Blackstone’s Crown Resorts Sells Nobu Stake, Turns Tidy Profit

Posted on: July 11, 2024, 09:13h.

Last updated on: July 12, 2024, 09:12h.

Crown Resorts, the Australian casino operator controlled by US private equity Blackstone (NYSE: BX), sold its 20% interest in the posh Nobu hotel-restaurant chain.

As is often par for the course with Blackstone, an impressive profit was wrung from the divestment. Crown reportedly grossed $180 million by selling its Nobu interest after buying into the hospitality entity in 2015 for $100 million. Crown’s sale implies Nobu, which counts actor Robert DeNiro among its investors, at $900 million.

At the end of last year, there were 56 Nobu restaurants in 23 countries around the world, the first of which opened in Los Angeles in 1987 under the name Matsuhisa — the surname of founder Nobu Matsuhisa. Crown acquired the Nobu stake under founder James Packer. The gaming company controls Crown Melbourne, Crown Perth, and Crown Sydney in its home country.

Nobu Still Has Gaming Ties

Even with Crown shedding its Nobu investment, the hotel-restaurant company maintains an array of ties to the casino industry.

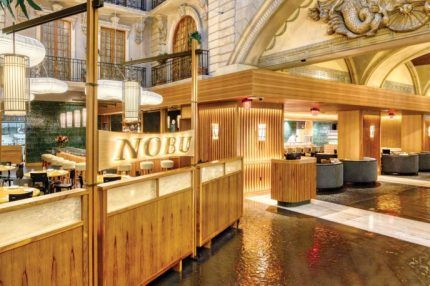

The first Nobu hotel opened in Caesars Palace on the Las Vegas Strip in 2013. Two years later, another such venue debuted at Melco Resorts & Entertainment’s City of Dreams Manila. A new Nobu hotel is also a centerpiece of enhancements at Caesars Palace on the Atlantic City Boardwalk as well as that operator’s New Orleans plans.

Nobu Hotel and Restaurant New Orleans are set to open within the newly created Caesars New Orleans, following a multimillion-dollar transformation of Harrah’s New Orleans,” according to the Nobu Hotels website.

The site indicates the New Orleans property should be open in late 2024. In Las Vegas, Nobu also has restaurant locations at Caesars-operated Paris and the Virgin Hotel in addition to Caesars Palace.

Blackstone Wants Crown Focusing on Gaming

Crown’s divestment of its Nobu stake was reportedly the result of Blackstone wanting the gaming to focus on its core competencies of casino hotel operations. The private equity giant shelled out $6.6 billion for the Aussie gaming firm in 2022, pledging an array of improvements to bolster Crown’s position in its home country and its appeal to bettors throughout the Asia-Pacific region.

Blackstone is intimately familiar with the casino business. It owned and operated the Cosmopolitan on the Las Vegas Strip before selling those operating rights to MGM Resorts International (NYSE: MGM) for $1.6 billion. The private equity firm also has an array of successes in the world of casino real estate.

In December 2022, it sold its 49.9% interest in Mandalay Bay and MGM Grand to VICI Properties (NYSE: VICI) for $4.27 billion. It sold Cosmopolitan’s property to VICI for more than $4 billion and is still the majority owner of Bellagio’s real estate. Blackstone also owns the property assets of Aria and Vdara, both of which are also operated by MGM.

Related News Articles

Las Vegas Sands Named Top Q3 Casino Stock Idea by Research Firm

Ader Says Okada Manila US Listing Can Still Happen in 2022

Macau Casino Stocks are Again Deeply Discounted

Okada Manila Mulling Philippines IPO

Most Popular

French Cops Catch Cheating Network Using ‘Microscopic’ Earpiece

Casino Crime Round Up: Two Red Rock Employees Stabbed, Suspect Shot

Most Commented

-

VEGAS MYTHS RE-BUSTED: You Don’t Have to Pay Resort Fees

— August 2, 2024 — 16 Comments -

VEGAS MYTHS RE-BUSTED: Elvis Was a Straight-Up Racist

— August 9, 2024 — 10 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 6 Comments

No comments yet