Wall Street firms part of ‘climate cartel,’ colluded to curb emissions: House report

Contact The Author

A “climate cartel” made up of left-wing advocacy groups and Wall Street firms have colluded to force American companies to reduce carbon emissions, a congressional committee charged in a scathing report Tuesday.

The interim report is the first of its kind produced by the Republican-led Judiciary Committee in the House since it launched an investigation in late 2022 into whether corporate efforts to tackle climate change violate antitrust laws.

It accused business groups and advocacy organizations of “muzzling corporate free speech” and “handcuffing company leadership” through “ever-escalating pressure tactics,” which included “taking out” directors at firms that are deemed “recalcitrant.”

The “collaborating” groups included climate Action 100+, the Net Zero Asset Managers initiative and the Glasgow Financial Alliance for Net Zero as well as the California Public Employees’ Retirement System (CalPERS) and the “Big Three” asset managers – Vanguard, BlackRock and State Street.

Representatives for BlackRock, State Street and Vanguard did not immediately respond to requests for comment.

Several Republican-controlled states have been already targeting Wall Street firms for entering into climate coalitions and marketing environmental, social and corporate governance (ESG)-focused investment products, fretting that these initiatives will harm jobs in the fossil fuel industry.

In the Judiciary Committee’s report, the committee staff accuse President Biden’s administration of failing to “meaningfully investigate the climate cartel’s collusion, let alone bring enforcement actions against its apparent violations of longstanding US antitrust law.”

A White House spokesperson did not immediately respond to a request for comment.

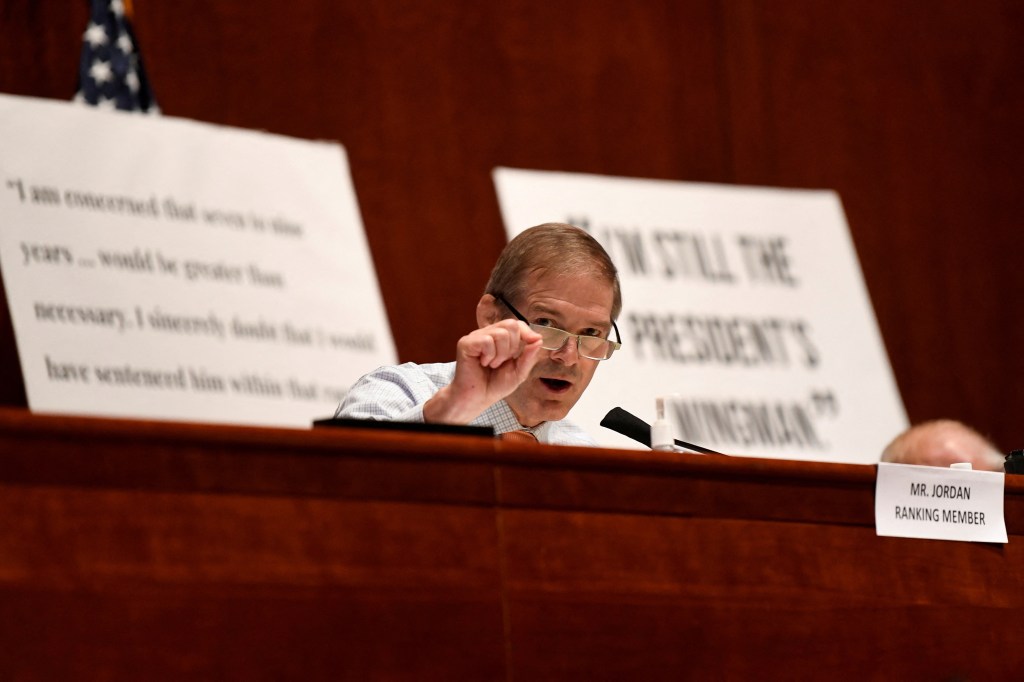

“The goal of any investigation is to inform legislative reforms,” a spokesperson for Judiciary Committee chair Jim Jordan said.

While legislation is unlikely as long as Democrats control the White House and the Senate, any bill the committee comes up with could offer hints at what a new administration led by Republican Donald Trump could try to implement if he prevails in November’s election.

The report credits the committee for forcing BlackRock, State Street and JPMorgan Asset Management to withdraw $14 trillion of total assets from Climate Action 100+ earlier this year.

A spokesperson for Climate Action 100+ said its aims to undertake investor stewardship on climate change were misunderstood in the political discourse, and that its investors were “independent fiduciaries, responsible for their individual investment and voting decisions.”

“As the world’s largest investor-led engagement initiative, Climate Action 100+ will be scrutinized … But any scrutiny must be fair, accurate, and based on facts,” the spokesperson said.

The report also takes aim at Climate Action 100+ co-founders, the California Public Employees Retirement System (CalPERS) and climate-focused investor group Ceres for their key support of Climate Action 100+. It says activist investor Arjuna Capital, a member, “seeks to destroy fossil fuel companies.”

No antitrust lawsuit has been brought against any climate coalition of companies. The spokesperson for Jordan declined to comment on any interactions with US antitrust regulators regarding the report. The Department of Justice and the Federal Trade Commission, which oversee antitrust reviews, did not immediately respond to requests for comment.

The report said it provided interim findings and that the investigation is continuing.

The committee issued subpoenas for documents and interviewed former regulators during the investigation.

The committee has called witnesses including Ceres president Mindy Lubber to appear at a public hearing on Wednesday.

Ceres said in a statement that the hearing is part of a “larger political campaign from opponents of climate action” who want “to ban investors from considering climate-related financial risk in decision-making.”

A CalPERS spokesperson said it was “proud to participate” in initiatives like Climate Action 100+. “This is not collusion; it is collaboration,” the spokesman said.

Arjuna did not immediately respond to requests for comment.

With Post wires