How much you need to have in your savings to feel financially prepared: poll

What would it take to feel financially prepared? New research has found the average American feels prepared for the worst once they have $5,078 saved up.

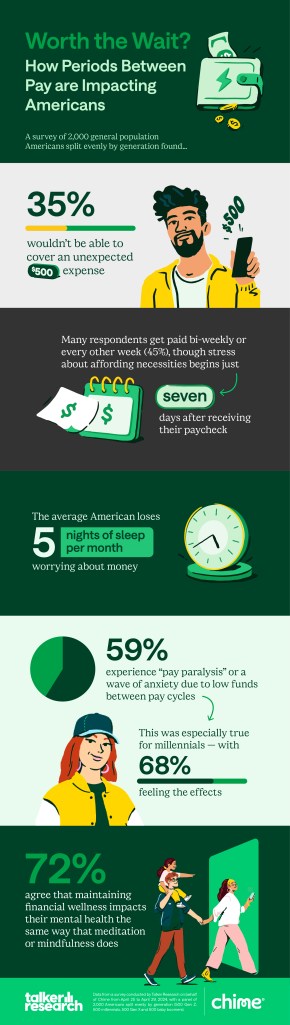

The poll of 2,000 employed Americans split evenly by generation (500 Gen Z, 500 millennials, 500 Gen X and 500 baby boomers) found Gen Zers need at least $4,286 in their bank account at any given time to feel prepared.

Meanwhile, baby boomers would like to have almost $6,500 ($6,490.70) and Gen X would feel most secure with closer to $5,000 ($4,910.10).

Conducted by Talker Research on behalf of Chime, results found 63% believe they could afford to cover an unexpected, $500 expense — although 30% of them admit it would put a strain on their finances.

Another 17% could not currently afford that type of expense, but believe they could eventually find some way to afford it.

In order to chip away at that cost, 32% of respondents would dip into their savings, while 28% would phone family and friends.

A quarter (26%) said they would pay off unexpected expenses by temporarily holding off on other expenses, such as groceries or less important bills.

Nearly three in four (72%) spend most of their paycheck on paying bills, and 69% said that’s the first thing they do when they get paid.

Twenty-nine percent of respondents said the first emotion they have when they receive their paychecks is “excitement.” However, that is usually followed by feelings of stress (19%), preparedness (19%) and overwhelm (19%).

Leading up to payday, 39% admitted they’re more likely to avoid social events in order to save funds for when they really need it. This is likely a result of trying to combat the feeling of “pay paralysis” that 59% experience — a wave of anxiety or fear due to low funds between pay cycles.

“The survey also found that the average American starts to feel stressed about their money just seven days after receiving their paycheck,” said Madhu Muthukumar, Chief Product Officer at Chime. “It’s clear that rising costs are impacting Americans’ well-being and people need simple, helpful and powerful tools to manage their budget, especially between paychecks.”

Start your day with all you need to know

Morning Report delivers the latest news, videos, photos and more.

Thanks for signing up!

Results also found the average American is taking steps to build their savings — setting aside 16% of their paycheck. Gen Z was found to take the most care, saving nearly a quarter (23%) of their paycheck.

Millennials, meanwhile, said they’re able to set aside 17% of their paycheck for their savings. Gen Xers are saving 12% and baby boomers are saving 11%.

Though 40% admit that their mental health is being negatively impacted by their current financial situation, 72% agreed that maintaining financial wellness positively impacts their mental health the same way that meditation or mindfulness does.

“Set clear financial goals that prioritize your needs and spending. Open communication about your financial boundaries can lead to better understanding and support in your inner circles,” said Dasha Kennedy, Personal Finance Advocate for Chime. “And practice open communication — talking about your financial boundaries can lead to better understanding and support from your inner circles.

“That means it is okay to say ‘no’ to events or purchases that don’t fit your budget. Take the lead in suggesting group activities by using free or low-cost activities to stay connected without going over your budget.”

Survey methodology:

This random double-opt-in survey of 2,000 employed Americans split evenly by generation (500 Gen Z, 500 millennials, 500 Gen X and 500 baby boomers) was commissioned by Chime between April 25 and April 29, 2024. It was conducted by market research company Talker Research, whose team members are members of the Market Research Society (MRS) and the European Society for Opinion and Marketing Research (ESOMAR).