Cash flow statement template (download for Excel)

Download our cash flow template for Excel and read about how to prepare a cash flow statement and the differences between direct and indirect method.

As one of the 3 main financial statements, a cash flow statement is an essential tool for understanding a company’s financial health, assessing its liquidity, and confirming how much cash it has on hand.

Along with the balance sheet and income statement, this set of financial documents are required for both private and public companies.

A standard cash flow statement format encompasses three main sections: operating activities, investing activities, and financing activities.

This guide will cover not only a cash flow statement template, but also how to prepare your cash flow statement, what to include in the three main sections, and how the direct and indirect methods differ.

We’ll also cover IAS 7 requirements for cash flow statements, including recent changes companies should keep in mind.

For more information, you can also read cash flow statements explained here.

To prepare a statement more efficiently, download our free cash flow template.

Here’s what we’ll cover

Completing the main sections of the cash flow statement

To prepare a cash flow statement, follow these six steps:

1. List the opening balance

Begin by listing the opening balance of cash and cash equivalents for the reporting period.

This figure should equal the closing balance from the previous reporting period.

The starting balance can be placed at the top or the bottom of the statement.

2. Input cash flow related to operating activities

This section can use either the direct or the indirect method.

- When using the direct method, record all cash received and all cash disbursed. Then, calculate the total.

- When using the indirect method, start by listing either the company’s profit or loss (under IFRS) or the company’s net income for the reporting period (under GAAP). Then, take steps to reverse the effect of the accruals. Adjust for elements like depreciation and amortization, and then calculate the total.

Under IFRS, companies may choose from several different starting points when using the indirect method. Options include:

- Profit or loss

- Profit or loss before tax

- Operating profit or loss

- Profit or loss from continuing operations

List cash inflows and outflows from operating activities:

Receipts from goods or services sold

Add any cash receipts from goods (for a product-based company) or services (for a service-based company).

General operating and admin expenses

Subtract any cash payments to suppliers for goods and services related to the company’s core business activities.

Also include office expenses, rent and utilities for the company’s facilities.

Wage expenses

Subtract any cash used to pay the company’s employees, executives and directors.

Income tax payments

Subtract any cash used to pay for the company’s income tax.

Other operations

Add any cash receipts that fall outside of the core business activities.

Such as license income, the share of profits from joint ventures or grant monies received.

Depreciation and amortization adjustments

Add in the value of any depreciation and amortization to undo the effect of these accruals.

Change in inventory

Subtract the value of any increases in inventory or add the value if inventory has decreased.

Change in operating assets

Subtract the value of any increases in operating assets such as accounts receivable and monies owed to the business or add the value if operating assets have decreased.

Change in operating liabilities

Add the value of any increases in operating liabilities such as accounts payable or subtract the value if operating liabilities have decreased.

Note that the process is similar to that for calculating the change in operating assets but that the process is reversed.

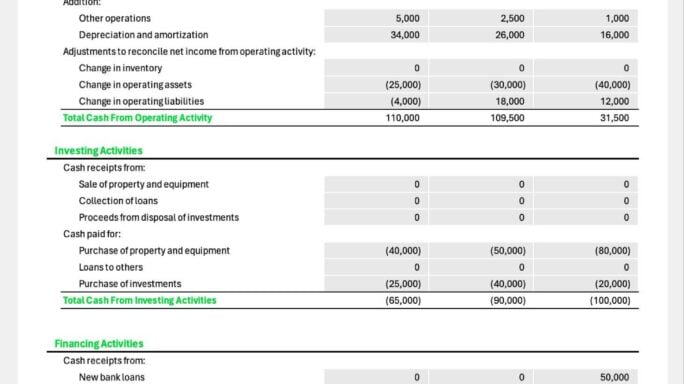

3. Input cash flow related to investing activities

In the next section, list cash received and disbursed from investing activities.

Tally all cash inflows and outflows related to buying and selling property and assets that increase the value of the business.

Note that IFRS allows for interest and dividend receipts to be included in either investing or operating activities.

The classification of these receipts must be consistent between reporting periods.

Receipts from the sale of property and equipment

Add any cash received from selling assets such as property and machinery.

Collection of loans

Add in cash from receiving financing from investors, mortgages or loans.

Proceeds from disposal of investments

Add in any cash received from the sale of marketable securities, or other investments such as contracts or IP rights.

Purchase of property and equipment

Subtract any investments in assets such as property and machinery.

Loans to others

Subtract payment of monies in the form of loans made to others, typically subsidiary companies.

Purchases of investments

Subtract any cash disbursed from purchasing marketable securities, or other investments such as contracts or IP rights.

4. Total cash flow related to financing activities

Here, list the cash received and disbursed from financing activities.

Tally all cash inflows and outflows from fundraising and repaying debts that allow the company to operate or grow.

Note that IFRS allows for interest and dividend payments to be reflected in either financing or operating activities.

Their classification must remain consistent between reporting periods.

New banks loans

Add any cash received from bank loans or other creditors.

Proceeds from issuing common stock

Add any cash received from the sale of equity, stock, or bonds.

Repayment of bank loans

Subtract any cash disbursed to repay loans and debt, either from investors, mortgages or the bank.

Dividend and interest payments

Subtract any cash disbursed to pay dividends and interest. Under IFRS, dividend and interest payments may be classified as operating activities instead.

5. Determine the total change in cash

Calculate the total change by adding together the operating, investing, and financing activities.

This figure reflects the total increase or decrease in the company’s cash and cash equivalents.

6. Calculate the cash at end of year

Finally, determine the ending balance. Add or subtract the increase or decrease in cash and cash equivalents to the starting balance for the cash flow statement’s reporting period.

A positive balance indicates that the company has more cash flowing in than out. A negative balance confirms that the company has more cash flowing out than in.

The difference between direct and indirect cash flow statements

Both IFRS and GAAP allow the direct or the indirect method of calculating operating activities.

While both methods provide the same end result, they have several important differences.

| Direct method | Indirect method | |

| Accounting method | Uses cash accounting, which tallies cash when it’s received or paid | Uses accrual accounting, which tallies cash when it’s earned |

| Starting point for calculating operating activities | Not applicable; simply lists cash inflows and outflows from operating activities | Starts with profit or loss under IFRS; starts with net income under GAAP |

| Estimated work level | Tends to be higher, as it requires listing all cash transactions | Tends to be lower, as it works back from the income statement |

| IFRS requirements | Must reconcile net income to net cash flow from operating activities | None |

| GAAP requirements | Must reconcile net income to net cash flow from operating activities | None |

IAS 7 requirements for cash flow statements

IFRS uses IAS 7 (International Accounting Standard 7: Statement of Cash Flows) for preparing cash flow statements.

Below are some requirements to keep in mind when using this standard.

Operating, investing, and financing activities

Any company using IFRS standards must analyze cash flows using 3 types of activities:

Operating activities

Focus on cash received and disbursed from revenue-producing activities

Investing activities

Focus on acquiring and disposing long-term assets and investments

Financing activities

Focus on borrowing funds and repaying debts

Direct method for reporting operating activities

For the direct method for reporting operating activities, IAS 7 requires reconciling net income to net cash flow from operating activities.

This extra step aligns the statement of cash flows with the income statement.

Indirect method for reporting operating activities

IFRS also allows the indirect method for reporting operating activities. IAS 7 requires using profit or loss as the starting point.

As of 2024, companies may define this starting point in one of several different ways.

However, IAS 7 requires a standard starting point for reporting periods starting January 1, 2027 (read more below).

Reporting investing and financing activities

IAS 7 requires companies to report most investing and financing activities gross, categorized by type of receipt or payment.

However, this standard requires certain activities to be reported net, including:

- Cash received or paid on behalf of customers

- Cash received or paid for items in large amounts, with rapid turnover, and with short maturities

- Cash received or paid related to financial institution deposits

Dividend and interest payments and receipts

IAS 7 allows some flexibility when reporting dividend and interest activity.

Both may be considered operating activities.

Companies have the option to consider dividend and interest receipts as investing activities instead.

Companies may also consider dividend and interest payments as financing activities.

However, IAS 7 requires companies to maintain consistent classification between reporting periods.

Disclosures

Non-cash investing and financing doesn’t appear on the cash flow statement.

However, IAS 7 requires companies to disclose these activities in other financial statements.

Recent IAS 7 changes to cash flow statement preparation (2024)

An April 2024 amendment to IFRS reflects a potentially significant change to using the indirect method for preparation.

Instead of choosing from several different starting points, companies will be required to use the operating profit or loss subtotal.

This change applies to annual periods starting on or after January 1, 2027.

This IFRS change is designed to standardize cash flow statements.

It will allow investors to analyze and compare cash flow statements more easily, enabling them to make more informed decisions.

Cash flow statement templates

Download our cash flow statement templates as Excel spreadsheets.

What are the 3 main sections of a cash flow statement?

Whether a company uses IFRS (International Financial Reporting Standards) or GAAP (generally accepted accounting principles), a cash flow statement consists of three main components:

Operating activities

Operating activities refer to the company’s primary revenue-producing activities.

Think of them as standard business activities that generate cash inflows and outflows.

Revenue covers cash coming into the business from goods and services, and out of the business to wages, operating expenses and income tax payments.

Investing activities

Investing activities refer to investments the company makes using cash, not debt.

However, for investment companies, investments are reflected in the company’s operating activities.

Investing activities cover buying and selling long-term assets.

The buying and selling of investments such as IP rights or contracts and the collection and issuance of loans from the business to subsidiaries of the company.

Financing activities

Financing activities refer to cash investments in the company.

They include cash inflows from raising funds and cash outflows from repaying debt.

Cash flow from financing activities can come from receiving financing from investors, issuing payments to shareholders or repaying debt principal.

What are cash and cash equivalents?

Cash flow statements reflect a company’s balance of cash and cash equivalents at the beginning and end of the reporting period.

These statements also show the total change from the beginning to the end of the period.

Cash

Cash includes both currency and demand deposits.

The latter refers to money held in bank accounts from which the depositor can withdraw at any time without significant financial risk or penalty.

In addition to domestic currency, cash can also include foreign currency.

The value of any foreign currency should reflect the exchange rate on the date the company received the cash.

Cash equivalents

Cash equivalents are investments designed to meet short-term cash commitments.

These highly liquid investments have a maturity date of 3 months or less after acquisition.

In addition, they can easily convert into known cash amounts.

As a result, cash equivalents have a very low risk of changes in value.

Cash equivalents can include:

- Money market funds, government bonds, and corporate bonds that meet the definition above and maintain an insignificant risk of changes in value

- Equity instruments that were acquired just prior to maturity and that have a firm redemption date

- Bank overdrafts that are part of the company’s cash management strategy, meaning the company regularly fluctuates between positive and negative demand deposit balances

What’s the difference between an income statement and a cash flow statement?

As two of the three main types of financial statements, both cash flow and income statements offer insight into a company’s financial performance.

Yet they do so from different perspectives.

Cash flow statements

Cash flow statements confirm how liquid a company is.

They reflect cash paid and received, revealing how much cash a company has on hand at the end of a reporting period.

Income statements

Income statements also called profit and loss (P&L) statements confirm how profitable a company is.

They reflect revenue and expenses accrued during a reporting period, including non-cash accounting like depreciation and amortization.

What isn’t included in a cash flow statement?

A cash flow statement doesn’t reflect:

- Debt instruments that have a maturity date of more than 3 months after acquisition and that carry significant risk of changes in value.

- Most equity instruments because they have a significant risk of changes in value and they aren’t convertible to a preset amount of cash.

- Cryptocurrency and gold because they aren’t readily convertible to predetermined amounts of cash.

- Restricted cash and cash equivalents that a company can’t readily access because of legal restrictions or financial controls, such as funds owned by a subsidiary.

- Non-cash transactions that don’t have a direct effect on a company’s cash inflows or outflows

What’s the difference between GAAP and IFRS for cash flow statements?

GAAP and IFRS use similar guidelines for preparing cash flow statements.

However, the way the two accounting standards classify cash flow activities differs.

IFRS considers the nature of the activity when classifying cash flow.

If using the indirect method, GAAP will use items from the income statement (net income, depreciation expense, etc) to prepare the cash flow statement.

Here are several ways these differences affect cash flow statements:

Bank overdrafts

IFRS doesn’t include overdrafts in cash or cash equivalents. Instead, it considers them liabilities and classifies changes as financing activities.

GAAP allows overdrafts to be included in cash and cash equivalents.

Restricted cash

IFRS requires companies to disclose restricted cash (i.e., inaccessible balances held by the company’s subsidiary) in the cash flow statement.

GAAP includes restricted cash in balances of cash and cash equivalents.

Dividend and interest receipts

IFRS allows dividends and interest paid to be classified as operating or investing activities.

GAAP requires these payments to be classified as operating activities.

Dividend and interest payments

IFRS allows dividends and interest paid to be classified as operating or financing activities.

GAAP requires these payments to be classified as financing activities.

Discontinued operations disclosures

IFRS requires companies to disclose cash flow from discontinued operations either in the cash flow statement or in its notes.

GAAP requires companies to disclose either total operating and investing cash flow from the discontinued operation or its total depreciation, amortization, capital expenditures, and significant non-cash operating and investing.

Sage financial reporting software can help with your reporting and the management and growth of your business.

Our cash management software also automates tasks and provides real-time, reliable cash flow visibility.

Sage Intacct has 150 built-in financial reports enabling you to easily create custom reports and leaving you with more time to focus on your business and prepare your financial statements.

Editor’s note: This article was verified by a US-based Certified Public Accountant (CPA). Accounting rules are complex and change frequently and we recommend you seek any accounting advice from a qualified CPA.

Ask the author a question or share your advice