Looking for a new job? These are the financial secrets of signing on with a company

When signing with a new company, keep these helpful tips in mind to make sure you are receiving the best benefits

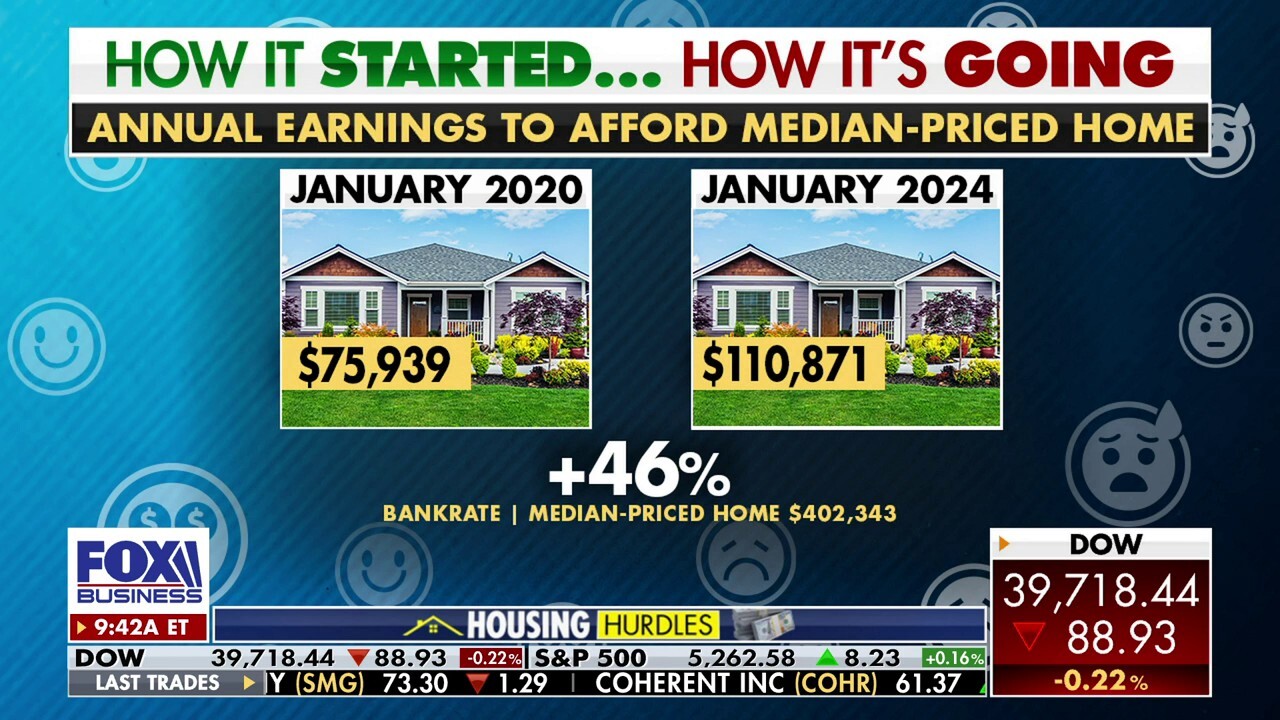

Six-figure salary now needed to buy average US home

FOX Business' Gerri Willis reports on the increased costs of homeownership over the last four years.

Whether you have been offered a new job or weighing the pros and cons of looking for something new, it is an extremely valuable tool to know the financial benefits up for grabs when signing with a new company.

Having a strong understanding of a company's monetary benefits can help you make a decision, at least from a financial standpoint, if the new role is worth taking.

Below are five key financial secrets of signing with a company for a new job.

Before joining a new company, consider these financial factors. (iStock / iStock)

TOP JOB CHALLENGE IN 2024: HOW DO YOU TRANSITION SMOOTHLY ONTO A NEW TEAM?

1. Sign-on bonus

A sign-on bonus is an additional payment on top of the salary that is given when the new employee starts their job. It could be received as a one-time payment, multiple payments over a period of time or through stock options.

A sign-on bonus serves as a financial incentive to join a company. There are many different reasons why a sign-on bonus could be offered to you. One reason could be that the employer wants you to sign on to the company quickly and therefore uses this additional payment as a means to do so.

It could also be offered if there are benefits that an employee was receiving with their prior job that they would not get in their new job.

Many companies will offer a sign-on bonus to entice a candidate to sign on with them. (iStock / iStock)

Keep in mind, that if an employee leaves the job within a certain period of time after accepting, they may have to pay back part or all of their sign-on bonus, according to Investopedia.

In addition to this, sign-on bonuses may be a secret unless you ask about them. Avoid leaving money on the table by asking the hiring manager if there is a sign-on bonus available.

2. Monetary incentives

There are several monetary incentives that a company can offer employees to encourage them, promote hard work and increase overall productivity.

Increases in pay are one example of a financial incentive, as well as cash rewards or gift cards for those who go above and beyond in their work.

Many companies will offer bonuses to their employees throughout the year, but popularly around Christmas.

YOUR WORK BONUS COULD BE MUCH SMALLER THIS YEAR

For those working in sales, commission is likely at play, which is when employees earn extra money for meeting their sales goals, in addition to their regular pay.

Additionally, some companies offer profit shares to employees. This means that employees earn a portion of profits made by the company in addition to their base pay.

Before you accept a job, be sure you are aware of the financial incentives for over-performing in your role. Understand the requirements of the bonus structure to ensure you meet them in order to earn the bonus.

3. Negotiate your salary

Negotiating your starting salary is critical right off the bat, before signing a contract. After you sign, you are locked into that salary for at least one year.

There are many resources online you can take advantage of to get an understanding of what other professionals in your same position and industry are earning across the U.S. Use these, plus your own experiences and skills, to come up with a number you believe is fair.

Be mindful of what the salary is for the job before interviewing for a position if that information is publicly available. This will ensure that the salary offered is at least in the same range as what you are looking for. If you ask for an amount drastically different from what the company is offering, you are probably not going to have much luck in your negotiation.

HOW TO EFFECTIVELY COUNTER A JOB OFFER

That said, have an open discussion about what you feel you deserve, and consider negotiating before accepting the first offer given to you.

Don't take the first salary offered to you. If you fail to negotiate, you may be missing out on a potentially higher salary. (iStock / iStock)

When thinking about the salary at your new job, also consider any possible additional benefits you are to receive. Maybe the salary is not as high as you would like, but you really would like to work from home and the new role offers flexibility. Perhaps your new job offers more paid time off than your old one, giving you a better work-life balance. Take all these benefits into consideration when you are thinking about what your desired salary is.

4. Stock options

An employee stock option gives employees the option to buy a specific number of shares at a pre-set price.

There are two basic types of stock options that employers can offer employees. One is incentive stock options. This type is typically reserved for key employees and top management, according to Investopedia.

Then, there are non-qualified stock options, which are given to those at all levels of a company, according to the source. Board members and consultants can also be offered non-qualified stock options, according to Investopedia.

5. Retirement plans

It is never too early to plan for retirement. No matter how old you are, you will want to contribute to your retirement and look into plans your company offers in order to set yourself up for the future.

In terms of your employer and what to look for, you will want to see if a 401(k) match program is offered. With a 401(k) match, your employer will make contributions to your retirement in addition to your own payments. How much they give is based on how much you are contributing.

It is never too early to start saving for retirement. The earlier you start, the more financial freedom you will have in your later years. (Getty Images / Getty Images)

Employers will usually match up to a certain percentage. For example, an employer could offer a 100% match, for up to 3% of your salary. So every dollar you put into your 401(k), the company will match that dollar for up to 3% of your salary. Some employers offer a partial match, such as 50%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

When thinking about how much you would like to contribute to your 401(k), keep this matching system in mind. If you are able, put in as much as your company matches in order to maximize your retirement plans.