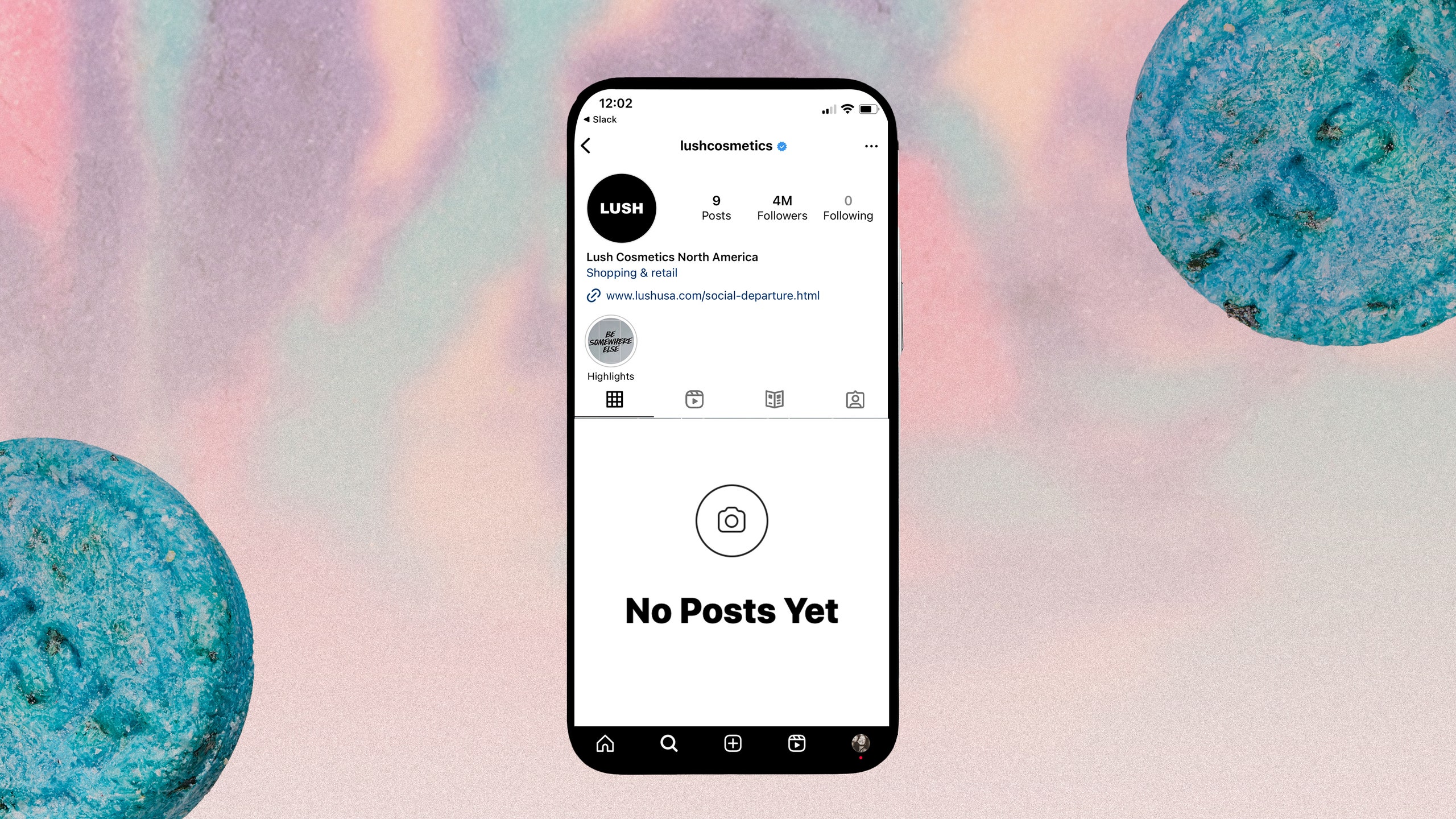

When you open @lushcosmetics and @lush on Instagram, you are greeted not by clips of bath bombs exploding into sparkles or photos of meticulously curated in-store soap displays but rather by a “No Posts Yet” graphic and a single highlight that spells out the brand’s social media mantra: Be somewhere else. Lush Cosmetics stopped posting on all Meta platforms — that’s Instagram and Facebook — in November 2021 after former Facebook employee Frances Haugen leaked documents to the press that revealed the company knew how much harm its algorithm was causing teens but was downplaying the effects. The company left social in 2019 but returned when the pandemic struck in early 2020. This time, though, the departure appears to be permanent. Almost two years later, they haven’t looked back.

To even the most dedicated Lushie, this news — ancient by internet standards — might come as a surprise. While the move initially made some headlines, most people I mentioned this story to had either completely forgotten that Lush had left Facebook and Instagram or never knew in the first place. Despite increased grumbling about Meta’s algorithms, the mass brand exodus from Meta that Lush hoped to inspire hasn’t come to fruition. Mark Constantine, Lush CEO, told Vogue Business at the time that he estimated the company could lose £10 million (over $12 million) as a result of leaving Meta. So what’s actually happened?

When Lush left Instagram

First, let me be clear: Lush left more than five million Instagram and Facebook followers, but it did not leave all social platforms. The brand still regularly posts on YouTube, where the Lush and Lush Cosmetics North America channels have almost 600K followers combined. It is still on Twitter as well, which is baffling for a brand that preaches the importance of transparency and ethics. When I ask Annabelle Baker, global brand director at Lush, why the brand has chosen to remain on Elon Musk’s ever-devolving platform, she sighs and says, basically, that they’re keeping an eye on how things go as content moderation rules continue to change and hate speech rises. The brand was active on TikTok before November 2021, but no longer posts to its official account.

The decision, Baker says, comes down to “the platform and the ethical considerations in being there.” In other words: The algorithm can suck in myriad ways. “There's no transparency there for us to understand actually what [these social platforms] are doing and what they're using that data for,” Baker says, noting that, in Lush’s view, Meta and TikTok’s algorithms are the most concerning. On the mental health front, just a few weeks ago the US surgeon general issued a warning that social media poses “a risk of harm” to adolescents.

But this isn’t just a case of Lush standing up for what’s right, profits be damned. There’s another issue with the algorithm that’s particularly bothersome for a company trying to use these platforms to sell stuff: Barely anyone was seeing Lush’s posts. In North America, Baker says only 6% of followers were seeing Lush’s content; in the UK, it was a paltry 3%. “It's not very motivational to have a social team pull together content and then only 3% of your audience ever gets to see it,” Baker says. (These percentages are actually pretty good for a brand: Nathan Adams, senior vice president of digital marketing at DKC Public Relations, which works with beauty brands like Dyson and MAC, says he finds the average is more like 1 to 2% of followers for organic posts, especially on Facebook.)

While paid promotion — or "boosting" their posts, in Instagram's terms — could have potentially introduced their brand to a wider audience, the company has never been one to spend a ton on advertising, Jack Constantine, the brand’s chief digital officer, said in a speech at the Lush House at South by Southwest this year, which I attended as a guest of the brand. Pair this low engagement with the fact that Instagram use was being linked to teen mental health crises (and, in some cases, suicide) and Facebook had seen an increase in political disinformation. Lush says it just couldn’t find a good reason to stay.

How UGC Has Kept the Brand Alive on Social

Lush might have officially left the Mark Zuckerverse, but Lush products absolutely did not. After all, if a soap bomb falls in a bath and there’s no one around to Reel it, did it ever really explode? In the nearly 30 years since it was founded, Lush, like many established brands, has amassed a horde of dedicated fans who, in 2023, like to make content featuring its products, populating the “Tagged” tab on Lush’s Instagram page much faster than any in-house social team could hope to fill a feed. The Super Milk conditioning hair primer is the latest Lush product to go organically viral on TikTok and subsequently sell out across North America. On Reddit, r/LushCosmetics has over 82,000 members. “We heard the other day that our Reddit community, which is managed by the community themselves, is in the top 5% of the largest communities within Reddit,” Baker says.

There is a theory floating around the internet that the company ditched Meta so it could lay off an internal social team. Who needs full-time staff when you have a network of fans creating content in exchange for free product? This, Baker says, is definitely not true. Lush still has a social team and cutting their combined salaries would have made up only a tiny percentage of that £10 million loss CEO Constantine predicted. Layoffs “weren’t even a consideration,” according to Baker. In fact, in order to get products into the hands of influencers who might make them go viral, the company created new jobs. “We didn’t even have a press office in North America until last year,” Baker says. “We also know that UGC [user generated content] for us is super important. So how are we getting the products into our customers' hands? What are we doing in terms of sampling activations?” At the end of the day, their “be somewhere else” social mantra holds less weight when you consider that they’re still very much engaged in getting their products promoted on Meta platforms… just not on their own handles.

Baker says that Lush doesn’t pay influencers to post on Instagram or TikTok, but in my experience as an editor who has received free samples from the brand, it also doesn’t actively discourage customers or partners from posting and tagging the brand or reminding the recipient about Lush’s stance on Meta platforms. The same goes for the many companies and media properties they collaborate with, a strategy the brand has amped up since leaving Facebook and Instagram. Baker cites the One Piece collab, which resonated in Japan as expected, but also with North American consumers, as anime continues to grow in popularity here. (The official One Piece Instagram account promoted the collection.) And Lush has done limited drops with Stranger Things and the indie clothing brand Lazy Oaf as well, both of which were promoted by those partners on Meta platforms.

Its biggest partnership to date was with Nintendo Illumination and Universal. The yellow Mario bath bomb had two social media moments that highlight the pros and cons of not controlling your brand’s narrative online: In one, Baker says that Mario himself (Chris Pratt) gleefully posted the product on his IG Story. Rusty Foster of the newsletter Today in Tabs summed up the second moment as “It’s a pee, Mario!” Despite the urine vibes, the Mario x Lush collection was inarguably successful in engaging nerds across the country, spawning gushing reviews, including some from people who don’t even have bathtubs.

Has abandoning Meta impacted Lush's business?

As of now, the company can’t say for sure if sales were impacted by leaving Instagram and Facebook. A rep for the brand tells me its 2022 financial report won’t be publicly available until later this year and, even then, blaming any dip in sales exclusively on the pivot would be tricky business. But what about the millions the CEO estimated that Lush stood to lose? “The brand calculated this number from data they had, plus external benchmarking, to estimate the number of customers who have not come directly from social media but might have seen a post and come back to purchase later,” the rep clarifies. In other words, it was an educated guess. “We actually didn't know how much of our sales were coming from social,” Baker says, “so we genuinely couldn't monitor it afterward either.” Especially in 2021, when shopping on Instagram was not as seamless as it is now, there was really no easy way to keep track of people who would see a product on the platform and then Google it or head to a brick-and-mortar store to buy it.

Anyone with an aunt who still shops at the mall can tell you that Lush fans are loyal, so if there was any loss it’s likely more in hypothetical new customers who would have discovered the brand’s account on their Instagram explore page. At least in the UK, its home base, Baker says, “the brand saliency is still super strong. And we are definitely known for making the best gifts at Christmastime. When people are looking for something, it's like, ‘Yes, going to Lush.’” In fact, 2022’s holiday season was Lush’s biggest.

So, should other brands do this?

As long as a brand plans to continue seeding product to social media creators who are going to film themselves using it, saying your brand won’t create its own content for certain platforms seems to be relatively low risk. It could also be said to be relatively half-assed. Yes, Lush shuttered its own feeds, but Lush fans and partners are still promoting the products on Meta platforms. And because it was never spending ad dollars on those platforms, its departure hasn’t affected Meta’s bottom line in any concrete, measurable way.

The reality is that in 2023 a brand that wants to continue to exist has little choice but to engage on Facebook and Instagram. A large percentage of new product discovery happens on social media and, according to a report by market research firm GWI, an even larger percentage of product research (the step most people take between seeing an intriguing ad and actually making a purchase) happens there too. While there have been a few recent attempts at hyping up alternatives to the big guys (especially Twitter) none of them have gotten anywhere close to Meta’s reach. (Are you on Bluesky or Mastadon yet?) To really, truly cease to have a presence on social would likely lead to a slow fade into brand oblivion.

Sabrina McPherson, senior managing director and management consulting lead for consumer products at digital business transformation consultancy Publicis Sapient, says plenty of brands are reevaluating their relationship with social media, though no one else she’s aware of has jumped the Meta ship like Lush has. Adams, the SVP at DKC, agrees, noting that Twitter is the platform more companies are actively pulling away from these days as it reinstates previously banned users and continues to allow what the Center for Digital Hate called “toxic content.” In fact, on Instagram — often included among the platforms considered most potentially damaging to users’ mental health — “the brands that we work with are doubling down and creating more content,” Adams says, noting that they are paying to make sure these posts “reach the audience of millions of people who could be viewing it, but it may not come to the top of their feeds.” As he points out, that platform is still growing in terms of usership, so it remains a valuable way to reach potential customers. (Instagram’s power to connect also recently made headlines after a Wall Street Journal investigation found that its recommendation systems actively connect a vast pedophile network.)

McPherson, who commented on Lush’s social switch-up back in 2021, says her clients aren’t ready to do a full pullback, but they are rethinking how they use social media to provide value to customers. “We’re in this phase of awareness…from consumers about what’s really happening with their data, how these social platforms are using it or not using it,” McPherson says. Consumers’ concerns with ethics and transparency are coming to the forefront. “Some of the brands we’re working with are getting that insight directly from their customers and starting to really rethink their strategy around how they’re going to engage.” This includes shifting investments to other platforms or, like Lush has, leaning more into getting samples into content creators’ hands. Now that Lush has created a model, McPherson says it makes it easier for other companies to follow suit.

In 2016, Lush created a set of Digital Ethics Policies and it encourages other companies to reference when coming up with their own. It also recently partnered with strategic foresight consultancy the Future Laboratory on a report that explores potential and, hopefully, more ethical ways for brands to engage with social media (and technology in general) moving forward.

While it’s wise to be skeptical of any brand that claims to hold its customers’ well-being above its bottom line, Lush does have a history of genuinely giving back (without any goodwashing). This, McPherson says, likely made it easier for them to take an ethical stance against Meta platforms in a way that felt authentic. “It’s being so clear with its stated strategy and then the actions to back it,” she says.

Most people who told me they didn’t realize Lush had left Meta platforms did have an awareness of the Charity Pot lotion. For almost 16 years, Lush has donated 100% of the purchase price to a rotating group of grassroots organizations with a budget of less than $500K, says Lush’s advocacy and activism manager Carleen Pickard, who had 20 years of experience in nonprofit activism before she joined the beauty company. Since Charity Pot’s 2007 inception, the brand has donated a total of over $87 million globally, thanks to sales of the product.

Lush also regularly partners with larger nonprofits. Take SXSW: Yes, the brand was there to give out free samples and drinks and throw a very fun party, but it also cohosted an exhibit and series of panels about the rise of book bans in the US, with the Zinn Education Project and the African American Policy Forum using data from PEN America. “Someone asked me, ‘How does [advocacy and activism] affect the bottom line?’” says Pickard of the separation between the company’s charity work and its profits. Her answer? “That’s not my job. I don’t know. I don’t have to worry about that.”

The modern consumer may be in the thrall of social media, but all of her time spent there has made her quite adept at sniffing out performative activism. And right now, Lush still smells pretty good — even if leaving Meta hasn’t proved to be the dramatic, change-making move the company initially hoped it would be.

More deep dives into the business of beauty:

How Augustinus Bader Made Us Believe

Inside the Complex World of Fragrance Dupes

Now watch a cosmetic chemist try to guess which makeup formulas are more expensive: