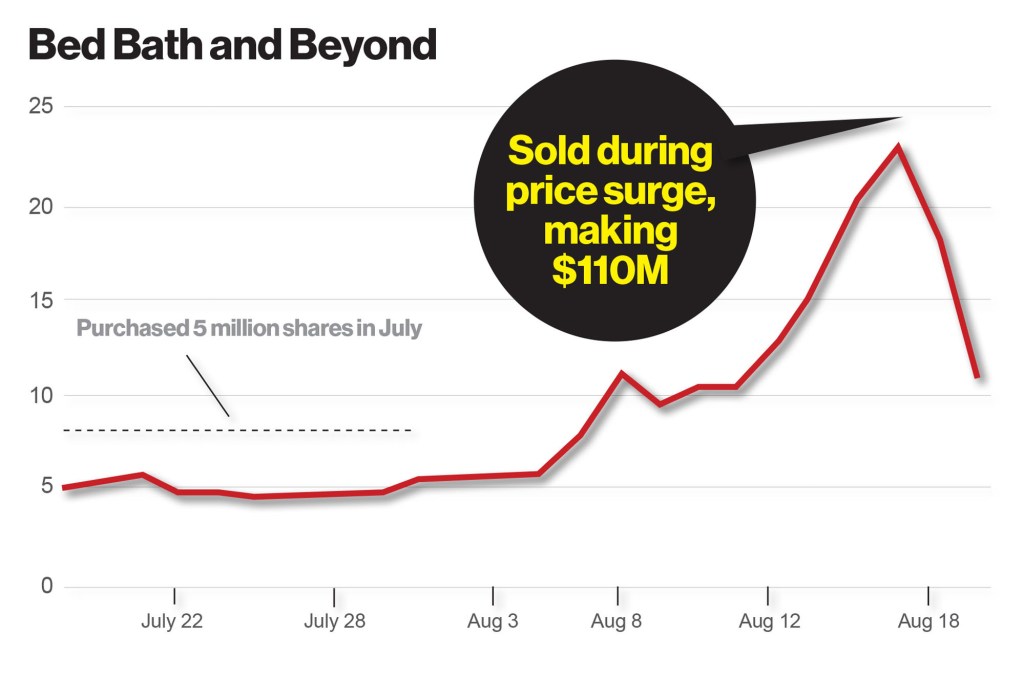

Cohen, the billionaire Chewy.com founder and GameStop chairman, disclosed that his firm RC Ventures had exited its position. Cohen earned a $68.1 million profit on the stock, generating a 56% gain on his original investment while selling after just seven months, Bloomberg reported.

Meanwhile, individual investors and others who poured money into Bed Bath & Beyond were left holding the bag as the company’s shares plunged a whopping 41% on Friday. Some Redditors aimed their ire at Cohen for making a hasty exit.

“After reading what Ryan Cohen just did I hope you all understand that he us not one of us,” Reddit user Ronpm111 wrote on the “WallStreetBets” forum.

“Cohen just showed his hand. He will screw everyone else so he gets wealthier. He is setting you up,” the user added.

“Ryan Cohen = dead to me. GME = dead to me. Selling all my bags,” another Redditor named Rock_Bottom00v said.

“Ryan is scum, this movement is a joke, and the majority of yall are the fools. This has been entertaining to watch from the sidelines,” another user wrote.

The Post has reached out to Cohen’s firm, RC Ventures, for comment.

Bed Bath & Beyond shares had surged in recent days, rising as high as $30 this month, after Cohen took an activist stake and pushed for changes at the company. Cohen built a massive following on WallStreetBets and other online forums as retail investors snapped up GameStop and other so-called “meme stocks” during the COVID-19 pandemic.

“Somebody bought it at $30, and someone lost 12 bucks a share to enrich Ryan Cohen,” Michael Pachter, an equity research analyst for Wedbush Securities, told the Wall Street Journal. “That’s a retail investor who bought the stock.”

Volatility in the company’s share price meant wild swings for investors. One investor, Jake Freeman, a 20-year-old student at the University of Southern California, became an internet folk hero after he earned $110 million by selling his stake in the retailer.

“I certainly did not expect such a vicious rally upwards,” Freeman told the Financial Times. “I thought this was going to be a six-months-plus play…I was really shocked that it went up so fast.”

It’s unclear what prompted Cohen to reverse course and sell his position in Bed Bath & Beyond, which forced out its CEO in June due to the company’s subpar performance. Prior to his exit, Cohen had successfully pushed for the company to add three new board directors and has also urged the retailer to sell itself.

Ryan Bennett, a 43-year-old agriculture worker in Beloit, Wisconsin, told Reuters that he is down more than $40,000 on his Bed Bath & Beyond investment after buying up shares based on Cohen’s earlier actions.

“I feel I took my hard-earned money out of my pocket and put it right into Cohen’s,” Bennett told the outlet.