Betting markets are useful when politics is chaotic

Why, then, are they largely outlawed in America?

In the early 20th century, for brief periods, the most frenetic American trading pits were not the raucous markets in which stocks were traded, nor the venues where bonds were exchanged. The real action was in the market for betting on the next president. “Crowds formed in the financial district...and brokers would call out bid and ask odds as if trading securities,” write Paul Rhode and Koleman Strumpf, two economists. Markets were deep, liquid and smart: in 15 presidential elections from 1884 to 1940, the favourite won 11 times and three races were essentially tied (in odds and result). Only once did markets miss the mark.

Explore more

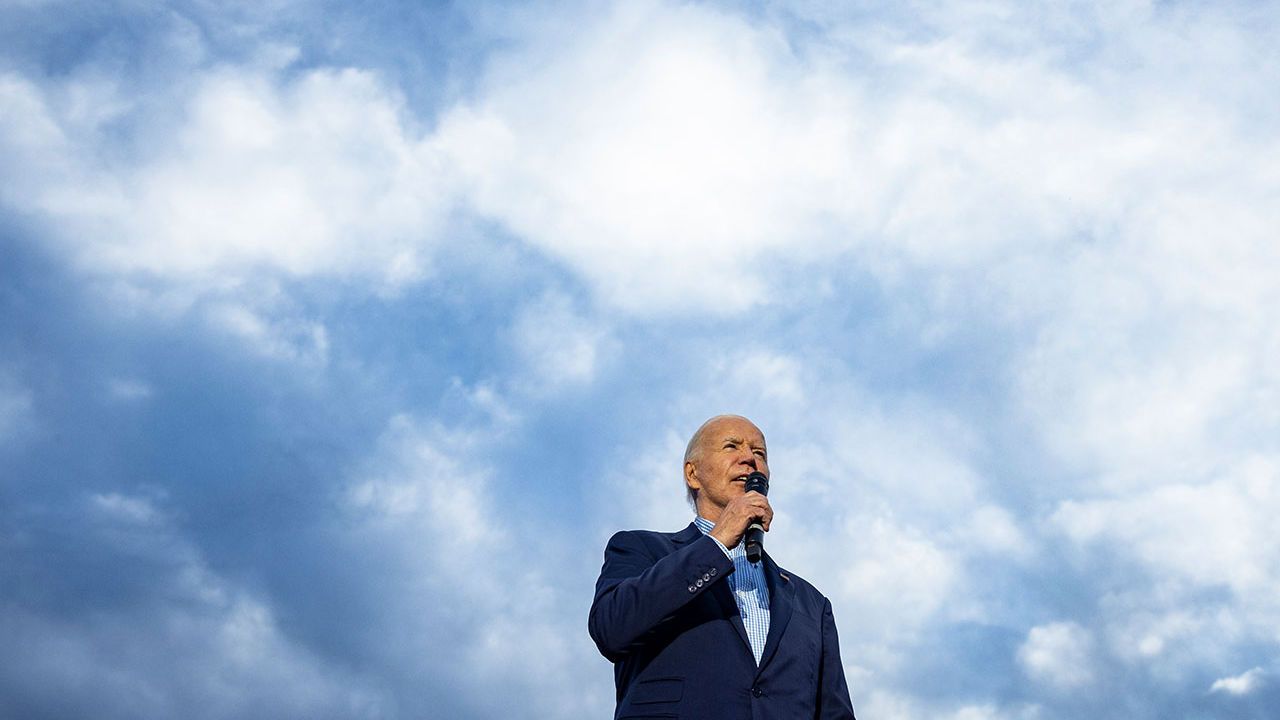

This article appeared in the Finance & economics section of the print edition under the headline “Gambling on Biden”

Finance & economics July 13th 2024

More from Finance & economics

Europe’s economic growth is extremely fragile

Risk is concentrated in one country: Germany

How vulnerable is Israel to sanctions?

So far, measures have had little effect. That could change

Why companies get inflation wrong

Bosses should pay less attention to the media

What is behind China’s perplexing bond-market intervention?

The central bank seems to think the government’s debt is too popular

How to invest in chaotic markets

Contrary to popular wisdom, even retail investors should pay attention to volatility

Vladimir Putin spends big—and sends Russia’s economy soaring

How long can the party last?