Woman issues urgent warning to Aussies lodging their tax returns: 'What the hell'

A young woman who received a smaller tax refund than she expected has warned Australians to manage their expectations of a big collect this tax season.

Nat Zelez, 24, filed her taxes promptly on July 1, eagerly anticipating a refund of over $5,000, which she planned to use for a trip to Southeast Asia.

However, after completing her tax return, she only received $3,000.

'So I got my tax return, and I'm not happy. I lodged it on July 1st, and I was so excited, like, oh my god, because it said I was going to get $5300 back, but I got it this morning, and I got $3,000,' she said in a video posted to TikTok.

Ms Zelez, who works in hospitality and marketing, said she was on welfare payments at one point during the financial year, which may have impacted her overall return.

She told her followers that while $3,000 was still a good amount, she still felt disappointed.

'I still feel like I lost $2,300, that is what it feels like. I know I didn't, but what the hell?' Ms Zelez said.

'Don't do it on July 1st because you're just going to get your feelings hurt.'

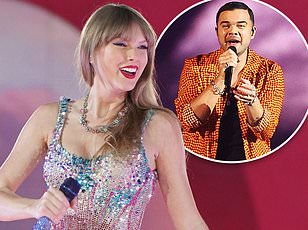

24-year-old Aussie Nat Zelez (pictured) said she felt 'lied to' by the tax office after receiving a tax return of $3,000 when she was estimated to receive $5,300

Social media users were not sympathetic to Ms Zelez's situation, with many reminding her that the initial refund calculation was uncertain.

'It's always an estimate, never expect to get the full return,' one said.

'You realise you shouldn't expect money back each time at all? You only get a refund if you've overpaid tax,' a second added.

Another claimed Ms Zelez's return was significantly different from the estimate because the ATO likely did not have all the necessary information on July 1st, as her employer might not have finalized the summary yet.

A recent survey from Finder found that the average Australian is expecting a refund of $1,288, and during the cost-of-living crisis, many were banking on such returns.

'Aussies are fed up with barely scraping by and are looking to their tax return to provide a bit of financial relief,' Finder's finance expert, Sarah Megginson, said.

'Many are struggling with debt and a significant proportion of people plan to reduce that burden with their tax time cash injection.'

Ms Megginson reminded Aussies that while they can file early, their employers have until July 14 to finalise their details with the tax office.

'If you try to do your tax return before this, you might run into trouble as your details are not yet set in stone with the ATO,' she said.

'If you are confident you're going to get a tax return, it makes sense to lodge it sooner than later so you can get your hands on that money.'

Ms Zelez urged Aussies who filed on July 1 like she did, before her employers finalised her tax details, to lower their expectations over their returns