-

Subscription billing

Manage even the most complex billing models with ease

Subscription management

Simply your customer lifecycle management, no matter how you bill

Revenue recognition

Automate your revenue recognition schedules to ensure GAAP compliance

Metrics & analytics

Leverage your billing, invoicing, and customer data for deep insights

By Go-to-Market Model

By Function

-

Subscription billing

-

Subscription management

-

Revenue recognition

-

Metrics & analytics

- Take a tour

By Go-to-Market Model

By Function

-

-

Maxio Platform

Your financial operations platform to manage subscriptions, billing, revenue recognition, and financial reporting.

Featured Modules

Advanced Billing

Automated recurring billing to power your product-led or self-service strategy

A/R Management

Reduce your A/R balance, drive down DSO, and get cash in the door faster

Advanced Revenue Management

GAAP/IFRS-compliant revenue recognition your auditors will love

Milestone-Based Projects

Bill customers and recognize revenue based on future events (i.e. implementations)

Expense Amortization

Expense accounting for prepaid expenses, fixed assets, and sales commissions

-

Pricing

-

Content Library

Get practical tips and tricks to improve your daily financial workflows

Blog

Level up your billing and finance knowledge, and keep up with the latest in SaaS

Podcast

Listen to engaging conversations with leading SaaS and finance experts

Maxio Institute

Get the latest insights into SaaS growth based on real companies’ billing data

Case Studies

Read real customer stories, and learn why B2B leaders love Maxio

SaaSpedia

The encyclopedia of SaaS finance terms and metrics

-

Quickstart guides

Everything your team needs to get up and running with Maxio

API documentation

Integrate with many environments and programming languages via our REST API

SDK code libraries

Available for JavaScript, Python, Java, Ruby, PHP, TypeScript, and .Net

Webhook documentation

Send HTTP POST requests for easy parsing in almost any programming language

-

-

Maxio Platform

-

Get a Demo

Revenue recognition software your auditors will love

Automate your revenue recognition schedules to ensure GAAP compliance, reduce risk inherent in manual processes, and pass your audit with flying colors.

Revenue recognition that’s always audit ready

Stay safe from manual errors and quickly produce accurate financial data when your auditor comes knocking.

Stay GAAP compliant

Create revenue recognition rules in line with your ASC 606/IFRS 15-compliant revenue policy. Maxio automatically applies these rules across your contracts for compliant, reportable revenue without the risk of human error.

Ditch the spreadsheets

No more manual calculations—choose from dozens of out-of-the-box revenue recognition methods to recognize revenue in accordance with your revenue policy. Automate revenue schedules and deferred revenue waterfalls.

Provide a provable audit trail

Pull audit samples in a snap. Create a Revenue Details report, our most granular revenue report. Drill into revenue by customer, contract, transaction, and item over a selected time period.

Automate your revenue recognition

Automatically apply your revenue policy with accuracy and consistency across your entire customer base. Configure your automated revenue recognition schedules and let Maxio take care of the rest.

Deal with revenue recognition caveats directly in Maxio. Easily modify revenue recognition schedules for individual customers, contracts, or transactions as needed. Keep your records and reporting up to date with everything in a single system.

Your Advanced Revenue Summary offers an aggregated view of recognizable revenue for all customers within a chosen period. It’s accurate, provable, and always ready for your general ledger.

Your Advanced Revenue Summary offers an aggregated view of recognizable revenue for all customers within a chosen period. It’s accurate, provable, and always ready for your general ledger.

Customer lists, invoices, and payments exist in both Maxio and your general ledger. Once an invoice has been paid, automatically update your general ledger—no manual transfer required.

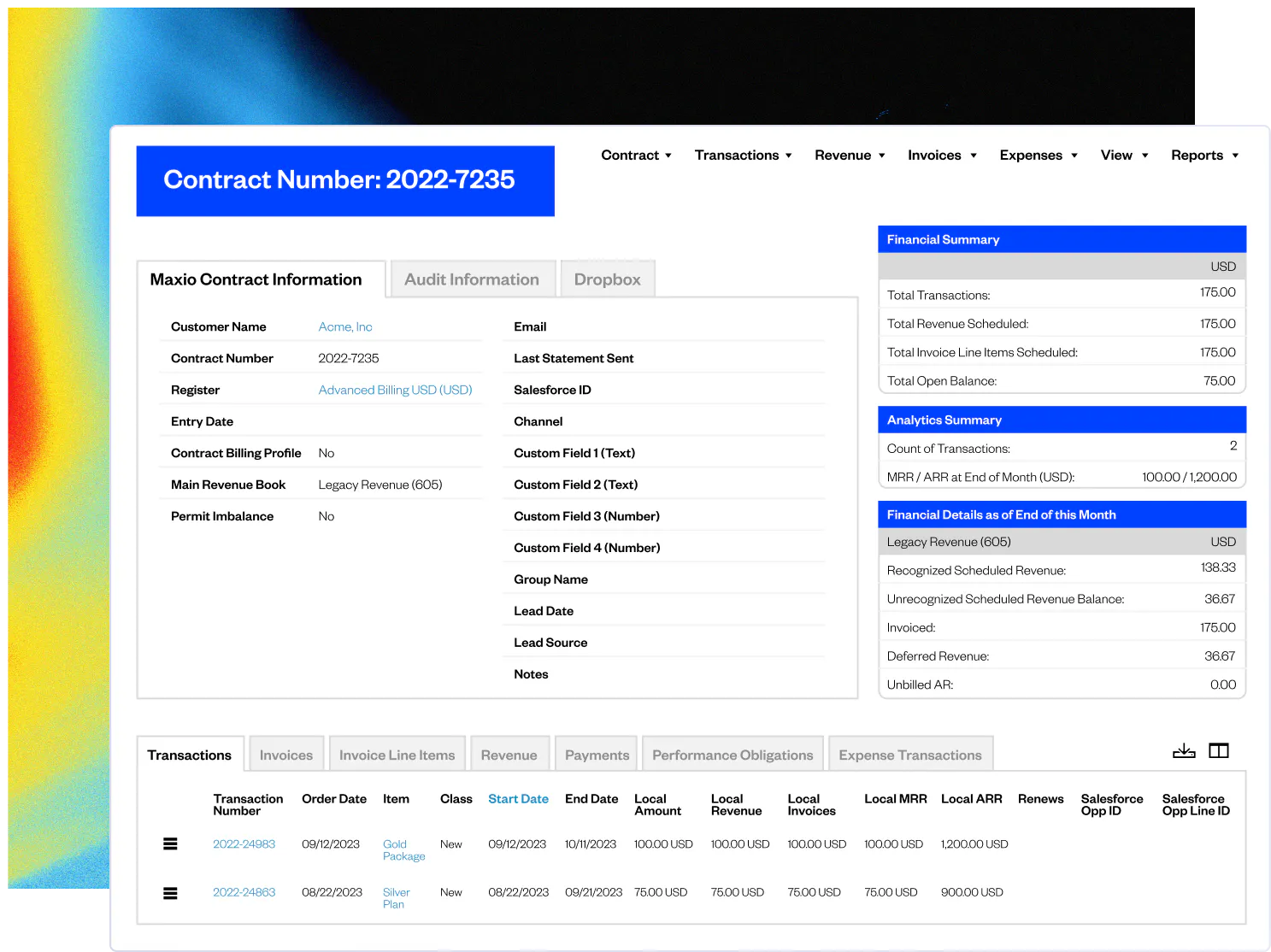

Drill down with your revenue subledger

Detail pages help you connect the dots between customers, invoices, and transactions.

Move seamlessly between customer records, invoices, payment history, and associated records from integrated services like Salesforce and Dropbox. Dive into the details behind your general ledger entries with all the financial information at your fingertips.

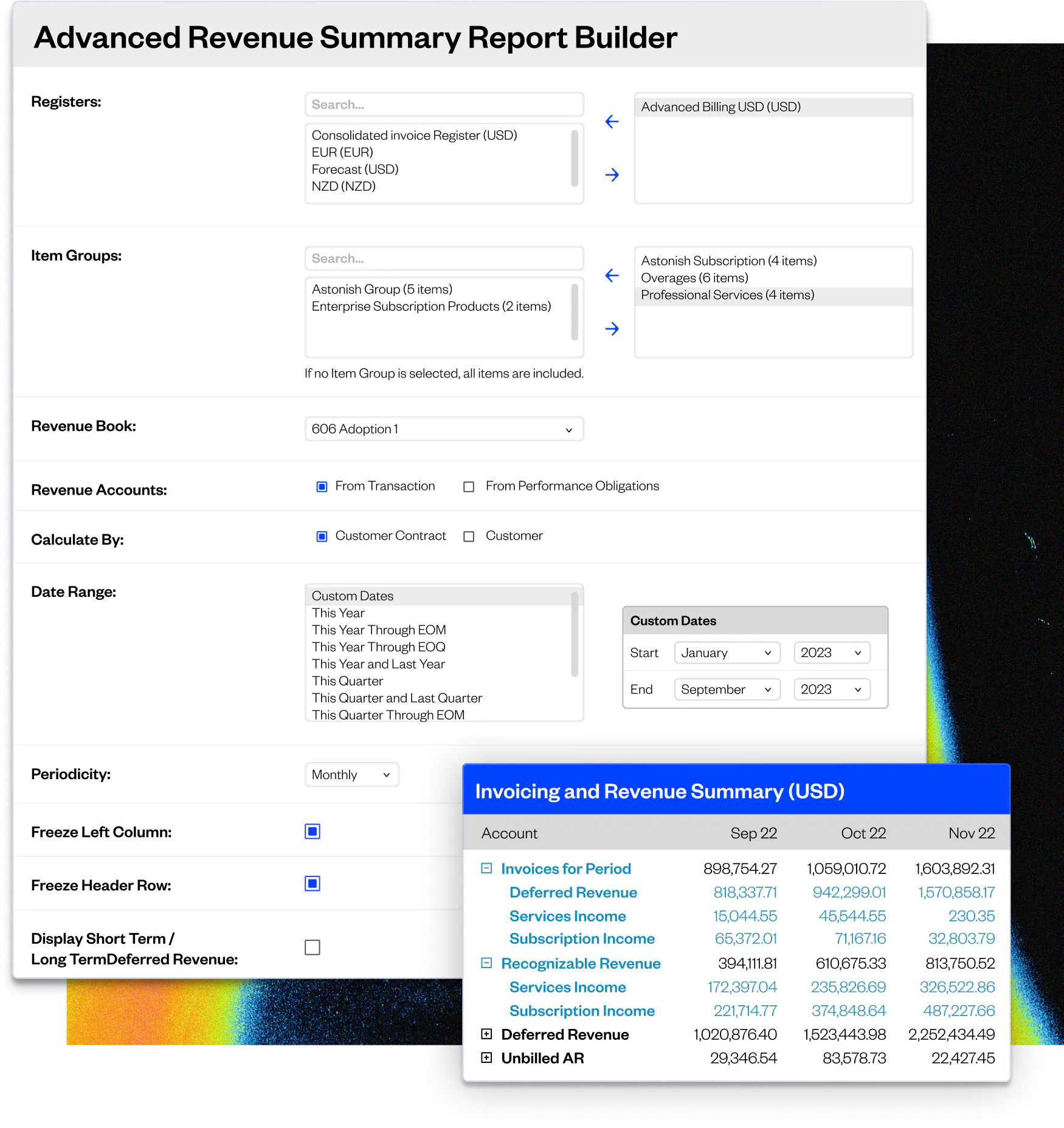

Advanced Revenue Summary

Gain a full picture of your customer revenue without hours of manual data manipulation.

See all your revenue data in one place, and create a consolidated journal entry at the end of the month that’s ready for booking to your general ledger.

Easily drill down into all your revenue data by customer or contract. Expand line items to see which customers, contracts, or transactions make up your revenue for that period. Click directly into invoices and customer elements for a complete picture of that customer’s revenue activities.

Filter and display your data the way you need to. Slice and dice your data by different registers, items, metrics, and more. Show custom date ranges and freeze rows or columns as needed to quickly find what you’re looking for.

Advanced Revenue Management

Create multiple revenue books, standard pricing models, and corresponding performance obligations. Apply carveouts as needed—right in your revenue management system.

Easily compare your old revenue recognition state to the new schedule without changing your underlying transaction data.

Apply different revenue recognition rules sets to a single contract, or across a larger population of contracts.

One-click financial reports

Save your team hours pulling reports every month. Just click “run” for near-instant insights into ARR summary, A/R aging, roll forwards, DSO, and more.

Revenue Recognition Software FAQs

Revenue recognition software is a tool designed for businesses to automate the revenue recognition process while staying within complex guidelines and requirements set by the Financial Accounting Standards Board (FASB). It’s often used by SaaS companies that utilize a subscription billing business model. It helps manage various recurring and nonrecurring revenue streams, considering both standalone selling prices (SSP) and negotiated transaction prices.

Such software allows businesses to easily recognize revenue at appropriate times during the customer lifecycle, which creates a clear picture of financial health and aids in strategic decision-making.

Revenue recognition software helps ensure compliance with Generally Accepted Accounting Principles (GAAP) by streamlining the revenue reporting process specific to your own business model. Revenue recognition automation features ensure consistent and compliant revenue accounting within the specific requirements of IFRS 15 and ASC606 and other GAAP principles, so your finances are always in order and annual financial audits go smoothly.

Yes. Maxio’s cloud-based revenue recognition solution provides a comprehensive revenue management solution for accounting teams dealing with intricate financial situations. Key functionalities that allow Maxio to streamline your financial reporting include the ability to recognize various revenue streams, handle carveouts and revenue reallocations.

Most revenue recognition tools are able to integrate with other systems. These may include customer relationship management (CRM) platforms like Salesforce; enterprise resource planning (ERP) systems like Oracle NetSuite; and a range of project management and general ledgers/accounting software your organization may use.

Integrating with these platforms streamlines workflows, allowing for real-time data synchronization, ensuring that all revenue-related activities, such as sales, renewals, and cancellations, are accounted for.

Help your finance team sleep at night

Get a customized product demo to learn how Maxio can save your team from audit anxiety and monthly all-nighters.

“Before Maxio, we spent a lot of time checking and reconciling. Now we copy the numbers straight out of Maxio into our revenue recognition journal. It probably takes two minutes instead of a full day.”

– Craig Humphrey, VP of Finance and Operations at Arctic Shores (UK)

Get a demo

Explore the #1 finance & billing platform for B2B SaaS

Subscription billing

Manage complex billing scenarios without cluttering your product catalog.

Reporting and SaaS metrics

Never lose sight of your business performance with accurate, reportable SaaS metrics

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond