It now costs 52% more to buy a home than rent one: ‘Never been a worse time’

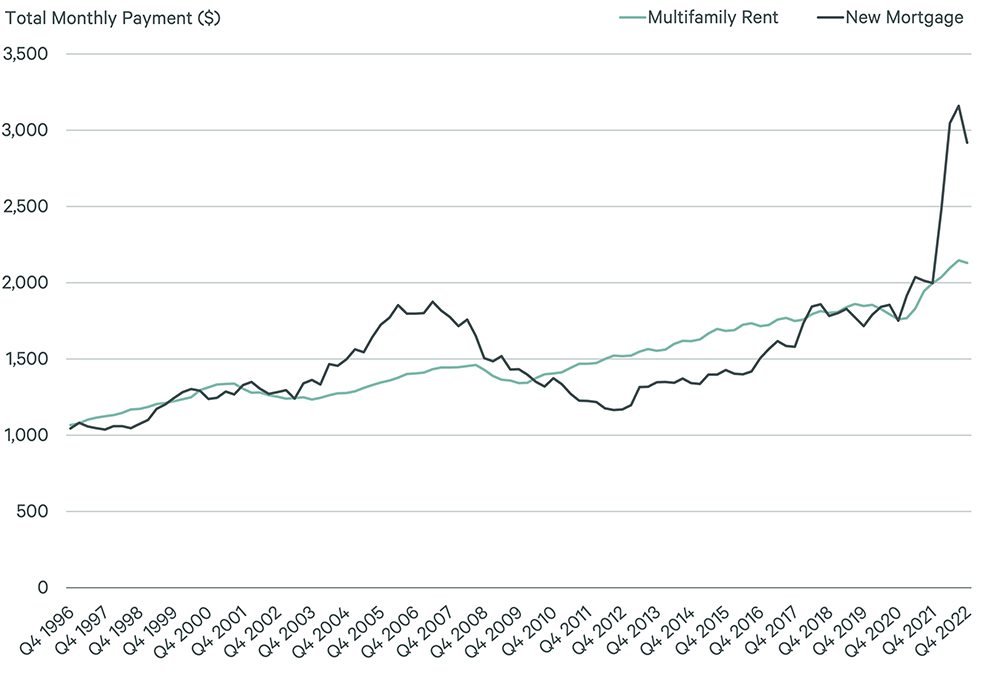

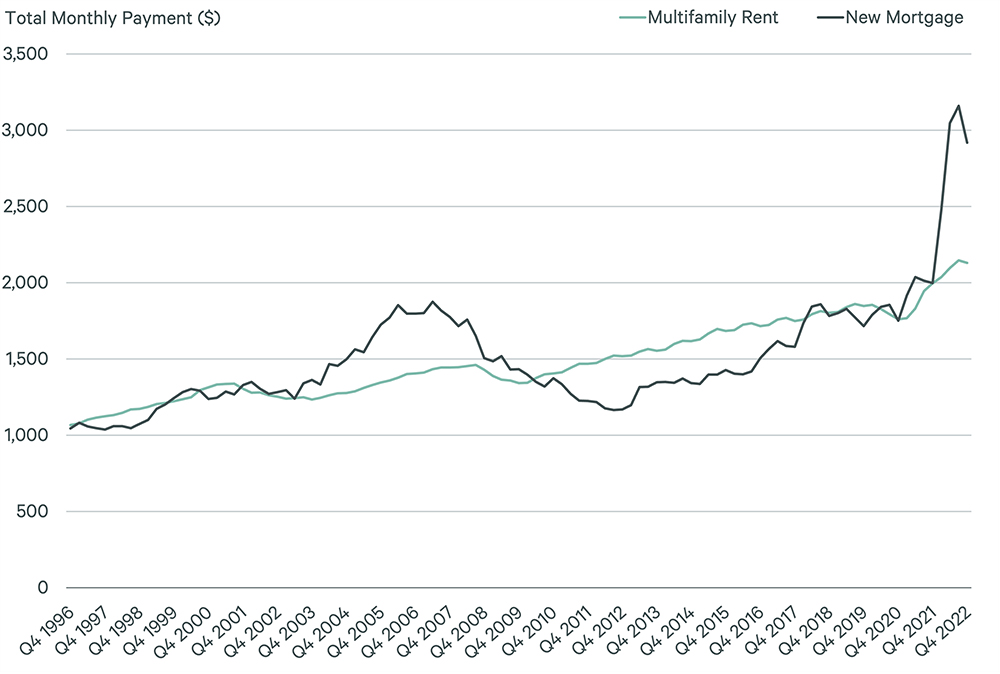

The average monthly mortgage payment is a whopping 52% higher than the average monthly rent on a house or apartment — a ratio that hasn’t been this out of whack since before the 2008 housing crash, according to The Wall Street Journal.

The last time the cost of buying a home versus renting one was this extreme was in 1996, The Journal reported, headlining its article “There’s never been a worse time to buy instead of rent,” citing data from commercial real estate firm CBRE.

Historically, monthly mortgage rates have cost the same or less than monthly rent payments on an apartment — which had been the case from 1996 to mid-2003 — since owners tend to put more cash into their homes than tenants because of expenses like repairs and renovations, per The Journal.

In the lead up to the ’08 market crash, the mortgage premiums peaked at 33% in the second quarter of 2006.

After the financial crisis, interest rates tanked as housing supply skyrocketed throughout the 2010s, making it 12% cheaper on average to buy a home rather than rent one, according tot he outlet.

However, the increased cost of debt as rates on a benchmark 30-year home loan hit 8%, coupled with low housing supply, have flip-flopped the ratio.

Last week, the average long-term rate hit 8% for the first time since 2000, according to Mortgage Daily News.

As of Monday, the figure has since come down to 7.97%, though it’s hovered close to the 8% mark for weeks, adding hundreds of dollars a month in costs for borrowers, limiting how much they can afford in a market already unaffordable to many Americans.

Around 80% of outstanding US mortgages are from buyers who scooped up their properties when rates were low, with interest rates below 5%, according to The Journal.

This gives homeowners an incentive to stay put, as even downsizing to take advantage of lower sticker prices doesn’t make sense given higher mortgage rates.

The higher rates also discourage homeowners who locked in low rates two years ago from selling.

The lack of housing supply also weighs on sales of previously occupied US homes, which are down 22.3% through the first seven months of the year versus the same stretch in 2022.

An 8% borrowing rate means that a buyer taking out a 30-year mortgage on a $410,200 — the average price of an already-standing US home, according to Bankrate — with a 10% downpayment would have to cough up some $3,000 per month, 60% more than if they were buying the same house in 2020.

Though most US cities’ real estate markets run the risk of pricing out consumers, there are still four large metro areas where it’s cheaper to buy a home than rent, according to a study by real estate brokerage Redfin.

Those cities are Detroit, Philadelphia, Cleveland and Houston, where mortgage payments will run buyers about 20%, 41%, 43% and 48% less, respectively, than monthly rent.

At least half of all properties in each of these cities are less expensive to buy than rent, Redfin found. This is true of a staggering 80% of homes in Detroit.