Levy Lid Lifts

This page provides an overview of the property tax levy lid lift for all cities, counties, and special purpose districts in Washington State, including informational graphics and sample documents.

For a more comprehensive discussion of the intricacies of the property tax in Washington State, refer to MRSC's City Revenue Guide and County Revenue Guide, or the Department of Revenue's Property Tax Levies Operations Manual.

Levy lid lifts are a complicated issue and if you are considering such a ballot measure it is important to seek guidance from legal counsel.

New legislation: Effective June 6, 2024, jurisdictions in King County are now allowed to use a multi-year levy lid lift to supplant existing funds similar to jurisdictions in all other counties in the state. See HB 2044.

We have updated this page to reflect the new legislation.

Overview

The passage of Initiative 747 in 2001 established a “101% levy limit” limiting the amount that any taxing jurisdiction can increase its regular property tax levy (the total amount of revenue collected) from current assessed valuation (excluding new construction) without voter approval. The state Supreme Court struck down the initiative in 2007, but the legislature reinstated it.

The levy limit is as follows:

- Taxing districts under 10,000 population may not increase the total levy amount collected from current assessed valuation by more than 1% annually (the “levy lid”).

- Taxing districts with a population of 10,000 or more may not increase the total levy amount collected from current assessed valuation by more than 1% annually or the rate of inflation, whichever is lower. However, if the inflation rate is below 1%, these jurisdictions may adopt resolutions of “substantial need” to increase the levy up to 1 percent. For more on the inflation rate and resolutions of substantial need, see our Implicit Price Deflator webpage.

Note: These tax limits apply only to current assessed valuation and do not affect property tax levies from new construction or increases in state-assessed utility valuation.

The 101% limit obviously restricts revenue growth, especially for jurisdictions that are heavily dependent on property taxes and whose costs are increasing more than 1% per year due to inflation, salary and benefit costs, and other factors. (To see property tax vs. sales tax reliance for all cities and towns in Washington, see our Tax Reliance Map.)

If property values are increasing more than 1% per year within a jurisdiction, the 1% levy limit also puts downward pressure on the maximum allowable levy rates (the tax rate per $1,000 assessed value), forcing the jurisdiction to collect a lower rate than it used to.

Example of How the 101% Limit Affects Property Tax Rates

| Year | Current Assessed Valuation (excluding new construction), assumes 2% annual increase | Maximum Allowable Levy (1% annual increase) | Maximum Allowable Levy Rate/$1,000 AV |

|---|---|---|---|

| 1 | $100,000,000 | $150,000 | $1.50 |

| 2 | $102,000,000 | $151,500 | $1.49 |

| 3 | $104,040,000 | $153,015 | $1.47 |

| 4 | $106,120,800 | $154,545 | $1.46 |

| 5 | $108,243,216 | $156,091 | $1.44 |

However, there are two ways for a jurisdiction to increase its regular levy above the 1% limit:

- Banked capacity: A jurisdiction may take less than the maximum increase in any given year and “bank” the remaining capacity to use in the future. For more information on banked capacity, see our page Property Tax in Washington State. If you do not know whether your jurisdiction has banked capacity that it can use, ask your county assessor.

- Levy lid lift: A taxing jurisdiction may seek voter approval to increase its levy more than 1%, up to the statutory maximum rate, for a specified amount of time.

Most jurisdictions may also submit a special, or excess, levy to their voters to temporarily increase their taxes above the statutory maximums (RCW 84.52.052 for most agencies and RCW 84.52.130 for fire protection districts). However, this is separate from the regular levy, expires after one year for all agencies except fire protection districts, and requires a 60% majority.

What is a Levy Lid Lift?

A taxing jurisdiction that is collecting less than its maximum statutory levy rate may ask a simple majority of voters to “lift” the total levy amount collected from current assessed valuation by more than 1% (RCW 84.55.050 – also see WAC 458-19-045, which provides a better understanding of the process than the statute). The new levy rate cannot exceed the maximum statutory rate.

Levy lid lifts may generate revenue for any purpose, but if the amount of the increase for a particular year would require a levy rate above the statutory maximum tax rate, the assessor will levy only the maximum amount allowed by law.

There are two types of levy lid lifts: single-year lifts (sometimes known as “one-year,” “one-bump,” “basic,” or "original" lifts) and multi-year lifts. However, these names can be confusing, since “single-year” levy lid lifts typically last for multiple years too.

A good way to think of the difference between "single-year" and "multi-year" lid lifts is: How many years can your total levy increase by more than 1 percent?

With a single-year lid lift, you can exceed the 1% annual limit for one year only, and then future increases are limited to 1% (or inflation) for the remainder of the levy. With a multi-year lid lift, you can exceed the 1% annual limit for up to 6 consecutive years.

Single-Year Levy Lid Lifts

The single-year (“one-bump”) lid lift is the original version created by Initiative 747 in 2001. It allows your jurisdiction to increase the maximum levy by more than one percent for one year only. That amount is then used as a base to calculate all subsequent 1% levy limitations for the duration of the levy.

Single-year lid lifts may be used for any lawful governmental purpose, including general government operations, and there are no supplanting limitations.

Single-year levy lid lifts can be temporary or permanent.

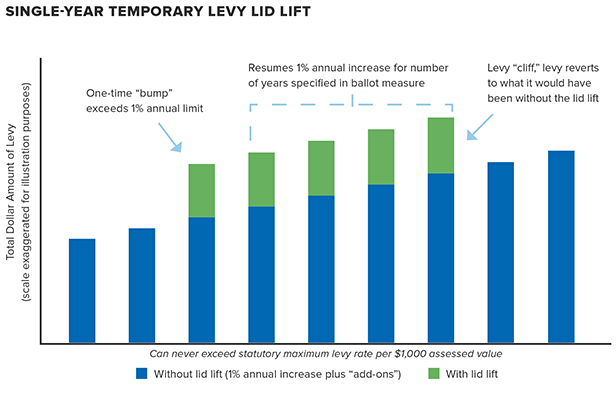

Temporary Single-Year Lid Lifts

With a temporary single-year lid lift, the levy lid bumps up more than 1% in the first year, and then that amount is used to calculate all subsequent 1% levy limitations until the measure expires. A temporary lid lift can be used for any purpose and last for any number of years, but if used to pay debt service it may not exceed nine years (except Thurston County, which may increase the levy lid for 25 years).

When the lid lift expires, the levy lid reverts to what it would have been if the levy lid lift never existed and the jurisdiction had increased its levy by the maximum allowable amount each year in the meantime (RCW 84.55.050(5)).

See below for a conceptual example (click on the image to download a larger version).

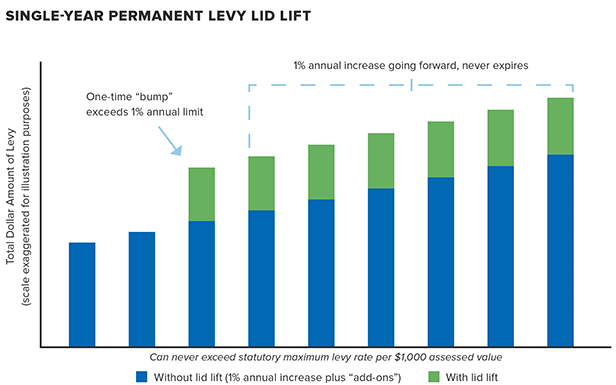

Permanent Single-Year Lid Lifts

With a permanent single-year lid lift, the levy lid bumps up more than 1% in the first year, and then that amount is used to calculate all future 101% levy limitations. The measure never expires and the levy lid never reverts. However, future annual increases may not exceed 1% without going to the voters for another lid lift.

See below for a conceptual example (click on the image to download a larger version).

Multi-Year Levy Lid Lifts

The state legislature added the “multi-year” levy lid lift option in 2003. Unlike the single-year (“one-bump”) levy lid lift, which bumps up once and is then used to calculate the 1% limitation for the remainder of the levy, a multi-year levy lid lift authorizes a jurisdiction to bump up or exceed the 1% limitation each year for up to six consecutive years.

A multi-year levy lid lift may be used for any purpose, but the ballot must state the limited purposes for which the increased levy will be used (unlike a single-year lid lift, where there is no requirement to state the purpose). There are no supplanting restrictions.

The lift must state the total tax rate for the first year only – it cannot state the maximum rate in future years. For all subsequent years, the measure must identify a maximum “limit factor” which the total levy amount may not exceed (stated as an annual percent increase or a specific inflation index). The limit factor does not have to be the same for each year.

For instance, the limit factor might be 3% annually, 6% annually for the first two years and 4% annually after that, or the annual inflation increase as measured by an index such as the Consumer Price Index (CPI).

Multi-year lid lifts may be temporary (up to six years) or permanent. Multi-year lid lifts may also be used for debt service for up to nine years, in which case they may fall somewhere in between “temporary” and “permanent.”

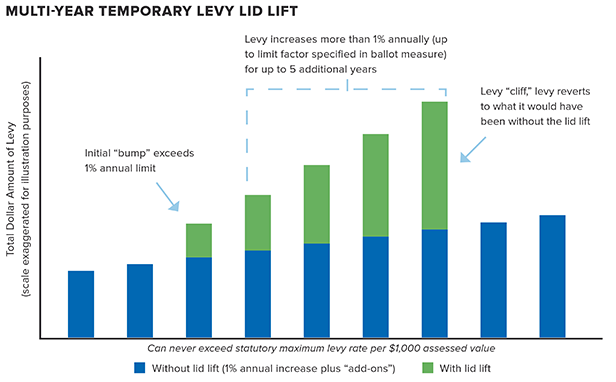

Temporary Multi-Year Lid Lifts

With a temporary multi-year lid lift, the levy lid bumps up more than 1% each year (subject to the limit factor) for up to six years. When the lid lift expires, the levy lid reverts to what it would have been if the levy lid lift never existed and the jurisdiction had increased its levy by the maximum allowable amount each year in the meantime (RCW 84.55.050(5)).

See below for a conceptual example (click on the image to download a larger version).

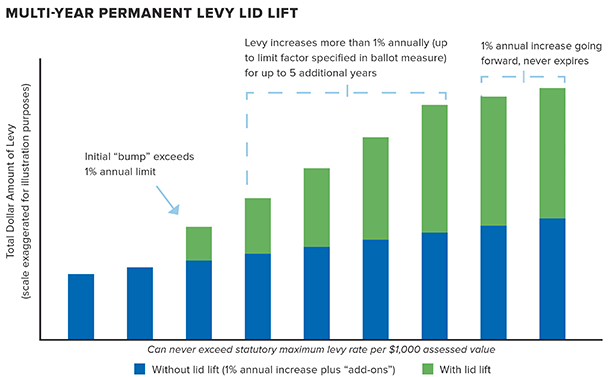

Permanent Multi-Year Lid Lifts

Similarly, with a permanent multi-year lid lift the levy lid bumps up more than 1% each year (subject to the limit factor) for up to six years. However, the lid lift does not revert and the maximum levy is then used as the base to calculate all future 1% levy limitations.

See below for a conceptual example (click on the image to download a larger version).

Multi-Year Lid Lifts for Debt Service

If a multi-year lid lift is used to pay debt service, the increased levy may not last for more than 9 years total (25 years for Thurston County). The multi-year lid lift would exceed the 1% limit for up to 6 years, and then the lid would increase up to 1% annually for the remaining years. After no more than nine years, the levy would expire and the levy lid would revert to what it would have been without the lid lift. In this way, a multi-year lid lift for debt service falls somewhere between a temporary (six year maximum) and permanent lid lift.

Choosing a Multi-Year Limit Factor/Inflation Index

A multi-year lid lift must identify a maximum “limit factor” which the total levy amount may not exceed in subsequent years (stated as an annual percent increase or a specific inflation index). The limit factor does not have to be the same for each year.

The main factor to consider when choosing an inflator is how much your assessed valuations are increasing. For instance, if a city seeks to raise its levy lid to its maximum statutory rate of $3.10 per $1,000 assessed value, and assessed valuations are rising about 6% annually, the city might want to establish an annual limit factor of 6% (sometimes expressed as 106%) in an attempt to maintain the $3.10 levy rate. (If the city uses a limit factor of less than 6% in that situation, the levy rate will likely fall in subsequent years as the increase in current assessed valuation outpaces the annual levy lid increase.)

If using an inflation index such as the Consumer Price Index, it is crucial to correctly identify the one you want to use in your ballot measure, since these will vary every year and are beyond the jurisdiction’s control.

Practice Tip: The considerations for choosing an inflation index are the same as choosing a consumer price index for a labor contract. See the Bureau of Labor Statistics webpage on How to Use the Consumer Price Index for Escalation.

Figure out when you will want the information, for budgeting purposes, on how much your property tax levy can be increased. Then make certain that the CPI index you have chosen will be available by that date. For example, the U.S. CPI figures are published monthly between the 15th and 20th following the end of the previous month, while the Seattle-Tacoma-Bremerton index is published bimonthly in odd-numbered months (for the preceding even-numbered month).

For more information on the CPI, including recent inflation rates, see our Consumer Price Index page.

Election Dates

When deciding on an election date for a levy lid lift, there are a number of factors to consider. Single-year lid lifts may be submitted to the voters at any special, primary, or general election, but multi-year lid lifts are limited to the primary or general election.

Your election date will determine (assuming the measure passes) when you will get your first tax receipts. Levy lid lifts must be submitted no more than 12 months before the levy is made (the date your budget is certified), and taxes levied in November are first due on April 30 of the following year. This means to receive increased tax revenues next year, your election can be no later than November of the current year.

Below are the filing deadlines by which your county auditor must receive your ballot measure resolution (RCW 29A.04.321):

- Special election (February or April): 60 days before the special election

- Primary election (August): the Friday before the first day of regular candidate filing

- General election (November): the date of the primary election

If you wait until September or October, during budget discussions, to begin discussing a levy lid lift for the coming year, it is too late because the general election deadline has passed. It pays to plan ahead!

Practice Tip: Councils and commissions should ask around to find out what other elections will be coming up during the coming year. You may not want to go head-to-head with a school levy election or a voted bond issue.

Ballot Measure Requirements

All levy lid lifts require a simple majority (50% plus one) for passage. Levy lid lifts do not have any validation (minimum voter turnout) requirements. However, there are slightly different ballot requirements for single-year and multi-year lid lifts.

Local Ballot Measures: For general information on ballot measures, including ballot title composition, pro and con committees, and more, see our page Local Government Ballot Measures. In addition, levy lid lifts have a number of specific ballot title requirements as indicated below.

Local governments are limited in what they can do to support a ballot measure. For more information, see our page on Use of Public Facilities in Election Campaigns.

Single-Year Lid Lift Ballot Requirements

A single-year lid lift ballot measure must:

- State the maximum tax rate to be imposed in the first year (for instance, $1.50 per $1,000 AV).

- If temporary, state the total duration of the levy (number of years).

- If permanent, state that it is permanent or that the dollar amount of the levy will be used for the purpose of computing the limitations for subsequent levies.

- State the exemption for senior citizens and persons with disabilities under RCW 84.36.381, if the jurisdiction wishes to exempt these individuals (cities and counties only)

The ballot measure does not have to state:

- The purpose, although doing so is a good idea

- The increase in the levy rate (for instance, an increase of $0.20 per $1,000 AV), although some jurisdictions do so

- The maximum total levy amount (for instance, a total levy amount of $300,000)

Multi-Year Lid Lift Ballot Requirements

A multi-year lid lift ballot measure must:

- State the total levy duration (number of years)

- If permanent, state that it is permanent or that the dollar amount of the levy will be used for the purpose of computing the limitations for subsequent levies.

- State the maximum tax rate to be collected in the first year (for instance, $1.50 per $1,000 AV)

- State the limit factor to be used for all subsequent years (stated as an annual percent increase or inflation index). The amounts do not need to be the same for each year.

- State the exemption for senior citizens and persons with disabilities under RCW 84.36.381, if the jurisdiction wishes to exempt these individuals (cities and counties only)

The ballot measure cannot state the maximum levy rate for subsequent years after the first year.

Which Option is Better?

The answer, of course, is “it depends”. There are several factors that may impact the decision of single-year vs. multi-year lid lifts. Here are a few to consider:

- How much money you need to raise

- What you need the revenue for, and for how long (for instance, continued operating costs versus a capital project that will only last a few years)

- How quickly your costs, and property values, are increasing

- Your desired election date (special, primary, or general)

- How you think voters will respond to the different alternatives (for instance, a permanent versus temporary tax)

The multi-year lid lift is slightly more restrictive in its uses, since the purpose must be stated in the ballot title. However, as stated earlier it is a good idea to state the purpose even if it is not required.

Levy Lid Lift Election Results

Want to know how other recent lid lifts have been structured or fared at the polls? Use our Local Ballot Measure Database to find out! Select “Filter by Ballot Categories” and, under “Funding Type/Statutory Authority,” select “Levy Lid Lift.” You can further refine your search by government type, subject matter, county, and years, if desired.

In recent years, about 75%-80% of levy lid lifts have passed, although of course the individual results can vary widely depending on local circumstances.

Examples of Levy Lid Lifts

Below are examples of levy lid lift resolutions, along with supporting information such as staff reports, ballot resolutions, and fact sheets.

General

- Washington Fire Commissioners Association: Sample 101% Levy Lid Lift Packet (2008) – Includes sample resolutions and ballot titles for single-year and multi-year levy lid lifts. Multi-year lid lift resolutions include options for fixed percentage increases, indexing to the Consumer Price Index, or variable percentages.

Single-Year Temporary Lid Lifts

- Bellingham Resolution No. 2018-09 (2018) – 10-year levy, combining a single-year levy lid lift with an affordable housing levy under RCW 84.52.105

- Duvall Resolution No. 16-13 (2016) – Single-year lid lift (9 years) for debt service on ballfields, as well as a full-time school resource officer and IT infrastructure improvements

- San Juan County Resolution No. 33-2014 (2014) – Single-year lid lift (6 years) for a wide variety of county services, canceling an existing levy lid lift

Single-Year Permanent Lid Lifts

- Cheney Ordinance No. W-68 (2015) – Single-year lid lift (permanent) for public safety, governmental services, communications/technology upgrades, and capital facilities.

- Clark County Fire District No. 6 Resolution No. 2015-04 (2015) – Single-year lid lift (permanent) for fire and EMS

- YouTube: 2015 Levy Lid Lift – 9-minute recorded presentation

- Eatonville Ordinance No. 2008-10 (2008) – Single-year lid lift (permanent) for the town’s fire and EMS, including transition from an all-volunteer fire department to a part volunteer/part full-time department

- Kitsap Regional Library Resolution 2017/04 (2017) – Single-year lid lift (permanent) to maintain and improve library services and prevent service cuts over the next five years

- Port of Klickitat Resolution No. 5-2012 (2012) – Single-year lid lift (permanent) for development and expansion of port district’s industrial facilities and properties, replacing an expiring industrial development district levy

- West Richland Resolution No. 25-16 (2016) – Single-year lid lift (permanent) for library services, replacing an existing 2.5% utility tax Also includes staff report evaluating various levy lid lift options and a mailer explaining the proposal to residents.

- Library Funding Tax Calculator – Interactive tool that residents can use to calculate their tax bills under the utility tax compared to the levy lid lift

Multi-Year Temporary Lid Lifts

- Port of Klickitat Resolution No. 2-2013 (2013) – Multi-year levy lid lift for port district operations, offsetting an expired industrial development district levy. 6 years, limit factor of 3%. Includes fact sheet.

Multi-Year Permanent Lid Lifts

- Island County Resolution No. C-54-10 (2010) – Multi-year lid lift to retain public safety and other essential services following significant budget cuts due to the Great Recession. 5 years/permanent, limit factor tied to Seattle CPI-U index. Includes FAQs.

- Lake Forest Park Resolution No. 1202 (2010) – Multi-year lid lift for public safety, parks, and other governmental services, as well as replenishing the “rainy day” reserve fund and/or restoring eliminated positions and services. 6 years/permanent, limit factor tied to Seattle CPI-U index. Includes FAQs.

- Shoreline Resolution No. 389 (2016) – Multi-year lid lift for police, parks and recreation, and community services. 6 years/permanent, limit factor tied to Seattle CPI-U index. Includes staff report, FAQs, mailer, and community presentation.

- Where Do Your Property Taxes Go? – One-page overview of where each dollar of property taxes goes; used in conjunction with levy lid lift

- Ordinance No. 873 (2019) – Setting property tax levy (dollar amount and percent increase) for next year; regular levy increased more than 1% since it was tied to the Seattle CPI-U.

- South Kitsap Fire & Rescue Resolution No. 2017-01 (2017) – Multi-year lid lift for fire and EMS. 6 years/permanent, limit factor tied to Seattle CPI-W index.

- Stanwood Resolution No. 2015-16 (2015) – Multi-year lid lift for contracted police, fire, and EMS services. 6 years/permanent, limit factor of 6%. Includes staff report evaluating levy lid lift options, as well as FAQs.

- Tumwater Ordinance No. O2011-005 (2011) – Multi-year lid lift for police and fire services and facilities. 6 years/permanent, limit factor tied to Seattle CPI-U index. Includes FAQs and PowerPoint presentation.

Interlocal Agreements

- King County/Fire Districts Levy Buy-Down Agreement (2015) – County will buy down fire district levy rates under RCW 39.67.020 if any fire district has its levy reduced through prorationing as a result of proposed countywide levy lid lift

Recommended Resources

- WA Department of Revenue Ballot Measure Requirements for Voted Property Tax Levies – Explains the requirements taxing districts must follow to create property tax ballot measures, including levy lid lifts

- Stradling Attorneys at Law: Comparison of Levy Lid Lift Mechanisms (2016) – One-page table comparing single-year and multiple-year lid lifts

- MRSC: Lessons Learned from Two Successful Levy Lid Lifts (2013) – Advisor column written by Tracey Dunlap, Finance Director for Kirkland, based on her experience passing two simultaneous levy lid lifts

- MRSC: Use of Public Facilities in Election Campaigns – Information on what local governments can and can’t do to support a ballot measure