fundraising

In the first half of 2024 alone, more than $35.5 billion was invested into AI startups globally.

Welcome back to another recap of Equity, TechCrunch’s flagship podcast about the business of startups. This episode is packed with deals, antitrust musings, AI and…

The capital will be used to expand in Europe, the U.S. and Asia.

J2 Ventures, a firm led mostly by U.S. military veterans, announced on Thursday that it has raised a $150 million second fund. The Boston-based firm invests in startups whose products…

Apiday leverages AI to save time for its customers. But like legacy consultants, it also offers human expertise.

In an industry where creators are often tossed aside like yesterday’s lootboxes, MegaMod swoops in with a heroic promise to put them front and center.

Climate tech startups especially those building hardware, face a particular challenge when trying to move beyond the prototype or pilot phase and start selling finished products to customers.

When Ironspring Ventures launched in 2020 to back startups in industrial sectors like construction and manufacturing, it was one of very few early-stage venture firms paying attention to those capital-intensive…

Fresh off the success of its first mission, satellite manufacturer Apex has closed $95 million in new capital to scale its operations. The Los Angeles-based startup successfully launched and commissioned…

Featured Article

In 2024, many Y Combinator startups only want tiny seed rounds — but there’s a catch

When Bowery Capital general partner Loren Straub started talking to a startup from the latest Y Combinator accelerator batch a few months ago, she thought it was strange that the company didn’t have a lead investor for the round it was raising. Even stranger, the founders didn’t seem to be…

It’s not often that you hear about a seed round above $10 million. H, a startup based in Paris and previously known as Holistic AI, has announced a $220 million…

Contour Venture Partners, an early investor in Datadog and Movable Ink, has raised $42M for its fifth fund

Longtime New York-based seed investor, Contour Venture Partners, is making progress on its latest flagship fund. The firm closed on $42 million, raised from 64 backers, for Contour Venture Partners…

Trawa simplifies energy purchasing and management for SMEs by leveraging an AI-powered platform and downstream data from customers.

Featured Article

Fairgen ‘boosts’ survey results using synthetic data and AI-generated responses

The Israeli startup has raised $5.5M for its platform that uses “statistical AI” to generate synthetic data that it says is as good as the real thing.

Featured Article

Investors won’t give you the real reason they are passing on your startup

“When an investor passes on you, they will not tell you the real reason,” said Tom Blomfield, group partner at Y Combinator. “At seed stage, frankly, no one knows what’s going to fucking happen. The future is so uncertain. All they’re judging is the perceived quality of the founder. When…

Featured Article

The ‘valley of death’ for climate lies between early-stage funding and scaling up

It’s easier for climate companies to get enough funding to get started. It’s much harder once they need money to scale.

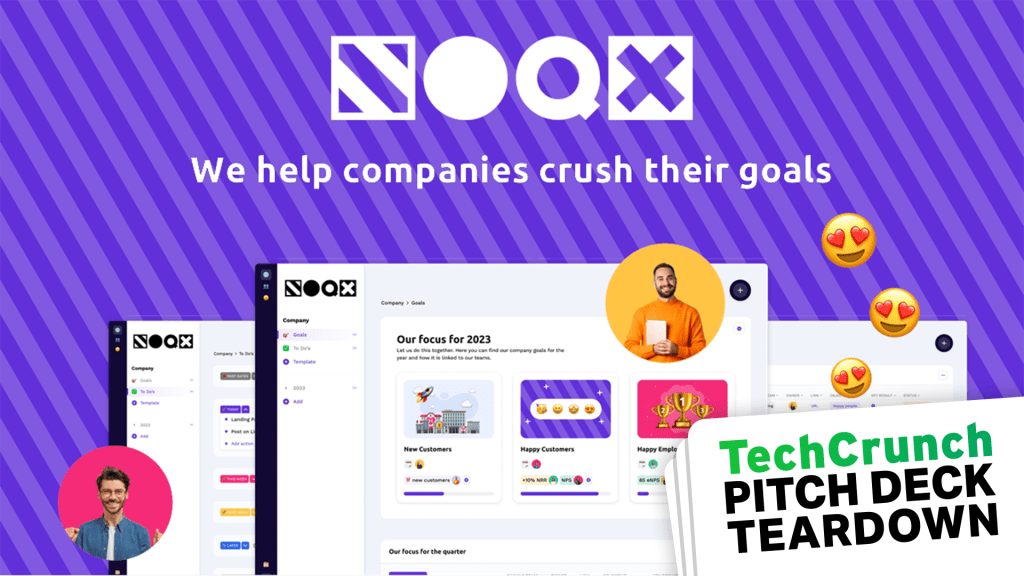

Aside from the crucial omission of an Ask and Use of Funds slide, just about every slide in the deck felt almost very good — but then stumbled by overlooking…

Conversational AI platform Parloa has nabbed $66 million in a Series B round, a year after it raised $21 million from a swathe of European investors to propel its international…

Featured Article

Deal Dive: Not all climate startups are focused on carbon

Windfall Bio sells methane-eating microbes to companies to help them reduce their carbon footprint in the short-term.

Xpanceo has shared its complete presentation deck, consisting of 19 slides. Dive into its pitch deck to learn how the company raised $40 million.

Two years ago, Jobs for the Future (JFF), a nonprofit dedicated to helping low-wage workers attain upward mobility, established a venture arm, JFFVentures, to back innovative employment tech. In a…

DCVC’s target for its first climate-focused fund, DCVC Climate Select, has been all over the place and highlights the roller-coaster venture fundraising conditions of the last few years and how…

Many startups are hoping that the gradual opening of an IPO window and the prospect of interest rate cuts later this year will finally encourage VCs to be less stingy…

We last checked in on Zaver, a Swedish B2C buy-now-pay-later (BNPL) provider in Europe, when it raised a $5 million funding round in 2021. The company has now closed a…

Rather than grimly assembling data about cancer deaths to predict outcomes in treatment, the founders of Cure51 had another idea.

Featured Article

LACERA decreases venture capital allocation range, but experts say it doesn’t signal a trend

The Los Angeles County Employees Retirement Association (LACERA) voted to decrease its allocation range to venture capital at a March 13 meeting. The board of investments voted to decrease its allocation range to venture capital and growth equity from between 15% and 30% of the pension system’s private equity portfolio,…

The company is promising to make marketing for games easier, and we know that great marketing is one of the crucial differences between an OK outcome and a smash-hit success.

After a shakeup at Kleiner Perkins a few years back, one of its star B2B investors, Ted Schlein, started his own firm. Ballistic has already closed a second fund, even…

Founded by former Silicon Valley engineers, UK-based Griffin Bank, has now raised $24 million (£19 million) in a fresh, extended Series A, funding round.

In the midst of CommandBar’s pretty slim pitch deck, there are some innovations that are worth shining a light on.