Some of the best stocks to buy in the past 25 years started as small-cap stocks. Amazon (AMZN 0.52%) was a $7 stock in 1998, and Tesla (TSLA 4.59%) had a market valuation of just over $1 billion in 2010.

Of course, not every small-cap company becomes a giant. Investing in small companies can be rewarding, but it also comes with risks that investors need to understand. Here's a close look at small-cap stocks, including our picks for some of the best.

What are small-caps?

What are small-cap stocks?

Small-cap is short for small market capitalization, which is equal to a company's share price times the number of shares outstanding. A company is classified as having a small market capitalization when its market cap falls between roughly $300 million and $2 billion.

Stocks classified by market capitalization are generally divided as follows:

| Category | Market Capitalization |

|---|---|

| Micro-cap companies | Less than $300 million |

| Small-cap companies | $300 million to $2 billion |

| Mid-cap companies | $2 billion to $10 billion |

| Large-cap companies | $10 billion to $200 billion |

| Mega-cap companies | More than $200 billion |

Small-cap companies are often young companies. They tend to have significant growth potential, but they also are generally less stable than their larger, more established peers. Often they are unprofitable.

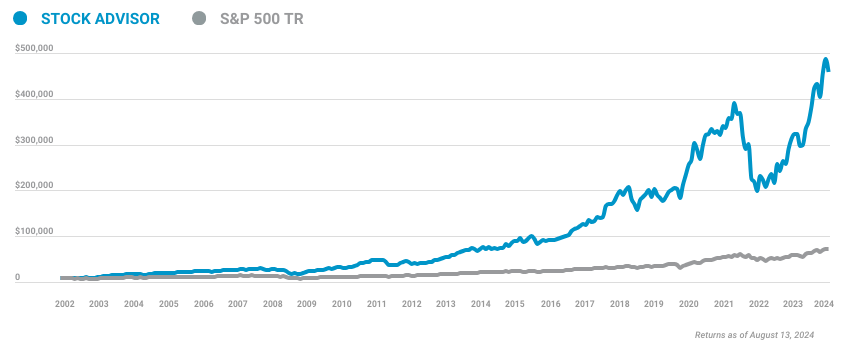

However, a comparison since 2000 of the Russell 2000, a small-cap-focused index, and the large-cap-focused S&P 500 shows that small-cap stocks have outperformed large-cap companies. The chart below demonstrates the difference:

Over time, small-cap stock prices tend to be more volatile than those of larger companies, and stock values fluctuate more dramatically.

Typically, small-caps tend to outperform in bull markets, but the recent one has been different. Thanks to the AI boom, large-cap tech stocks have paced the stock market's gains, and small-cap stocks have underperformed in part due to high interest rates. However, with interest rates expected to fall, small caps have started to show signs of life as they are seen as having greater risk, meaning they're more sensitive to interest rates.

If the Fed lowers interest rates and achieves a soft landing, meaning bringing down rates while avoiding a recession, small caps look like a good bet to outperform large caps like the S&P 500.

Best small-cap stocks

Best small-cap stocks to buy right now

Many small-cap companies aren’t household names -- at least, not yet. These are some small-cap stocks to consider:

1. Magnite

Magnite is a supply-side digital advertising platform that was formed by several mergers and acquisitions. The company has established itself as a leader in video and connected TV (CTV) advertising, or ad-driven streaming, catering to online publishers and streaming platforms like Walt Disney (DIS 0.71%), Fox (FOX 0.55%), and Warner Bros. Discovery (WBD 7.33%).

Magnite partners with The Trade Desk (TTD 1.77%) and other ad tech companies to manage its inventory efficiently and keep its technology up to date. While its growth has slowed with the weakness in the streaming sector, Magnite still has a lot of potential growth in front of it and remains the CTV leader for supply-side ad tech.

2. ACM Research

As a manufacturer of cleaning equipment for semiconductor wafers, ACM Research (ACMR 1.41%) is a "picks-and-shovels" play in the semiconductor industry. Investing in ACM Research provides exposure to a high-growth industry without exposure to the risk of commodity chip prices declining.

Additionally, ACM is a U.S. company that conducts most of its business in China, giving investors a relatively safe investing method for gaining exposure to the Chinese market. ACM is one of the rare small-cap companies that offers both high growth potential and solid profitability.

3. Consolidated Water

Utilities come in all shapes and sizes, so it shouldn't be surprising to find a water utility on this list.

Consolidated Water (NYSE:CWCO) specializes in desalination, which could become a big trend in coming years as water supplies around the world are stretched and more coastal and tropical communities turn to desalination.

The company is currently focused on the Caribbean market, with several plants in the Cayman Islands and the Bahamas. That's helped the company deliver strong growth in the coming years, outperforming its water utility peers. The trend should continue as it capitalizes on the desalination opportunity.

ETFs & mutual funds

Best small-cap funds

If you don't want to choose individual small-cap stocks for your portfolio, you can instead gain exposure to small-cap companies by investing in a small-cap-focused exchange-traded fund (ETF) or mutual fund. Here are a couple of options:

- iShares Russell 2000 ETF (IWM 3.19%): This ETF tracks the performance of the Russell 2000, which is considered the leading index of small-cap stocks. The fund's managers charge an annual management fee of 0.19%, which works out to $1.90 for every $1,000 invested.

- Fidelity Small Cap Growth Fund (FCPGX -0.85%): This mutual fund invests in small-cap stocks that have high growth potential. It's actively managed, with the objective of outperforming the Russell 2000, so the fund's fees -- 0.94% annually -- are somewhat high compared to most ETFs.

Looking forward

Small-cap stocks in 2024

In the bull market that began in early 2023, small-cap stocks have largely underperformed as the bulk of the gains have gone to "Magnificent Seven" stocks like Nvidia (NVDA 4.55%).

However, investors expect the bull market to eventually broaden out with small caps catching up to large caps. We saw a taste of this in July before broader economic concerns pushed stocks lower again. Small-cap stocks should also benefit from falling interest rates, which are expected to come down soon. Small caps tend to be more sensitive to interest rates so they should benefit from a lower-interest-rate environment. After the pullback, the Russell 2000 still trades at a significantly lower price-to-earnings ratio than the S&P 500, though that could soon change.

Related investing topics

Should you invest?

Should you invest in small-cap stocks?

If you are willing to hold an investment for several years and feel comfortable with the price of a stock fluctuating greatly, then small-cap stocks might have a place in your portfolio. Owning small-cap stocks can boost your portfolio's overall growth rate -- provided you commit to a buy-and-hold investing strategy.

Remember, small companies are more likely to fail than large, established businesses, as was demonstrated during the COVID-19 pandemic. It's important to conduct the necessary research before investing in any small-cap stock. You can also lower your risk even more by investing in a small-cap-focused fund.