First Republic Bank falls nearly 70%, trading halted after collapse of SVB, Signature

Contact The Author

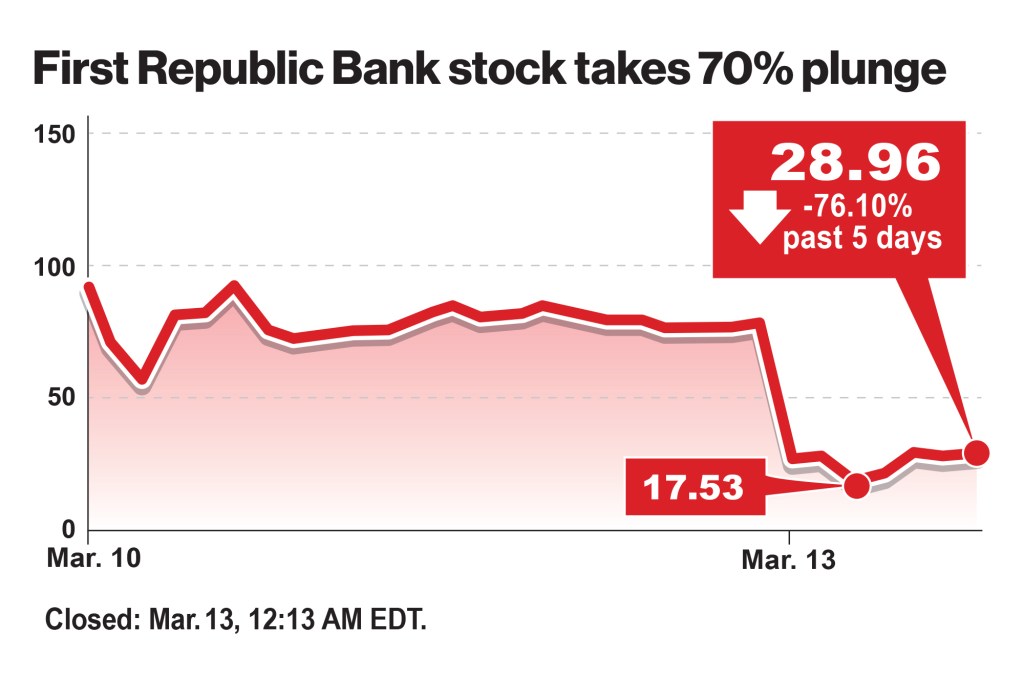

Shares of First Republic Bank tanked by nearly 70% in pre-market trading on Monday before trading in the stock halted — just hours after federal regulators announced that they would step in and assume control of failed lenders Silicon Valley Bank and Signature Bank.

The San Francisco-based First Republic Bank, a regional lender with more than $216 billion in assets under management, was last down 67% at $27.08 before its trading was halted for volatility.

Trading was halted despite President Biden addressing the burgeoning crisis.

First Republic was one several regional banks that led Monday’s decline in the banking sector — fueling more fears that large financial institutions were at risk.

Among other regional lenders, Western Alliance was down 82.% and PacWest Bancorp slid 52% before their trading was halted for volatility.

Charles Schwab’s stock price fell by some 12% before the opening bell on Monday after it reported a 28% decline in average margin balances to $60.6 billion in February from a year earlier.

The company’s shares tumbled as much as 18% in volatile trading after markets opened with multiple halts and resumptions. They have shed 23% in the last two trading days.

The stock was last down about 10% at $52.99.

Still, the Dow managed to shake off some of the panic, rising more than 200 points in mid-morning trading.

First Republic’s stock price has taken a beating recently — falling 29% in the last two trading sessions on Wall Street.

Steven Rattner, the Wall Street financier who advised President Barack Obama during the 2009 bailout of the auto industry, wondered whether the falling stock price will ignite a run on the banks.

“Shares of First Republic and PacWest Bancorp set to open way down today,” Rattner tweeted Monday morning.

“What will their depositors do?”

In his White House speech, Biden declared the banking system “safe” and vowed stiffer bank regulation.

“Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” Biden said.

The managers of the banks will be fired, Biden noted, and investors will lose money.

“They knowingly took a risk, and when the risk didn’t pay off his adjusters lose their money. That’s how capitalism works,” he said.

The speech came a day after the Biden administration sought to head off a potential banking crisis after the historic failure of Silicon Valley Bank, assuring all depositors at the failed institution that they could access all their money quickly.

Regulators had worked all weekend to try to find a buyer for the bank, which was the second-largest bank failure in history. Those efforts appeared to have failed Sunday.

The financial near-crisis that US regulators had to seek to prevent left Asian markets jittery as trading began Monday.

Japan’s benchmark Nikkei 225 sank 1.6% in morning trading, Australia’s S&P/ASX 200 lost 0.3% and South Korea’s Kospi shed 0.4%.

But Hong Kong’s Hang Seng rose 1.4% and the Shanghai Composite increased 0.3%.

Manhattan-based Signature Bank — a key financial institution for the cryptocurrency industry — was shut down over a “similar systemic risk exception,” according to a joint statement from the heads of the US Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Silicon and Signature depositors will be made whole, but the banks’ shareholders and unsecured debtors will not be protected, officials said.

Follow The Post’s coverage of Silicon Valley Bank’s collapse

- Ex-Silicon Valley Bank CEO Greg Becker jets to Hawaii after collapse

- Goldman Sachs lost $200M in recent US banking chaos: report

- Kevin O’Leary grilled on why he kept money at SVB if management were ‘idiots’

The California-based Silicon Valley had $209 billion in assets when it failed Friday, while Signature Bank had more than $110 billion.

Silicon was the second-largest bank to collapse in US history, after Washington Mutual in 2008. Signature was the third-largest.

The Federal Reserve said it will create a new Bank Term Funding Program to offer depository institutions loans of up to one year, backed by US Treasury securities and other assets, to help the banks.

The feds said the steps they are taking “will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.”

With Post wires