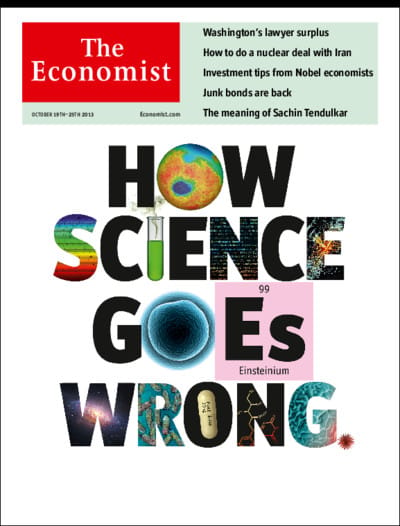

An appetite for junk

Companies have taken advantage of investors’ growing willingness to buy speculative bonds

WHEN cash deposits pay virtually zero, investors have an incentive to take risks in search of higher returns. That has been good news for the high-yield, or junk, bond market, where companies with poor credit ratings (below the investment-grade threshold of BBB) turn for finance. Many companies can now borrow at rates that governments would have been pleased to achieve two decades ago. Indeed, so low have borrowing costs fallen that some wags have dubbed the market “the asset class formerly known as high-yield”.

This article appeared in the Finance & economics section of the print edition under the headline “An appetite for junk”

More from Finance & economics

Can anything spark Europe’s economy back to life?

Mario Draghi, the continent’s unofficial chief technocrat, has a plan

Has social media broken the stockmarket?

That is the contention of Cliff Asness, one of the great quant investors

American office delinquencies are shooting up

How worried should investors be?

China is suffering from a crisis of confidence

Can anything perk up its economy?

America has a huge deficit. Which candidate would make it worse?

Enough policies have been proposed to make a call

Why Oasis fans should welcome price-gouging

There are worse things in life than paying a fair price