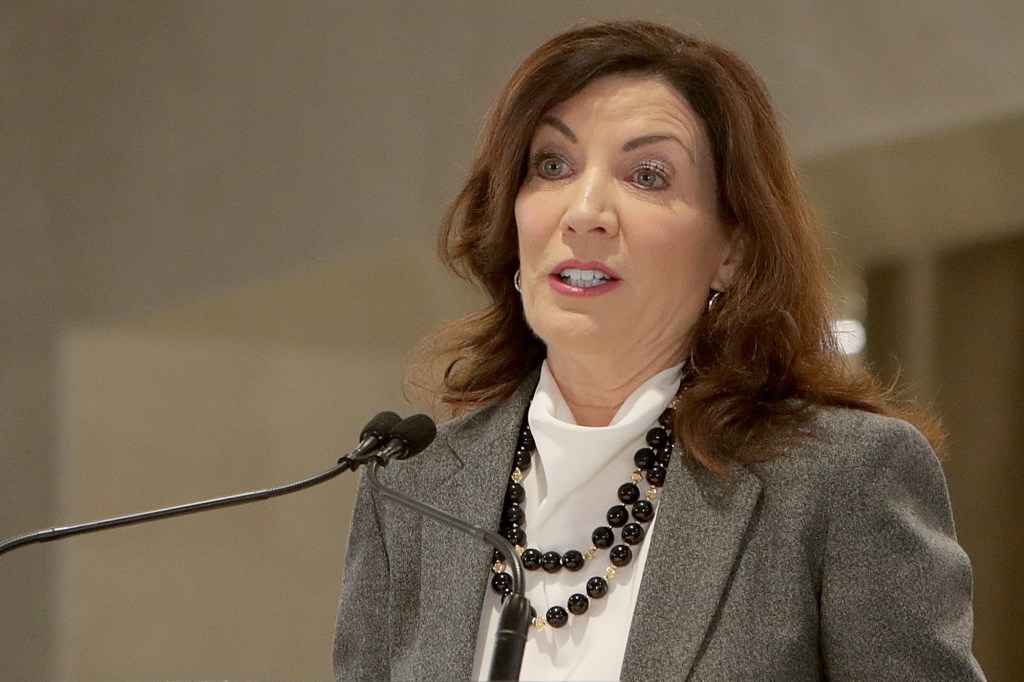

Gov. Kathy Hochul tries to calm New Yorkers after Signature Bank collapse

Gov. Kathy Hochul on Monday said the New York banking system remained on solid ground despite the failure of Signature Bank this weekend.

“The main message I want to deliver is New Yorkers should have confidence that their money is secure,” Hochul told reporters in Manhattan.

“Wherever they’ve chosen to bank, that is protected,” she said.

State regulators took over Signature on Sunday, which had total deposits of $82.6 billion, amid worries that its collapse, which closely followed the fall of California-based Silicon Valley Bank, could lead to a national financial meltdown.

A fund supported by banks will cover all deposits in the two failed banks as part of efforts to limit the financial storm, according to the Federal Deposit Insurance Corporation.

Hochul downplayed the remaining risk to the state financial system and economy Monday.

“We don’t have any evidence that anyone else is in a situation like Signature at this moment,” she said.

Her comments came shortly after President Biden addressed the crisis, using similar terms.

“Thanks to the quick action of my administration over the last few days, Americans can have confidence that the banking system is safe,” Biden insisted. “Your deposits will be there when you need them.”

Biden’s remarks seemed aimed at broader fallout and ripple effects through the stock market and potentially other lenders.

The FDIC will manage the day-to-day operations of Signature Bank moving forward with its previous leadership kicked to the curb.

Hochul said her administration pushed the feds to make sure depositors at Signature would be completely covered following the announcement by the Biden administration that all Silicon Valley Bank customers would be made whole, including those above the normal $250,000 FDIC insurance limit.

“Our view was to make sure that the entire banking community here in New York was stable, that we can project calm, that this is a time when we could manage a certain narrow situation, and to make sure that that did not get any worse. And that was what our objectives were,” Hochul said.

State Department of Financial Services Superintendent Adrienne Harris downplayed the extent to which cryptocurrencies might have contributed to the Signature collapse.

“Signature Bank had a broad depositor base so this idea that it is a crypto-bank is not an accurate one,” she said at the press conference.

Silicon Valley Bank was a go-to financial institution for tech firms, with bank management reportedly taking the risky decision to place many of its customers’ money in securities – a move that backfired amid the bumpy economy, according to Business Insider.

But taxpayers are not on the hook for covering depositors at either bank, but their investors will likely have their losses, according to the White House.

“They knowingly took a risk and when the risk didn’t pay off, investors lose their money. That’s how capitalism works,” Biden said.