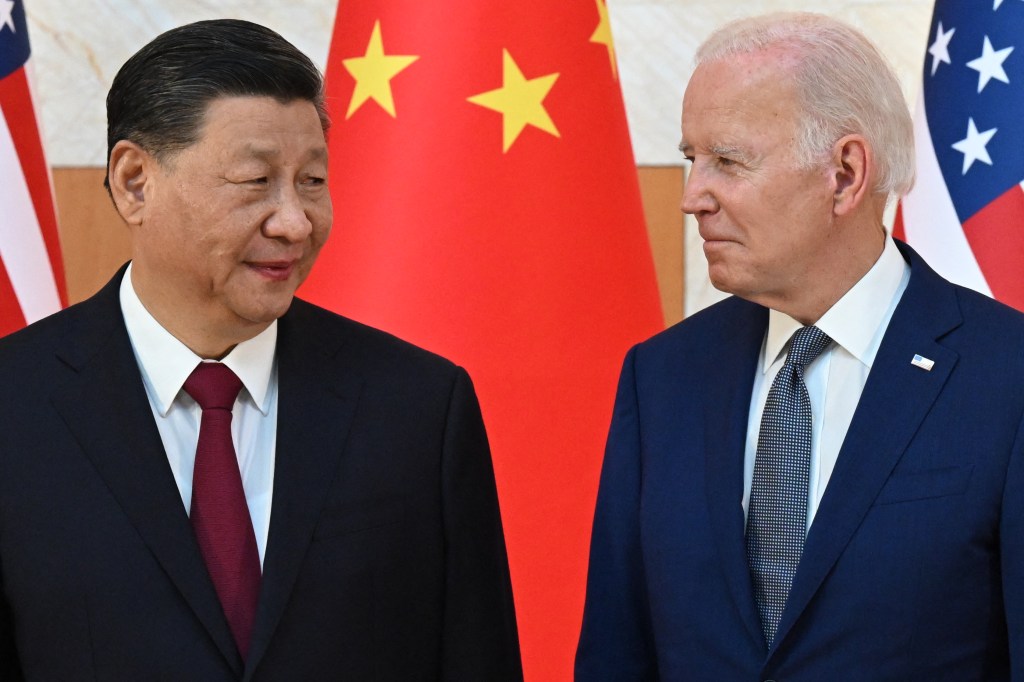

Biden raises tariffs on Chinese EVs and aluminum after Hunter’s former firm helped broker deals benefitting same industries

An investment firm linked to Hunter Biden helped broker deals benefitting the Chinese electric vehicle and aluminum sectors – the same industries Joe Biden slapped tariffs on Tuesday over fears that the US adversary would come to dominate both markets.

The embattled first son co-founded BHR Partners in 2013. Three years later, the firm was influential in facilitating a deal in which a Chinese firm bought a Congolese cobalt mine from American and Canadian companies.

The transaction, first reported by the Washington Free Beacon during the 2020 presidential campaign and subsequently spotlighted by the New York Times, granted China Molybdenum Company Limited – a state-owned enterprise – control of one of the world’s largest sources of cobalt.

Cobalt is a key material in the manufacturing of electric vehicle batteries.

The $3.8 billion transaction that transferred 80 percent of Congo’s Tenke Fungurum mine to China Molybdenum came the same year that BHR Partners bought and sold a stake in Chinese electric car battery maker CATL, the New York Times reported.

BHR Partners also attempted to facilitate a deal the year prior, in 2015, between the US subsidiary of Chinese company Zhongwang and US aluminum manufacturer Aleris, the Washington Free Beacon reported on Wednesday, citing emails from Hunter’s infamous laptop.

Zhongwang, the company’s owner and affiliated companies were indicted by the Justice Department in 2019 over an alleged scheme to circumvent paying more than $1 billion in tariffs on aluminum goods.

Hunter’s 10% stake BHR Partners was allegedly purchased by the first son’s so-called “sugar brother” Kevin Morris, a Hollywood lawyer, during Joe Biden’s first year as president.

“For years, the Chinese government has poured state money to Chinese companies across a whole range of industries — steel, aluminum, semiconductors, electric vehicles, solar panels, the industries of the future, and even critical health equipment like gloves and masks,” Joe Biden said Tuesday, as he announced tariffs that will apply to roughly $18 billion per year in Chinese imports.

“China heavily subsidized all these products, pushing Chinese companies to produce far more than the rest of the world can absorb, then dumping the excess products onto the market at unfairly low prices, driving other manufacturers around the world out of business,” the 81-year-old president added.

Over the next two years, Chinese electric vehicles will face a 100% tariff. Tariffs on certain Chinese steel and aluminum products will climb to 25% this year under Biden’s action.

Start and end your day informed with our newsletters

Morning Report and Evening Update: Your source for today's top stories

Thanks for signing up!

Congressional Republicans leading an impeachment inquiry into alleged Biden family corruption have produced evidence that Joe Biden met with the leaders of two separate Chinese government-controlled business ventures that involved Hunter and first brother James Biden, including BHR Partners CEO Jonathan Li.