Donald Trump’s media company surges 50% in Wall Street debut

Contact The Author

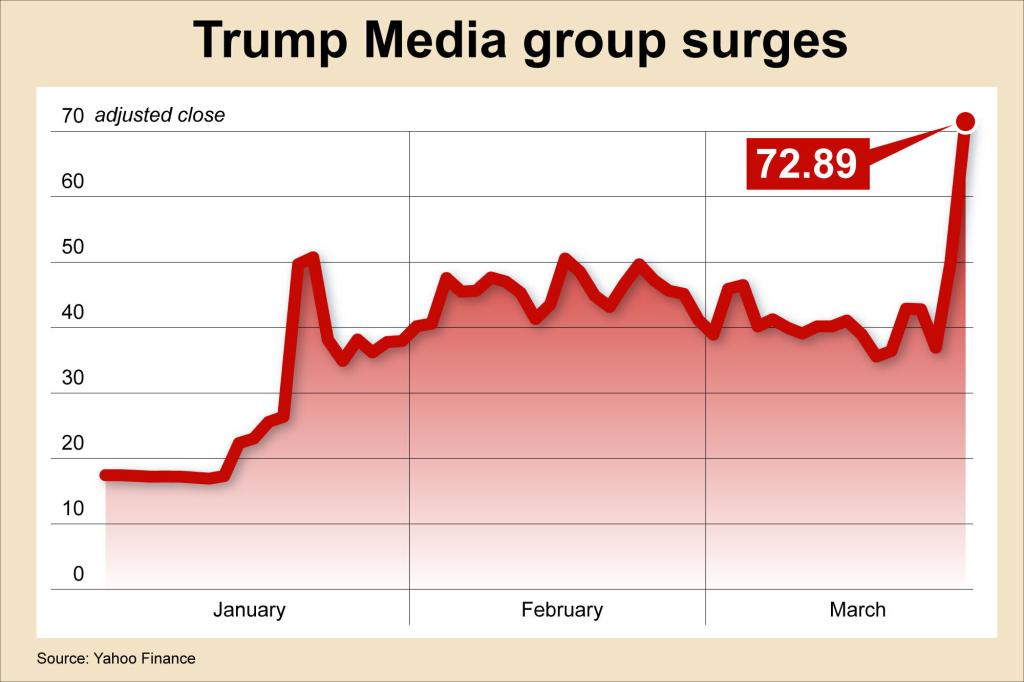

Shares in Donald Trump’s media company surged more than 50% at the start of trading on Tuesday — the first day investors could own a piece of the former president’s social media platform Truth Social.

Trump Media & Technology Group started trading on the Nasdaq index under the ticker name DJT — the initials for Donald John Trump — with the stock dipping from its opening spike to around $71 a share by 10:30 am ET, 42% higher than its closing price on Monday.

Trump owns a majority stake in DJT with nearly 79 million shares, raising his value to around $5.9 billion.

The soaring stock price was fueled by news that Trump managed to secure a drastically reduced bond of $175 million in his civil fraud case.

However, the overheated demand for the stock comes despite Truth Social losing $10.6 million from its operations in the first nine months of 2023.

“The valuation of the business is rich relative to its underlying fundamentals, but I would not get in front of it in the near term,” said Thomas Hayes, chairman of Great Hill Capital.

“This valuation may be more of a proxy on the enthusiasm of supporters for Trump than a reasonable estimate of underlying business prospects.”

The surge in the former president’s net worth earned him a spot on the Bloomberg Billionaires Index, which valued his fortune at $6.5 billion before Tuesday’s opening bell.

The newly formed company is a result of its merger with the blank-check company Digital World Acquisition Corp, whose shareholders approved the move on Friday.

The DJT ticker was last used in the 1990s, when shares of Trump’s hotel and casino company traded on Wall Street.

The company also provides a way for supporters of Trump to bet on his resurgence as a political figure, as evidenced by shares of DWAC nearly tripling in value this year.

Trump appeared to be on the brink of financial ruin as a Monday deadline for him to post a $500 million bond was looming.

But a New York state appeals court agreed to hold off collection of the $454 million civil fraud judgment if he puts up $175 million within 10 days.

However, Trump can’t tap his newfound wealth from DJT because of lock-up restrictions for six months that could prevent him from selling or borrowing against his shares.

Trump has pledged to post the $175 million bond, which will prevent the state from seizing the presumptive Republican presidential nominee’s assets while he appeals.

The appeals court also halted other aspects of a trial judge’s ruling that had barred Trump and his sons Eric Trump and Donald Trump Jr., the family company’s executive vice presidents, from serving in corporate leadership for several years.

In all, the order was a significant victory for the Republican ex-president as he defends the real estate empire that vaulted him into public life.

The development came just before New York Attorney General Letitia James, a Democrat, was expected to initiate efforts to collect the judgment.

Trump, who was attending a separate hearing in his criminal hush money case in New York, hailed the ruling and said he would post a bond, securities or cash to cover the $175 million sum in the civil case.

Speaking in a courthouse hallway, Trump revisited his oft-stated complaints about civil trial Judge Arthur Engoron and the penalty he imposed.

“What he’s done is such a disservice and should never be allowed to happen again,” said Trump, who argues that the fraud case is discouraging business in New York.

James’ office, meanwhile, noted that the judgment still stands, even if collection is paused.

“Donald Trump is still facing accountability for his staggering fraud,” the office said in a statement.